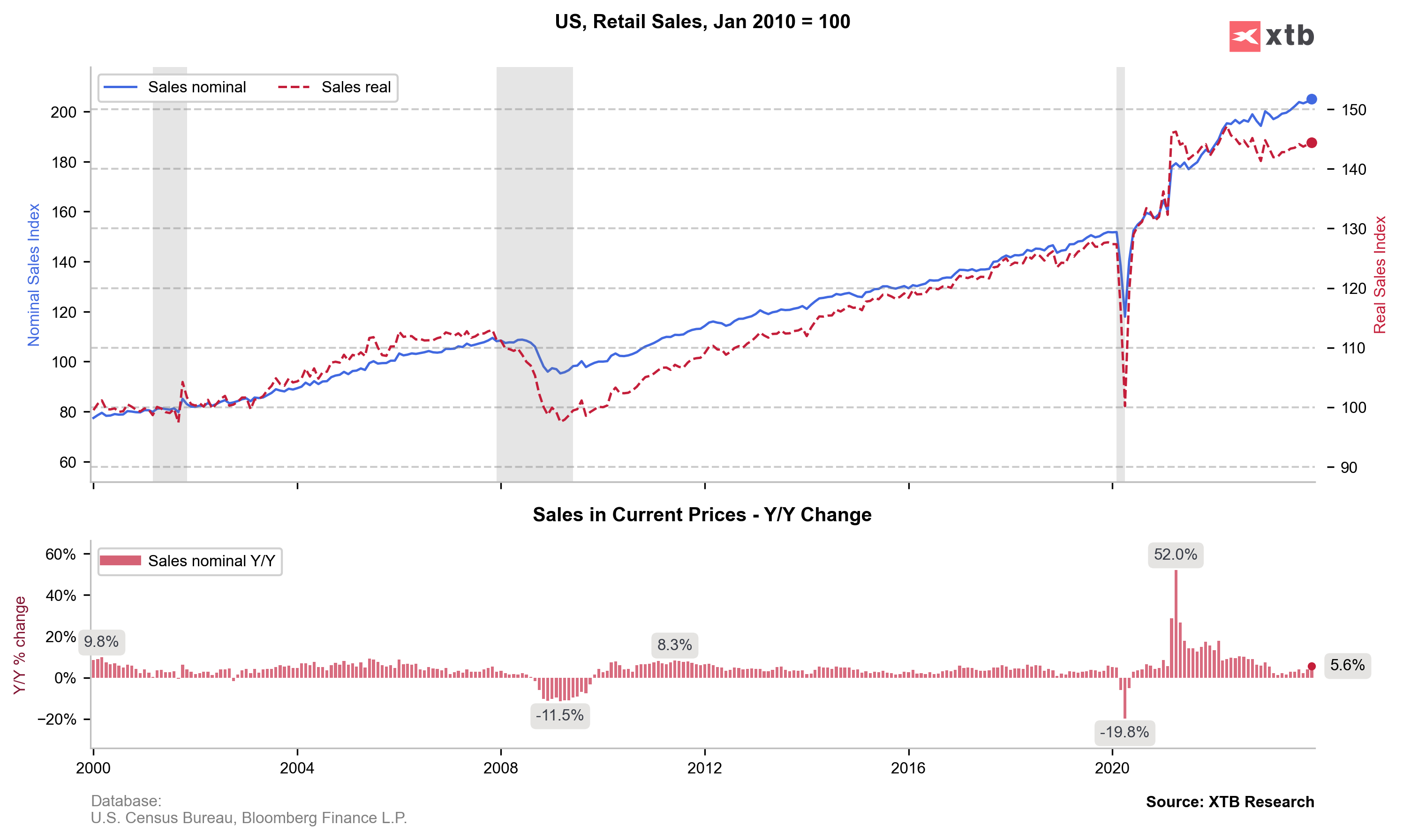

US retail sales reading for December came in 0.6% MoM vs exp. 0.4% exp. and 0.3% previously

