Reserve Bank of Australia announced an expected 25 basis point rate hike today. This was the first rate move after four meetings of holding rates unchanged. Money markets saw an around-60% chance of such a decision while the majority of economists revised their expectations to rate hike following a higher-than-expected CPI report for Q3 2023.

Key takeaways from statement

- CPI inflation is now expected to be at the top of the target range of 2 to 3% by the end of 2025

- The board remains resolute in its determination to return inflation to the target

- The board judged that an increase in interest rates was warranted today to be more assured that inflation would return to target in a reasonable timeframe

- Services price inflation has been surprisingly persistent overseas and the same could occur in Australia

- Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable time frame will depend upon the data and the evolving assessment of risks

- To date, medium-term inflation expectations have been consistent with the inflation target and it is important that this remains the case

- There are still significant uncertainties around the outlook

- High inflation is weighing on people’s real incomes and household consumption growth is weak, as is dwelling investment

- Wages growth has picked up over the past year but is still consistent with the inflation target, provided that productivity growth picks up

- The weight of information suggests that the risk of inflation remaining higher for longer has increased

While a rate hike is a hawkish decision, the remainder of the statement suggests that further tightening may not be necessary. RBA highlighted that inflation trends are consistent with return of inflation to target but remained open to more moves, saying that they will depend on incoming data. Money markets are no longer pricing in any RBA rates hikes. However, no rate cuts are priced in throughout 2024 either.

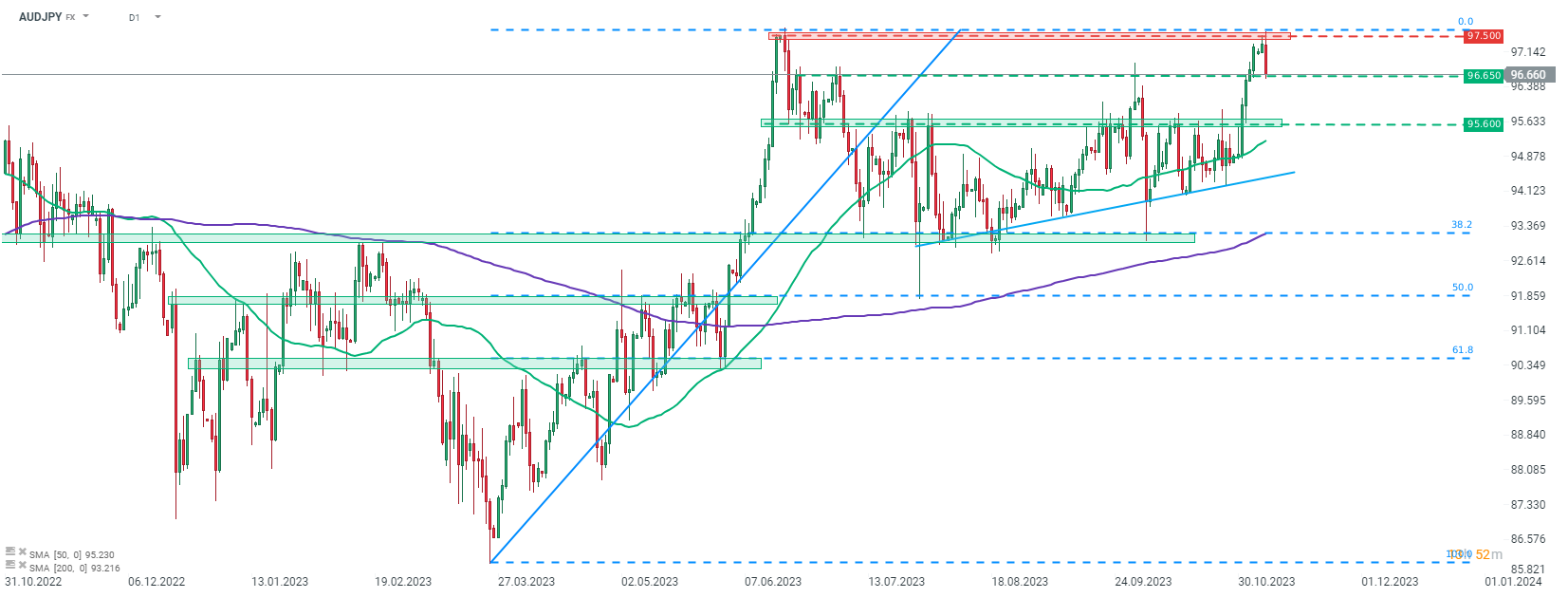

Australian dollar took a hit amid lack of clear hawkish guidance from RBA. Taking a look at AUDJPY chart at D1 interval, we can see that the pair is taking a dive today after failed to break above the 97.50 resistance zone. Sellers are now testing 96.65 swing area and a break below would pave the way for a test of the 95.60 support, which served as the upper limit of the ascending triangle pattern.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.