EURCHF took a hit on Thursday last week and pulled back from the vicinity of the downward trendline. The move was triggered by European Central Bank insisting that the slower pace of purchases under Pandemic Emergency Purchase Programme is not a tapering but rather just a recalibration. While some ECB members hint that normalization of its monetary policy is needed, things look different in Switzerland. Fritz Zurbruegg, Vice President of the Swiss National Bank, said in an interview with Sonntagszeitung over the weekend that raising Swiss rates back into positive territory is off the table for now. Zurbruegg argued that negative rates are needed as they prevent the Swiss franc from strengthening and, in turn, are positive for growth and the jobs market. However, what looks to be similar in Switzerland as well as other parts of the developed world is perception that recent pick-up in inflation is temporary.

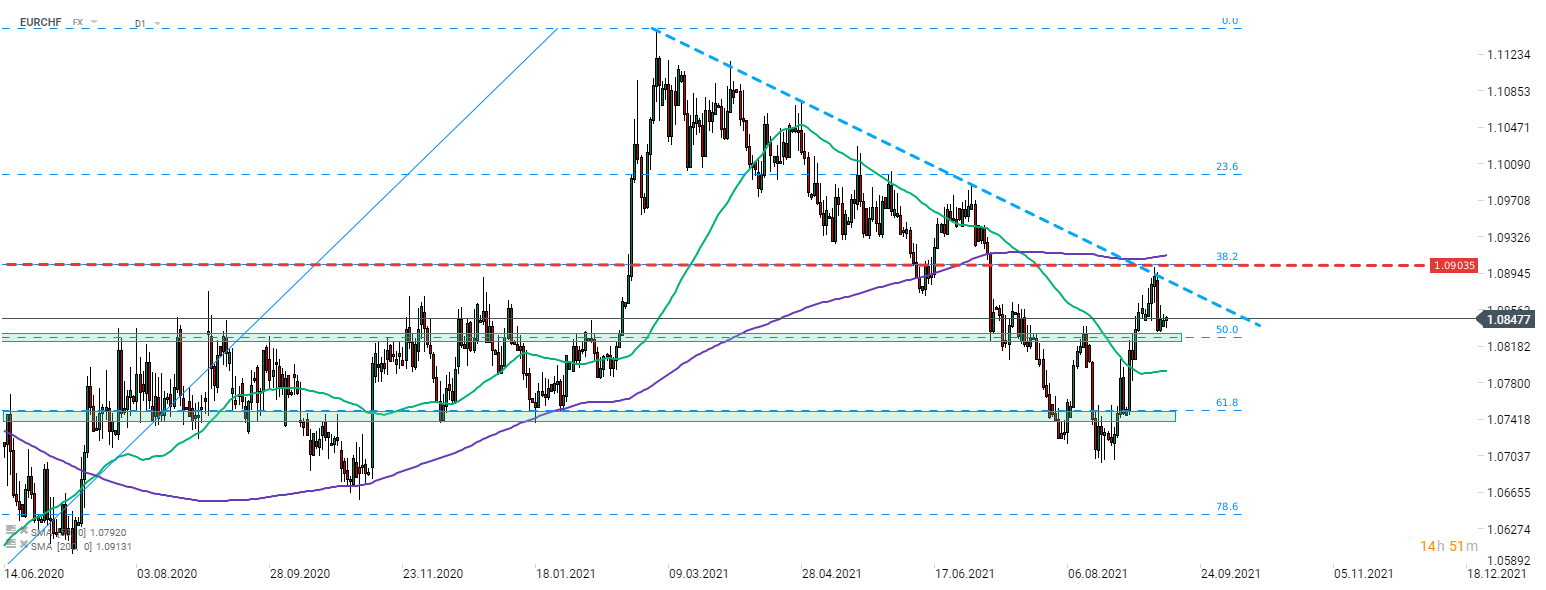

Taking a look at EURCHF chart, we can see that following last week's failed attempt of breaking above the downward trendline and resulting pullback, the pair found support at the50% retracement of the upward move launched in April 2020 (1.0830 area). Pair has been slowly climbing higher since and a retest of the aforementioned downward trendline cannot be ruled out.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.