Bitcoin extends its losses today, dropping another 1.00% following yesterday's sharp sell-off. The catalyst for yesterday’s decline was stronger-than-expected ISM data from the U.S., particularly the record-high price subindex. This sparked serious concerns about a resurgence of inflationary pressures in the U.S. Additionally, Donald Trump, in his recent interviews, emphasized campaign promises that reinforce fears of a strong pivot in U.S. policy toward protectionism, which in turn has driven further strengthening of the U.S. dollar.

As a result, the cryptocurrency market experienced cascading liquidations of long positions, exceeding $500 million. This high volatility was fueled by the market's significant leverage, which had been positioned for continued gains after Bitcoin broke above the $100,000 barrier on Monday. Consequently, significant liquidations of long positions followed the release of U.S. macroeconomic data. Pressure on the cryptocurrency market is being exacerbated by weaker sentiment in traditional stock markets and the strong U.S. dollar. Historically, a strengthening dollar has always been correlated with increased selling pressure on risky assets such as Bitcoin. Therefore, considering the dollar’s current strength, which has reached two-year highs and broken out of a two-year consolidation, Bitcoin’s current decline does not seem overly dramatic. Since its low in early October, the dollar index has risen by over 9%.

So far, the dollar's appreciation has acted as a headwind for demand for risky assets. However, it’s possible the market is currently overreacting, and we may see declines reverse after Donald Trump’s inauguration. In yesterday's interview, Trump stated that the dollar is currently overvalued, making it difficult for local companies to compete in the global market. He made similar remarks about interest rates.

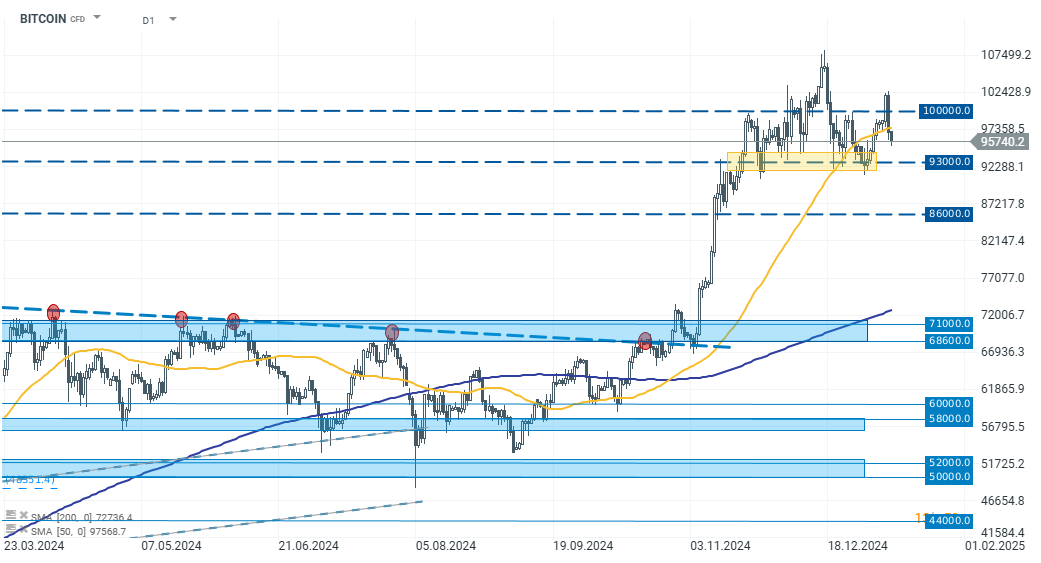

Looking at Bitcoin’s chart, the most important support level now is the zone above $93,000. For bulls, a sustained breakout above the $100,000 barrier remains a key challenge.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.