Global stock markets as well as cryptocurrencies experienced a massive sell-off yesterday as the Wall Street Journal report sparked fears of a 75 basis point FOMC rate hike tomorrow. An improvement in risk moods can be spotted this morning with indices from Europe trading higher. AUDJPY, a FX pair considered to be risk barometer, also trades higher and is one of the best performing G10 crosses today. However, traders should expect markets to remain nervous until FOMC decision tomorrow at 7:00 pm BST. As market expectations have tilted towards a 75 basis point rate hike, a scope for a dovish surprise increased.

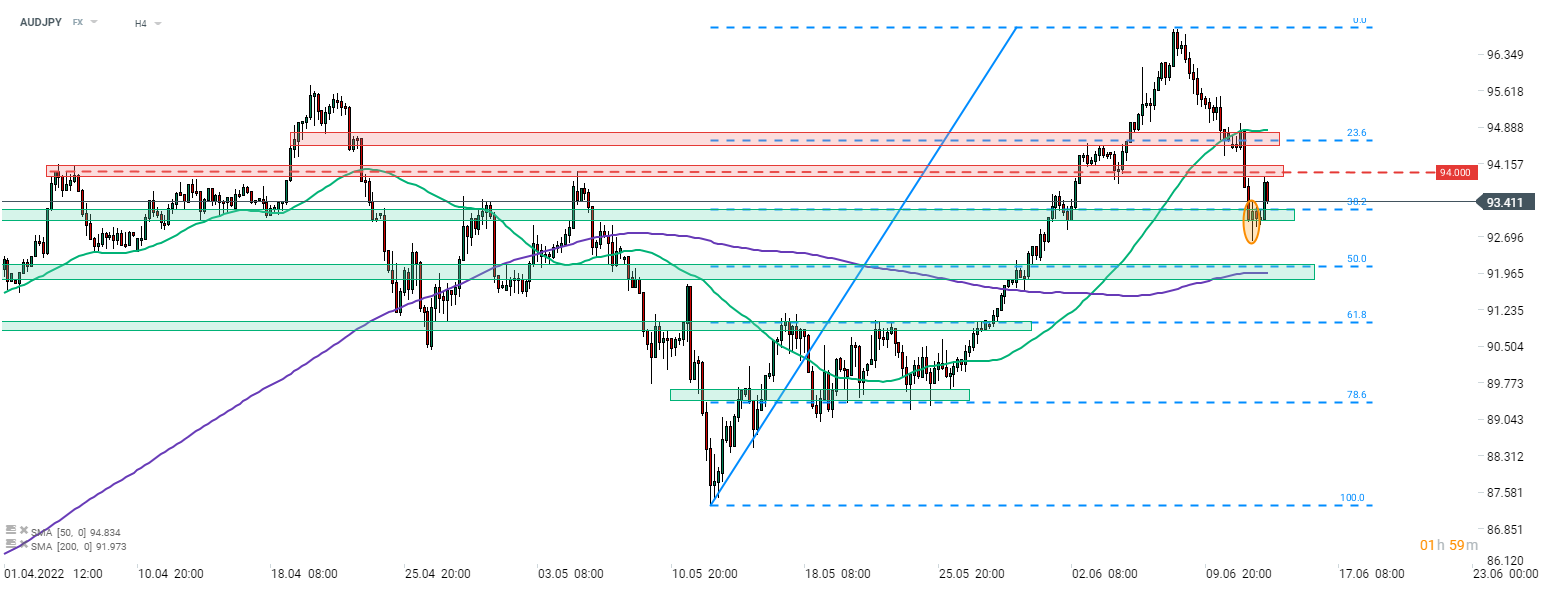

Taking a look at AUDJPY chart at H4 interval, we can see that the pair has halted pullback at 38.2% retracement of a recent upward impulse (93.20 area). An attempt of breaking below failed, resulting in a candlestick with long, lower wick that heralded a rebound. Pair bounced off the 93.20 zone but the advance was halted this morning by a short-term resistance in the 94.00 area. Support at 93.20 and resistance at 94.00 are key near-term levels to watch. The pair is likely to respond to changes in overall risk sentiment so FOMC meeting is a significant potential catalyst for the pair. AUDJPY may also move following the release of monthly activity data from China during the Asian session ahead.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.