Catalent (CTLT.US), a contract pharmaceutical manufacturer whose clients include giants like Moderna, Johnson & Johnson, and Novo Nordisk, has announced a delay in the publication of its highly anticipated Q1 report. The company also indicated that it expects to significantly reduce its forecasts for the remainder of the year. Investors reacted with panic, resulting in a significant decline in the company's stock price. Catalent attributed the delay and reduced forecasts to performance issues and higher costs at three of its facilities. These issues are expected to impact both company profits and prospects. The company has acknowledged previous forecast discrepancies and is currently working to address these issues.

-

Catalent is going to lower its annual revenue projections by over $400 million. The final report has been rescheduled for May 15th to allow for adjustments in the financial statements.

-

The company has signaled performance issues and warned that slower-than-expected growth in production capabilities will weigh on results.

-

Catalent has estimated a goodwill impairment of over $200 million primarily related to the acquisition of Bettera Wellness.

-

In February, Catalent had forecasted full-year net revenues between $4.63 billion and $4.88 billion, along with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) between $1.22 billion and $1.30 billion.

-

According to analysts, quality and transparency issues may harm the company's reputation and its relationships with current and future clients.

-

Catalent was the sole manufacturer of Novo Nordisk's weight-loss drug Wegovy. However, the Danish company has not been affected by this and has already revealed a second producer last month to meet the growing demand.

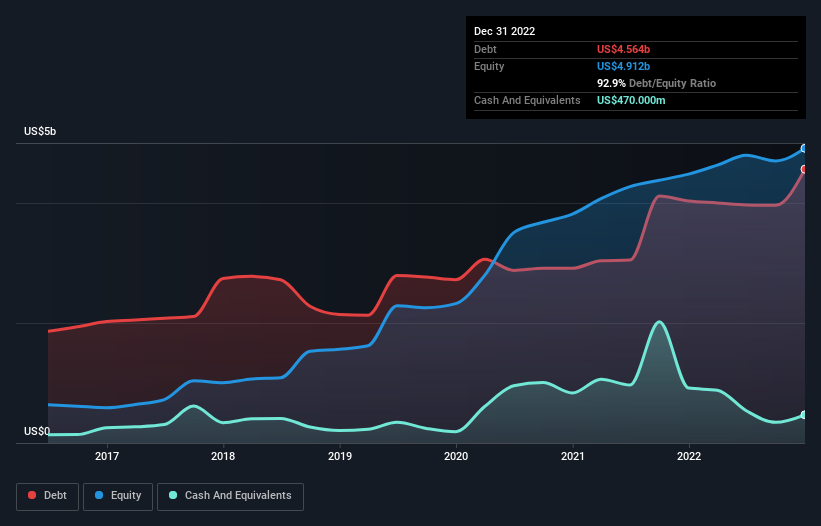

Recently, the company's debt has been increasing at a faster rate than the valuation of its assets, as of May 5th. The debt-to-equity ratio stands at approximately 0.93, indicating that the company's asset valuation is at a similar level to its overall level of debt. Source: SimplyWallStreet.

Recently, the company's debt has been increasing at a faster rate than the valuation of its assets, as of May 5th. The debt-to-equity ratio stands at approximately 0.93, indicating that the company's asset valuation is at a similar level to its overall level of debt. Source: SimplyWallStreet.

After a massive downward gap, Catalent shares are retracing close to the low of the March 2020 sell-off. Source: xStation5.

After a massive downward gap, Catalent shares are retracing close to the low of the March 2020 sell-off. Source: xStation5.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.