A number of macro reports from the United States were released at 1:30 pm BST today, including revised US GDP report for Q1 2024. As this is the third release of the Q1 GDP data no major deviation from previous readings was expected. However, durable goods orders data for May and weekly jobless claims reports could offer some surprises and trigger some market moves.

There were some surprises when actual data was released. While US GDP growth was confirmed at annualized 1.4% in Q1 2024, PCE data was revised higher to 3.1% and core pce data was revised from 3.6 to 3.7%. Headline durable goods orders surprised to the upside with an unexpected increase, while core orders unexpectedly decreased. Initial jobless claims came in lower than expected but continuing claims increased. Overall, data pack was mixed and so was reaction of the markets.

USD dropped initially before erasing gains quickly afterwards. However, those gains were erased and now it trades slightly lower compared to pre-release levels. US index futures moved higher.

US, GDP report for Q1 2024 (third release)

- Annualized growth: 1.4% vs 1.4% in second release

- PCE: 3.1% QoQ vs 3.0% QoQ in second release

- Core PCE: 3.7% QoQ vs 3.6% QoQ in second release

US, durable goods orders for May

- Headline: +0.1% MoM vs -0.1% MoM expected (+0.6% MoM previously)

- Excluding transport: -0.1% MoM vs +0.2% MoM expected (+0.4% MoM previously)

US, jobless claims report

- Initial jobless claims: 233k vs 236k expected (238k previously)

- Continuing jobless claims: 1839k vs 1828k expected (1828k previously)

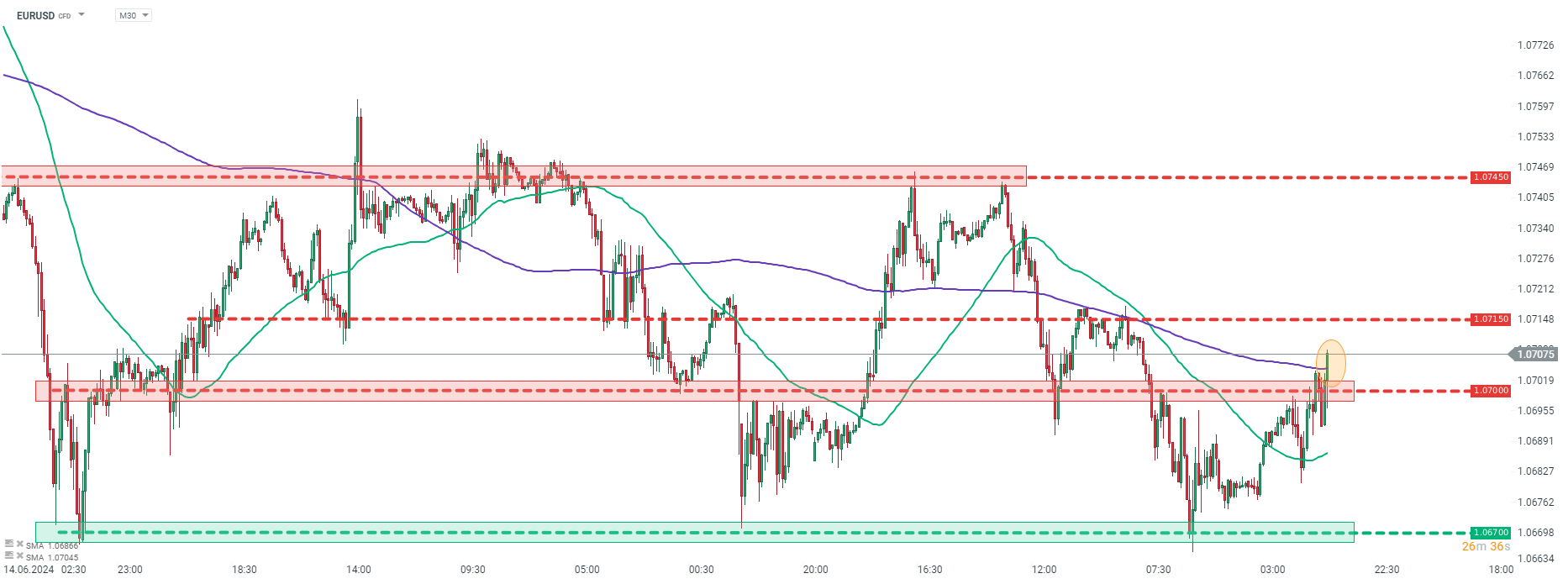

EURUSD gains after release of US data and breaks above the 1.0700 resistance zone as well as the 200-period moving average on 30-minute interval. Source: xStation5

EURUSD gains after release of US data and breaks above the 1.0700 resistance zone as well as the 200-period moving average on 30-minute interval. Source: xStation5

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.