Another set of hawkish comments from two FED members Williams and Bullard caused some moves in the market in the evening. USD dollar strengthened, while US equities deepened downward move.

Fed's Bullard:

-

The markets are underpricing the risk that the FOMC may be more aggressive.

-

The Fed will have to continue raising interest rates until 2023.

-

The FOMC must reach the low end of the 5%-7% rate range.

-

We will have to maintain sufficiently high rates throughout 2023 and 2024.

-

Everything will go better if we reach the restrictive level sooner, making 2023 a year of disinflation.

-

The first 250 basis points of tightening were just getting to neutral.

-

The labour markets remain extremely strong and its response to inflation is not as strong as many people believe.

-

A recession is not inevitable.

-

Estimates for fourth-quarter US GDP are positive.

-

Continues to believe that growth will be below trend in 2023.

Fed's Williams:

-

Inflation remains far too high and will take time to fall.

-

The Fed has more work to do to reduce inflation.

-

The unemployment rate in the United States is expected to rise from 3.7% to 4.5%-5.0% by late 2023.

-

More interest rate increases will aid in the restoration of economic balance.

-

Noticed signs of moderating inflation amid supply chain improvement.

-

Inflation is expected to fall to 5.0%-5.5% by the end of 2022 and 3.0%-3.5% by late 2023.

-

The job market remains remarkably tight, with strong hiring and wage gains, while inflation expectations remain stable

-

The Fed's outlook is dependent on the data.

-

Economists do a bad at forecasting recessions.

-

There are several downside risks to the forecast.

-

The baseline forecast does not predict a recession for the US.

-

Fed could reduce rates in 2024.

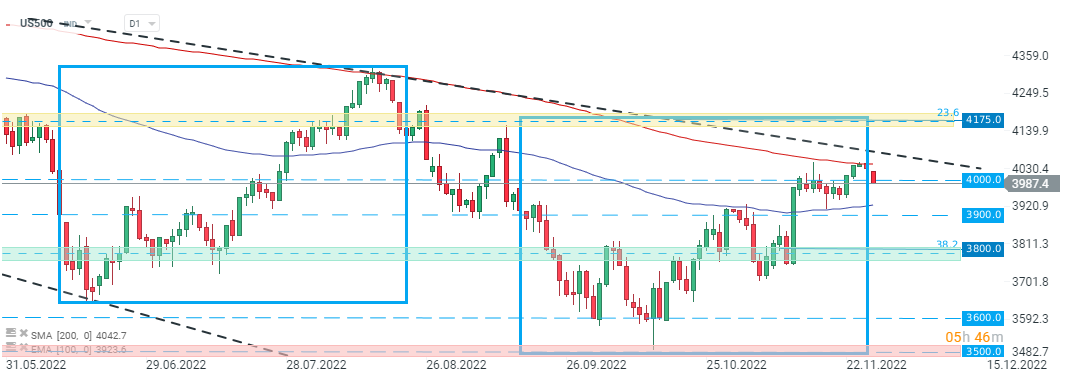

US500 failed to break above 200 SMA (red line) last week, and today's index returned below psychological 4000 pts level following Bullard and Williams comments. Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.