Bitcoin is retreating back above $95,000 and data from Bloomberg, this week, suggests a significant slowdown in buying activity in ETFs. Yesterday, they accumulated BTC worth 'only' $91 million, and this entire week saw a net outflow of about $300 million, while long-term investors are making steady distributions and selling off BTC reserves at a rate of as much as $2 billion per day, according to on-chain data from Glassnode. Such an environment suggests for potentially more selling pressure, with insufficient demand, and could signal a potential correction in BTC prices.

- On the other hand, however, a potential defense of the area around $91,000 could indicate another upward impulse above the $100,000 level. The financial media was circulated yesterday with the news that Scott Atkins, former SEC member is likely to become chairman of the Securities and Exchange Commission. Atkins himself has long been and is associated with the blockchain industry, but the market 'didn't celebrate' these reports for too long, and Bitcoin price is gradually cooling down now, after yesterday's rebound.

- This, too, could indicate more selling activity and a prevailing belief in profit-taking, after record highs this year. However, looking at the scale of BTC sales by long-term addresses, they have currently sold off about 550,000 BTC which is a much smaller number than the about 930,000 sold this spring; which may suggest that there is still room for growth, and that so-called 'HODLers' addresses are less likely to part with Bitcoin before Donald Trump's presidency, in January.

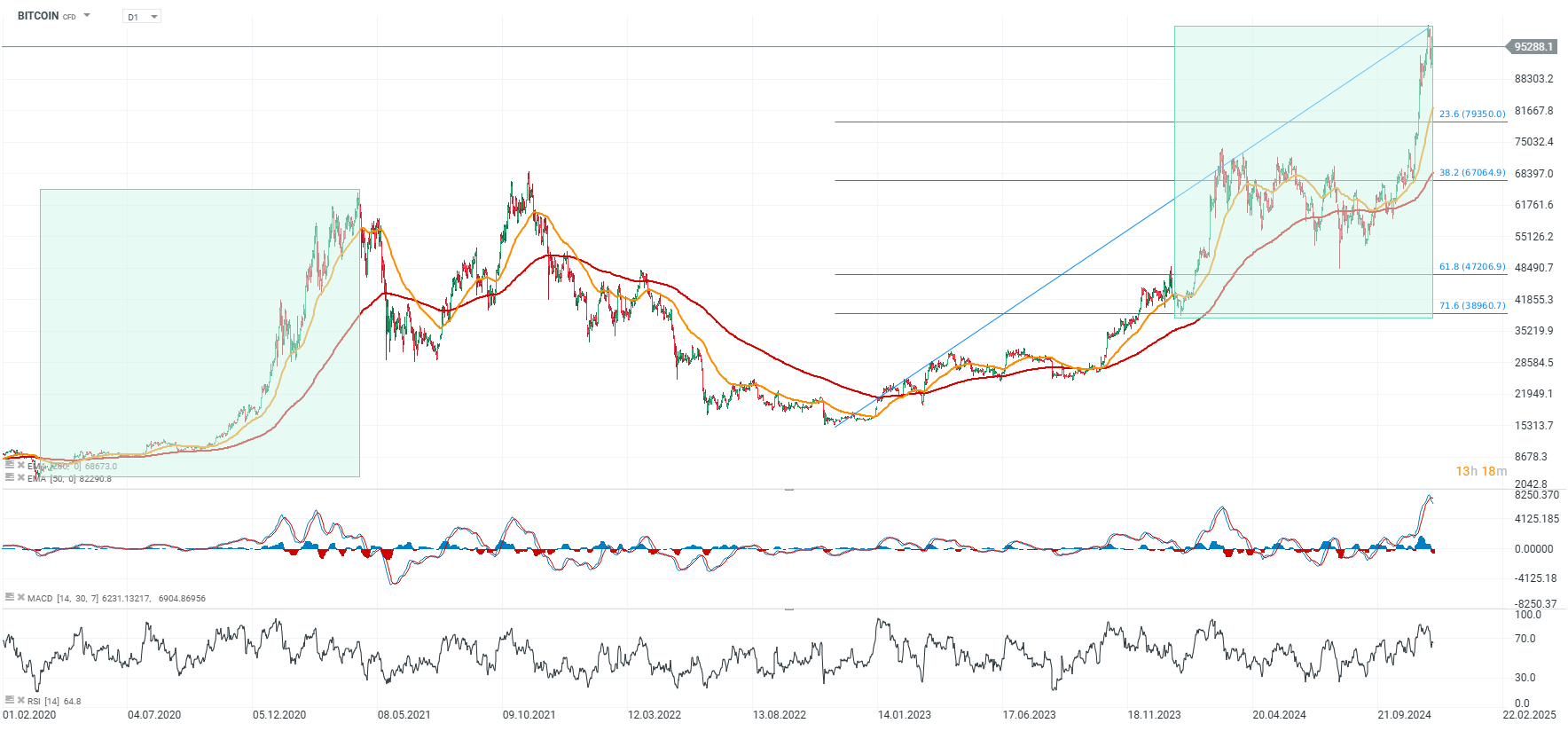

Bitcoin chart (D1, H1)

Looking at the cryptocurrency's chart on both the daily and hourly intervals, we see that the $80k level could prove crucial, looking at the 23.6 Fibo retracement of the entire 2022 upward wave and the 61.8 Fibo retracement of the surge after Trump's victory. A pullback from $99.5k to $80k would also be consistent with similar corrections in previous Bitcoin cycles.

Source: xStation5

Source: xStation5

Net inflows into Bitcoin and Ethereum ETFs

_49d9895aaf.png)

Source: Bloomberg Finance L.P. , XTB Research

Source: Bloomberg Finance L.P. , XTB Research

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.