- US core retail sales MoM: 0.4% vs 0.2% exp and 0.2% previously

- US retail sales y/y: 5.59% vs 4.09% previously

- US export prices MoM: -0.9% vs -0.7% exp. and -0.9% previously

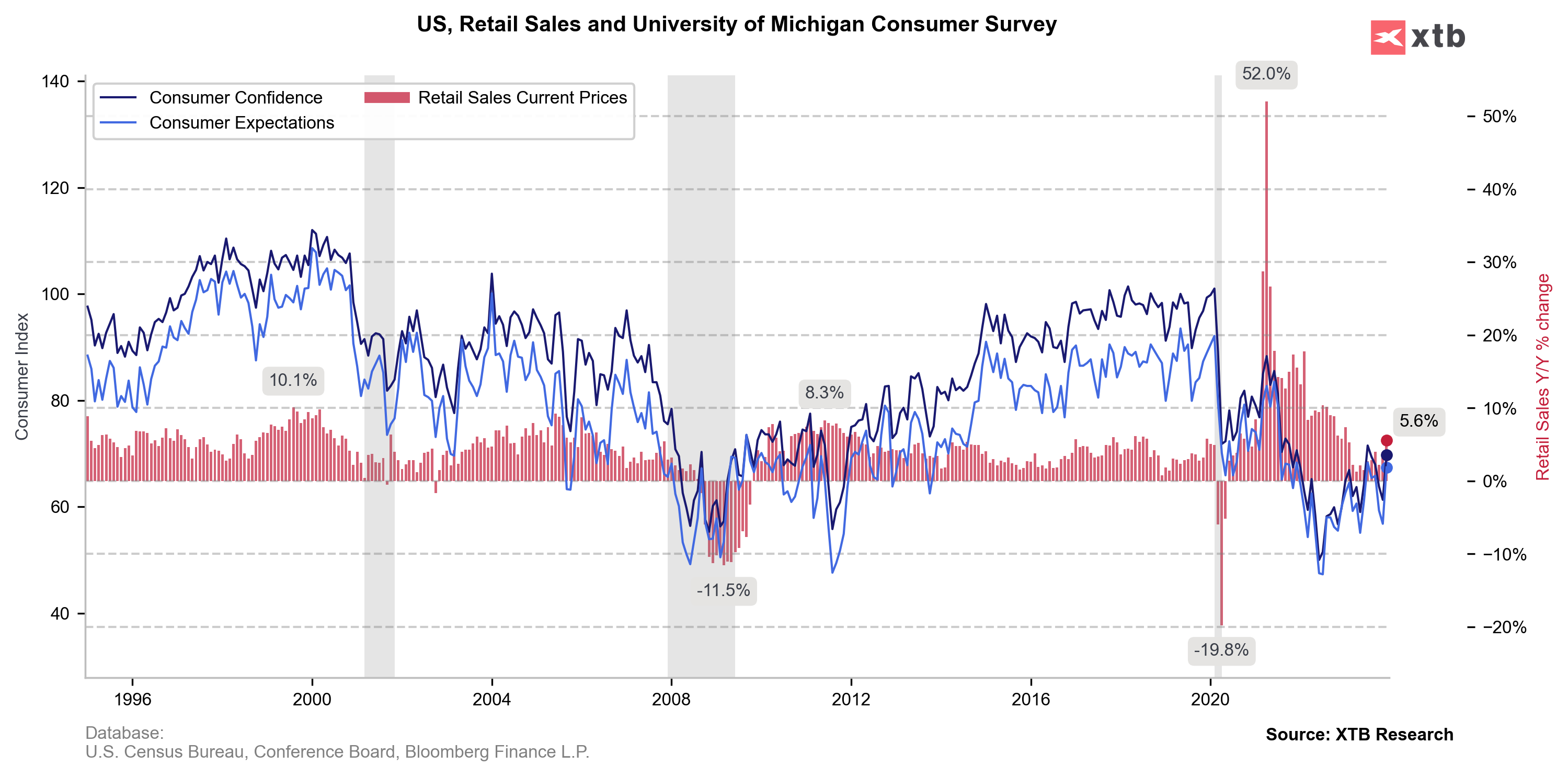

US100 loses after the data, we can see an uptick in yields and bonds under pressure. Also, US short-term interest-rate futures drop after stronger reading. Today, retail sales data suggest that US Consumers are still in good condition. It supported also favorable for US dollar narration of the Fed member Christopher Waller, who signaled yesterday that Fed will be not in hurry cutting rates and the possible scale of easing will be much less than markets expect.

- Despite today data, analysts from Citigroup expect that the Fed will start rates cuts in June vs previously expected July (125 bps of total cuts in 2024 vs 100 bps forecasted before). It's 50 bps higher that Fed Waller signalled yesterday, but the truth is that the future US economy momentum is still unknown.

- For now US economy reflects almost 75% Fed policy transmission, according to IMF analysts and as for now there are some signs that the soft landing is possible. The cost of that is quite persistent inflationary risk, which may signal a 'sea change' in Fed policy (higher rates, for longer). It may be also a sign that the Fed will cut but to higher than expected levels such as 3 or 4% and left rates for longer. In that case, higher risk-free rate may be good for fixed income assets but theoretically less favorable for stocks in the long term.

Source: xStation5

Source: xStation5

Source: Bloomberg Financial LP, US Census Bureau, XTB Research

Source: Bloomberg Financial LP, US Census Bureau, XTB Research

Source: US Census Bureau, Conference Board, Bloomberg Finance LP, XTB Research

Source: US Census Bureau, Conference Board, Bloomberg Finance LP, XTB Research

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.