-

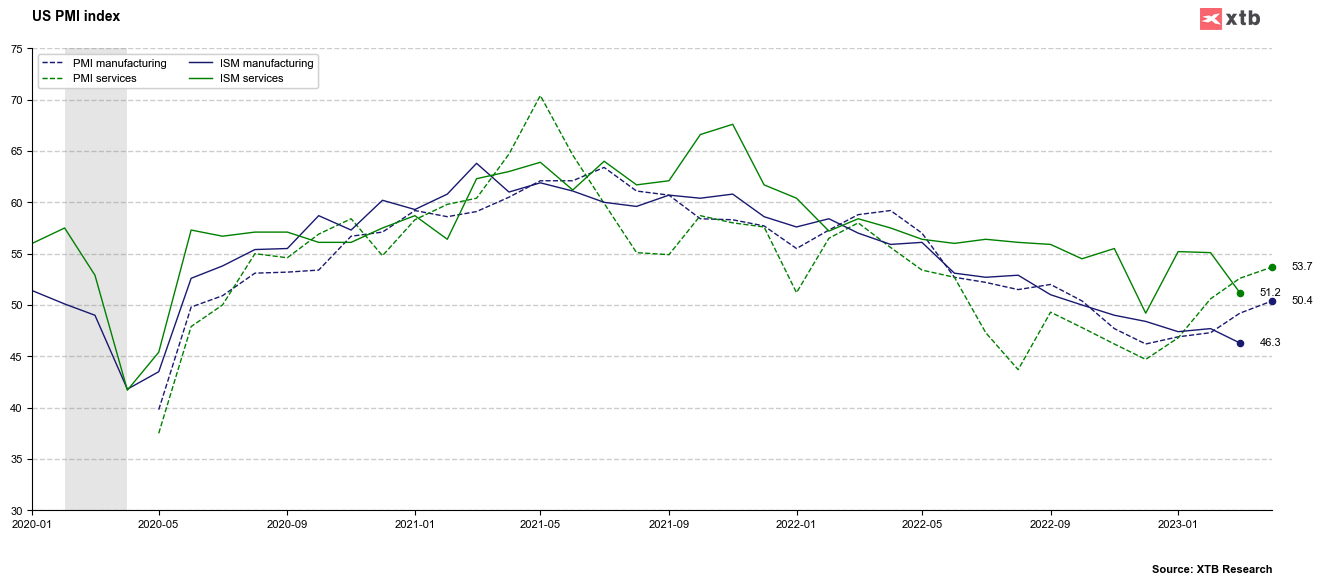

Manufacturing: 50.4 vs expected: 49 Previous: 49.2

-

Services: 53.7 vs expected: 51.5. Previous: 52.6

Data came better than expected by analysts and this means the US economy remains strong. Which gives some space for the FED to continue to tighten monetary policy. As in the EU, the PMI services came much better than manufacturing.

Currently investors estimate the probability of a 25 pb rate hike at 86.6% in favor of a 25 bp hike and 13.4% in favor of no change at the Fed meeting in early May. After the release of the PMI data, investors have some hints on what to expect from the ISM data for April, which will be released on May 3.

US500 is trading below 4160 points. Right after the publication there was no significant reaction. However, a moment later the index dipped below 4150 points moving away from the upper support line.

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.