Oil is continuing its rally triggered by OPEC+ actions, especially supply cut extensions from Saudi Arabia and Russia. Both countries announced 2 weeks ago that they will extend output and export cuts through the end of the year, catching markets off guard as a 1-month extension was widely expected.

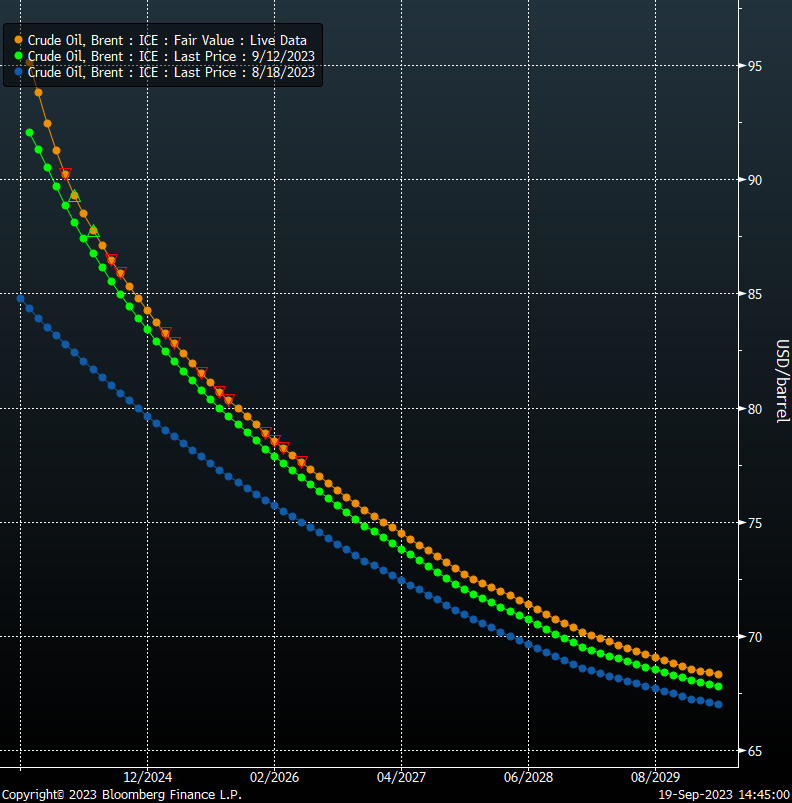

Changes in the crude oil futures curve highlight that the market may be undersupplied in the short-term and that the physical oil market is getting tighter. Taking a look at the chart below, plotting current futures curve as well as week- and month-ago curves, we can see a strong increase in the near-term contracts. Such a situation signals that either short-term demand is very strong, or short-term supply is constrained. The latter seems to be the case as there are still a number of questions around Chinese demand growth. Spread between 1st month Brent contract and 4th month Brent contract is approaching $4 per barrel - levels not seen since mid-November 2022.

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Taking a look at Brent (OIL) chart at D1 interval, we can see that price is at daily highs, just a touch below $95.50 mark. Oil prices are up over 15% since late-August low and market analysts as well as oil industry insiders saying that $100 per barrel may soon be reached. However, while consensus seem to be build around forecast that $100 will be breached, it is almost equally accepted that any such breakout will be short-lived given how quick recent gains were, how strongly overbought the market is and how fundamentals does not justify such price levels. The near-term resistance to watch can be found in the $98 per barrel area - around 2.5% above current market price - and is marked with local highs from the second half of 2022.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.