Copper futures (COPPER) are trading down more than 1.5% today and are retreating after an impressive August rebound. China's copper stocks, in June this year, reached historic highs with 336,000 tons, but have been on the decline since then. At the same time, also in June, China's copper exports reached a record 158 thousand tons, which only confirms that demand in the domestic economy, which is struggling with the crisis in the construction sector - is (or at least was) very weak.

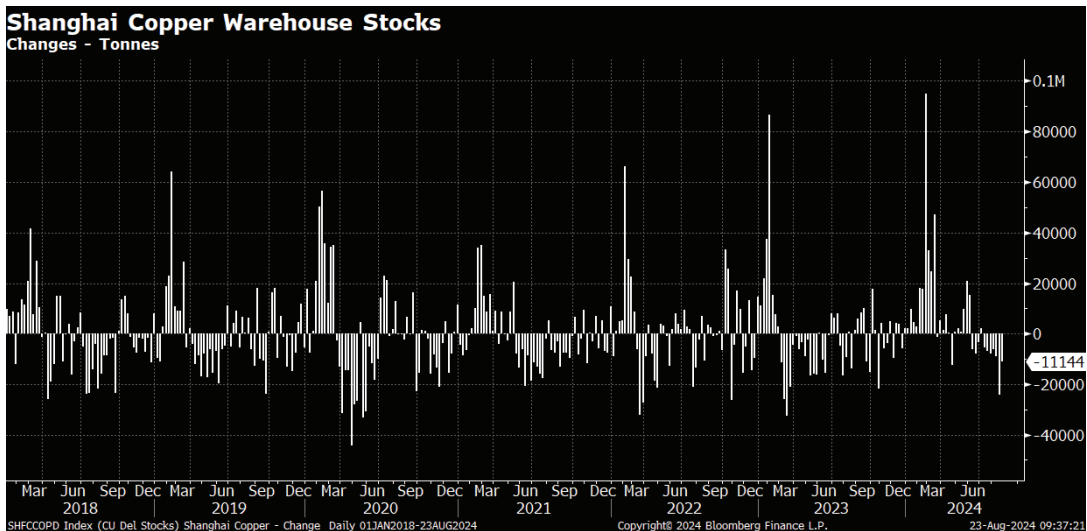

- In July, however, China's copper exports unexpectedly fell by 70,000 tons, as stocks on the Shanghai exchange steadily declined. The last two weeks, according to the Hightower report, saw the largest drop in domestic copper stocks, in all of 2024 (24 and 11.1 thousand tons, respectively). As a result, investors are beginning to reconsider whether this is a seasonal effect and an anomaly, or whether demand for copper in China's economy has really begun to slowly recover.

- Since the beginning of August, copper contracts have risen nearly 8%, on a wave of falling Chinese inventories, a weakening dollar and increasing chances of Federal Reserve rate cuts. Now that contracts have reached a resistance zone, investors may again be 'weighing' the fundamental factors behind sustaining the rebound at a time when the outlook for the global economy, including China's, remains uncertain.

- Investment in the construction sector, in China - although higher y/y is encountering weak demand. In addition, inventories on the London Stock Exchange (LME) remain high, and 'mixed' data out of China may continue to limit market euphoria associated with monitoring inventory levels in Shanghai. Saxo analysts pointed out that the rebound in August was driven by newly built hedge fund positions. We can expect, that if global economy will not slow down meaningfully, US rate cuts may support copper prices.

Shanghai copper stocks are trading down slightly, but are up more than 220,000 tons from their 2023 peaks. They are currently at their lowest since March (seasonally, stocks are lowest in December, then record a seasonal spike, at the beginning of the year, when China is in a 'lunar year'). During this seasonal period, they have risen by more than 94,000 tons this year, a historic high. Source: Bloomberg Finance L.P.

COPPER (D1 interval)

Copper futures are down 1.5% today, with the rise halted at the 38.2 Fibonacci retracement level of the 2022 upward wave. Source: xStation5

Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.