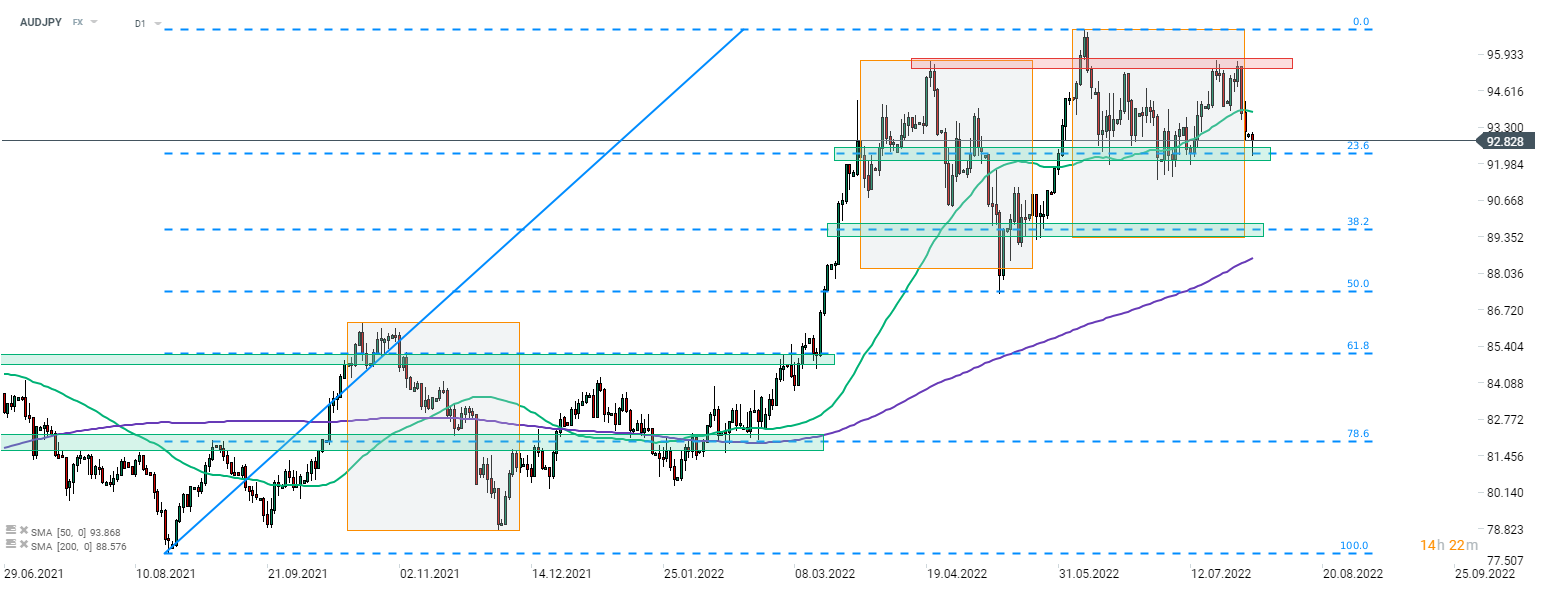

Japanese yen is regaining its shine as of late. While attention is mostly centered on USDJPY, which has pulled back from a high of around 144.00 to almost 132.00 now, other JPY-tied pairs are also noteworthy. AUDJPY, often seen as a risk barometer, is currently trading 3% below a local high reached last Wednesday. The pair tested a short-term support zone marked with 23.6% retracement of the upward move launched almost a year ago in August 2021 (92.30 area). Bears failed to push the pair below this hurdle on their first attempt today but the pair remains closeby. Should we see a break below, downward move may deepend towards the 89.60 area, where 38.2% retracement and the lower limit of the Overbalance structure can be found.

AUDJPY traders should keep in mind that the pair may get more volatile during the next Asian session as the Reserve Bank of Australia is set to announce monetary policy decisions tomorrow at 5:30 am BST. Market is pricing in an over-90% of a 50 basis point rate hike, what would be the third such a move in a row. Guidance may be crucial for AUD, especially whether RBA plans to carry on with rate increases amid deteriorating macroeconomic conditions.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.