The core PCE price index, which excludes volatile items such as food and energy and is the Federal Reserve's favorite inflation indicator, rose to 3.5 % over year-on-year in June, after a 3.4% advance in May and below market expectations of 3.7%. On a monthly basis, core PCE prices decreased to 0.4% in June from 0.5% in May, below market consensus of 0.6%.

Personal income in the United States edged 0.1 percent higher in June , trying to recover from a revised 2.2 percent drop in May and beating market expectations of a 0.3 percent fall.

Personal consumption in the US surged 1% mom in June, rebounding from a 0.1% drop in May and beating market forecasts of a 0.7% increase.

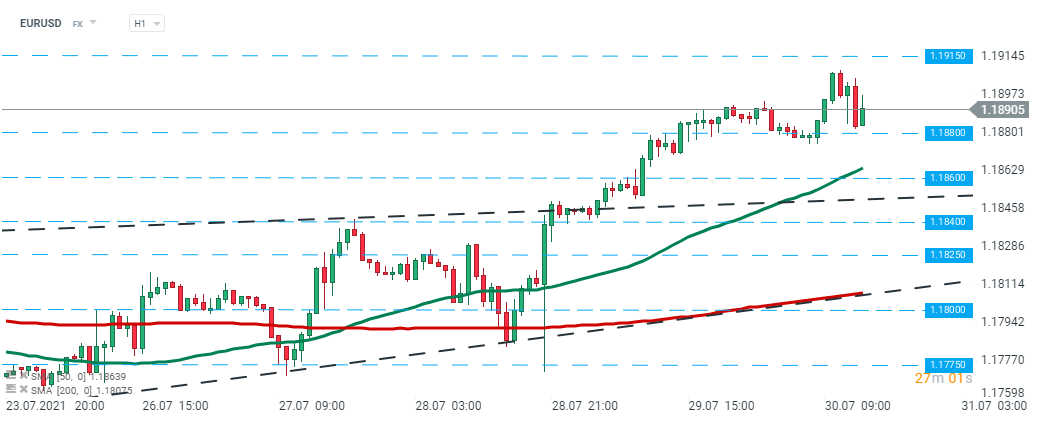

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.1890 level. Source: xStation5

EURUSD saw a relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.1890 level. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.