Italian-based Campari Group (CPR.IT), opearting in beverage industry (producer of spirits, wines, famous Aperol, Campari and even non-alcoholic apéritifs) rebounding almost 8% after sell-off initiated by CEO Fantacchitotti resign (unsuccessful cadence), US interest rate cuts, and better sentiments across the European (also Italian) stock market. Investors now see higher odds for the company to create value for shareholders.

- Matteo Fantacchiotti, has stepped down abruptly after less than half a year in his position, unofficially due to 'personal reasons'. Fantacchiotti brought to the company experience Carlsberg, succeeding 17-year cadence of Bob Kunze-Concewitz.

- Now Kunze-Concewitz is probably coming back with a possible role of Campari CEO. The firm announced that its Chief Financial Officer, Paolo Marchesini, and General Counsel, Fabio Di Fede, would jointly take over as interim co-CEOs.

- Campari has a very weak yer with weak half-year financial earnings from July, which lead to stock market dump. The sharp drop in shares occurred also, after a discussion on the U.S. spirits industry on September 13, when Campari addressed weak demand trends. The company made its largest acquisition to date, purchasing Courvoisier Cognac

- for $1.32 billion. This deal occurred amid slowing consumer demand in the cognac market. At the time, Kunze-Concewitz downplayed concerns, stating that the slump was temporary and medium- to long-term outlook will be optimistic. Now, the company faces new challenges and as a new CEO with the companies Board will have to address it.

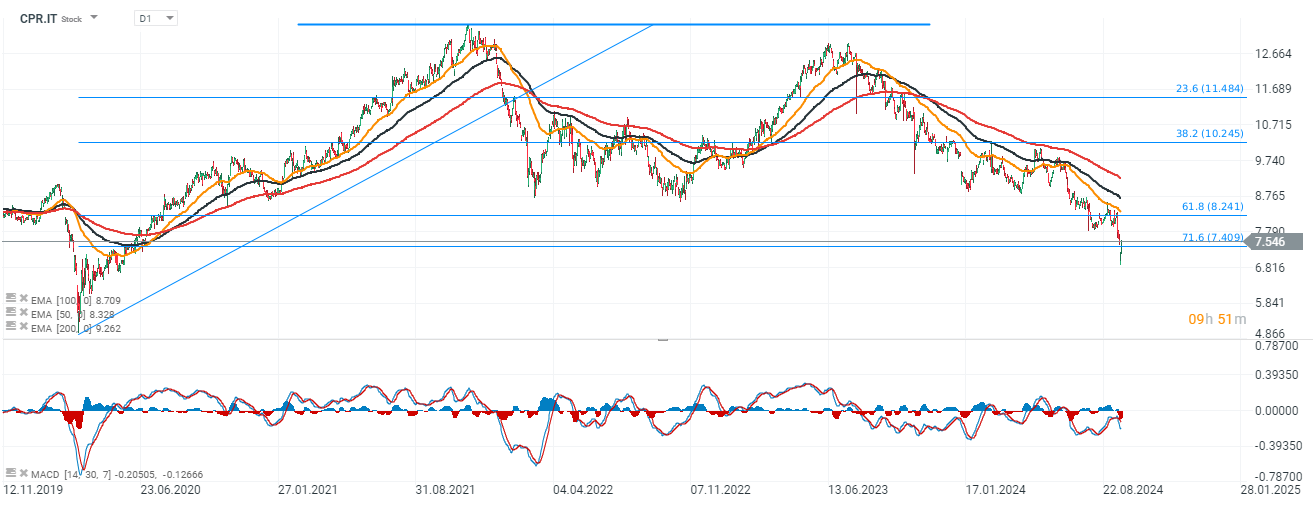

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.