The Australian Dollar (AUD) is facing a downturn for the second consecutive session. Today, AUD is the weakest currency among G10 currencies, influenced by weaker-than-expected inflation data from Australia. The Monthly Consumer Price Index (CPI) for December reported a decrease to 3.4%, a significant drop from November's 4.3%. This slowing inflation rate has led traders to anticipate two potential rate cuts from the Reserve Bank of Australia (RBA) in 2024.

01:30, Australia - Inflation data:

- Weighted average CPI (Q4): current 4.4% y/y; forecast 4.5% y/y; previously 5.2% y/y;

- Weighted average CPI: current 3.40% y/y; forecast 3.70% y/y; previous 4.30% y/y;

- Trimmed Mean CPI (Q4): current 4.2% y/y; forecast 4.3% y/y; previous 5.2% y/y;

- Trimmed Mean CPI (k/k) (Q4): current 0.8%; forecast 0.9%; previous 1.2%;

- CPI (k/k) (Q4): current 0.6%; forecast 0.8%; previously 1.2%;

- CPI (Q4): current 4.1% y/y; forecast 4.3% y/y; previous 5.4% y/y;

In response to the latest Australian inflation data, the likelihood of the RBA maintaining interest rates unchanged at its upcoming meeting, however, the likelihood of an earlier rate cut later in the year has increased. The Trimmed Mean CPI, a core measure of inflation closely watched by the RBA, also showed a decline to 4.2%, down from 5.2% and below the expected 4.3%.

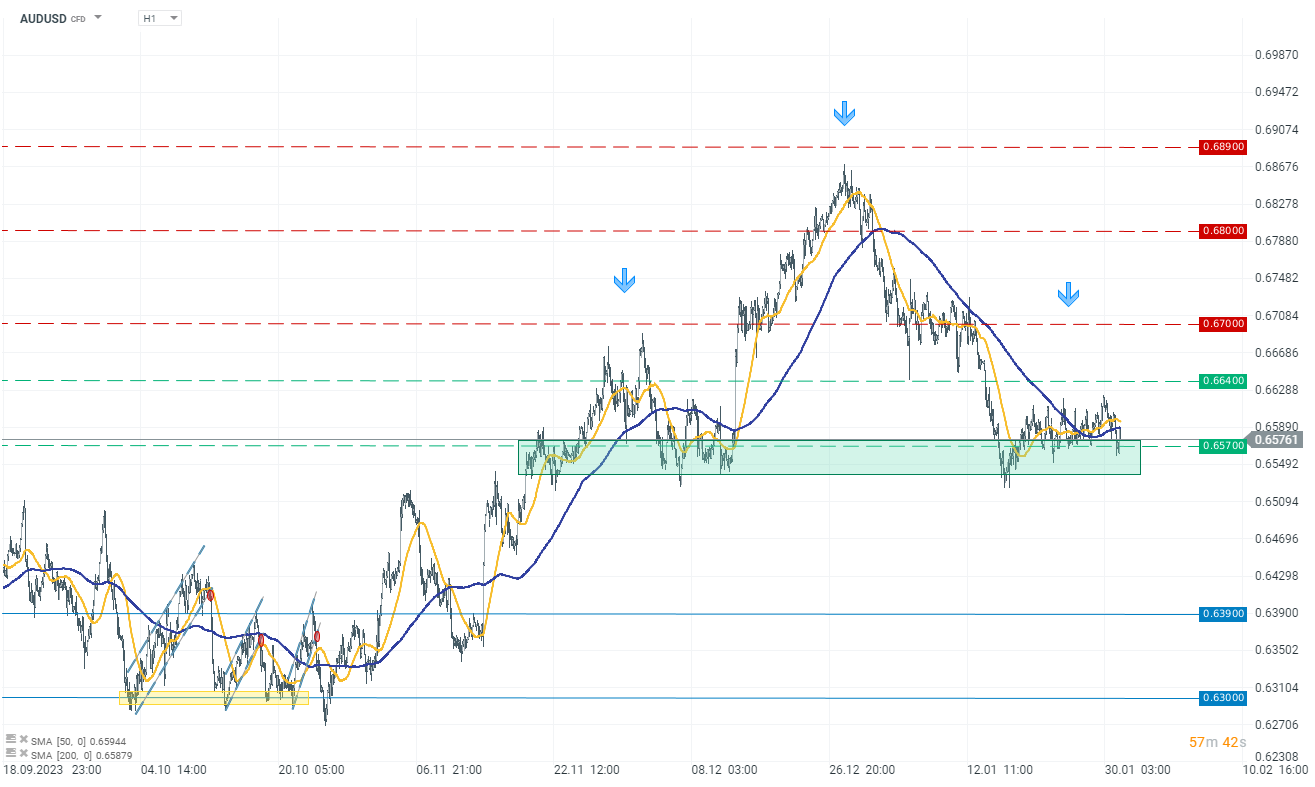

The Australian Dollar reacted negatively to these developments, with the AUDUSD pair declining by 0.40% at 0.6576.

Source: xStation 5

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.