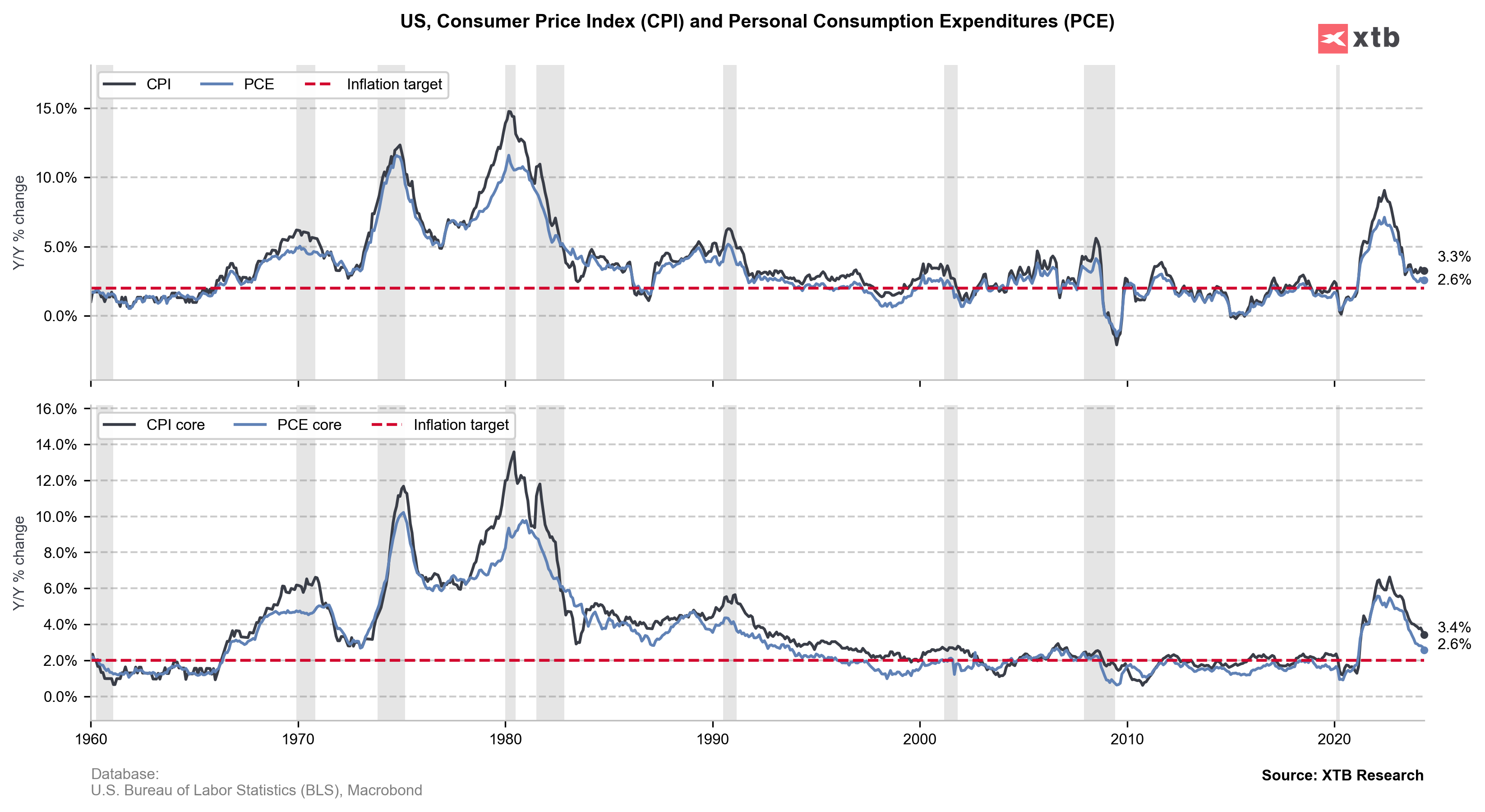

US monthly data pack for May, including PCE inflation data, was released today at 1:30 pm BST. Report was expected to show a slowdown in headline and core PCE measures, as well as acceleration in personal income and spending growth. However, it should be said that while PCE is Fed's preferred inflation measure, it is released with a lag compared to CPI data and therefore may not have as much as impact on the markets.

Actual data turned out to be mostly in-line with expectations - headline and core CPI slowed to 2.6% YoY, just as market expected, with monthly changes also matching estimates. Some surprise was offered in personal income and spending data, with the former growing more than expected and the latter growing less than expected. Overall, data should not have too much impact on Fed's policy view.

Market's reaction was dovish at first with USD moving lower in a knee-jerk move and equities moving higher. However, gains on indices were already erased, while declines on USD market were trimmed.

US, data pack for May

- Headline PCE (annual): 2.6% YoY vs 2.6% YoY expected (2.7% YoY previously)

- Headline PCE (monthly): 0.0% MoM vs 0.0% MoM expected (0.3% MoM previously)

- Core PCE (annual): 2.6% YoY vs 2.6% YoY expected (2.8% YoY previously)

- Core PCE (monthly): 0.1% MoM vs 0.1% MoM expected (0.2% MoM previously)

- Personal income: 0.5% MoM vs 0.4% MoM expected (0.3% MoM previously)

- Personal spending: 0.2% MoM vs 0.3% MoM expected (0.2% MoM previously)

Source: xStation5

Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Chart of the Day: EURUSD after data from Europe and weaker US labor market

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.