- US NFP report for April.

- Change in non-farm employment. Currently: 175 thousand. Expected: 245 thousand. Previously: 303 thousand.

- Change in private sector employment. Currently: 167 thousand. Expected: 180 thousand. Previously: 232 thousand.

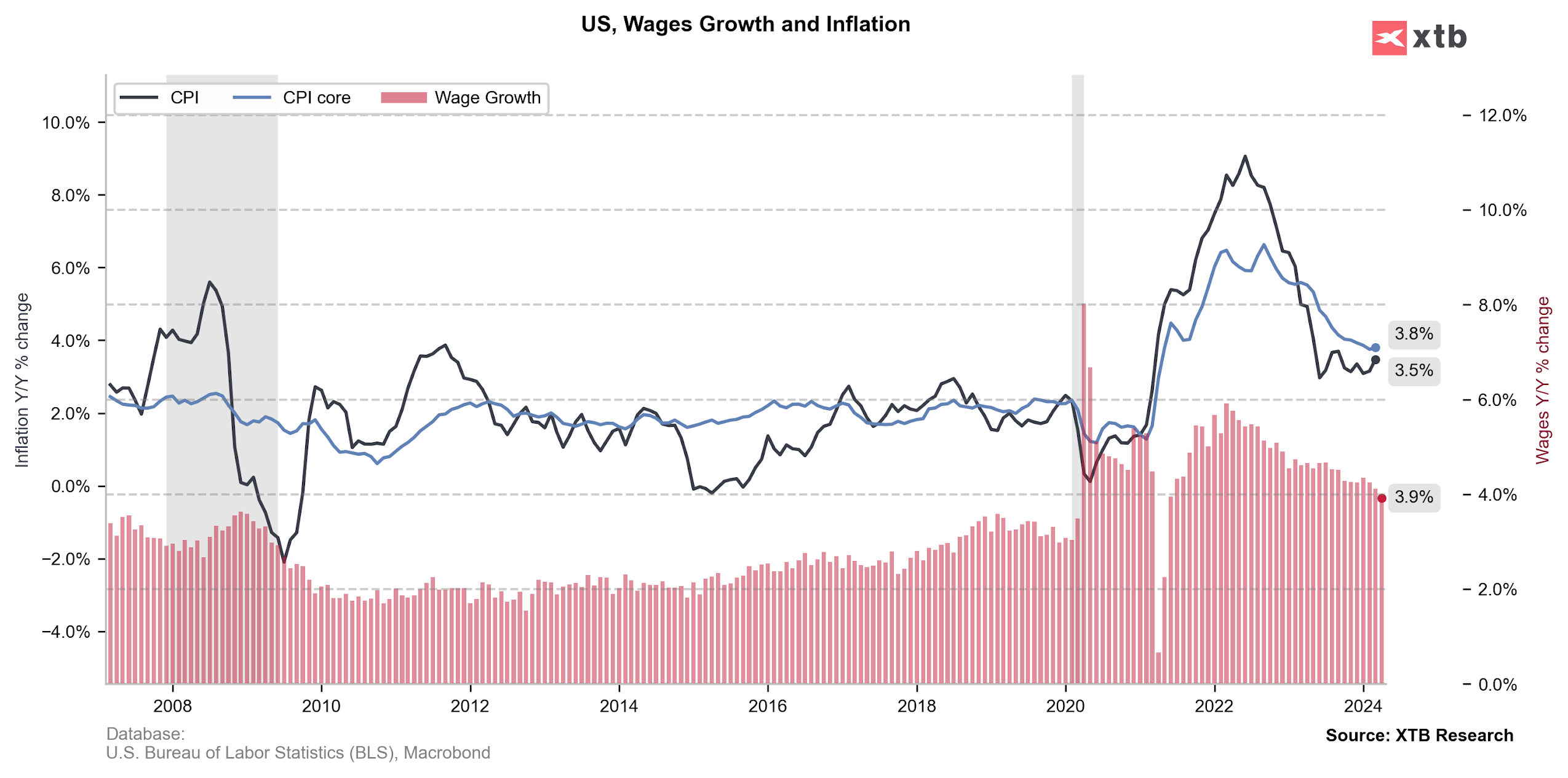

- Average hourly wages on an annualized basis. Currently: 3,9%. Expected: 4%. Previously: 4.1%.

- Average hourly wages by month. Currently: 0.2%. Expected: 0.3%. Previously: 0.3%.

- Unemployment rate. Currently: 3.9%. Expected: 3.8% y/y. Previously: 3.8% y/y.

The data is performing poorly, given that many investment banks were expecting that the data may have come out more clearly above expectations. U.S. Fed funds futures raise the odds of a rate cut in September to 78% after the employment data, compared to 63% just before it. In addition to the sheer powerful rallies in the quotations of U.S. indices, we are seeing a large appreciation of the yen against the U.S. dollar. The USDJPY pair is currently losing nearly 1.2%.

Source: XTB Research

Source: XTB Research

Source: xStation

Source: xStation

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.