US PCE price index y/y: 4,2% vs 4,1% exp. and 5,0% previously

US PCE price index m/m: 0,1% vs 0,1% exp and 0,3% previously

US Core PCE y/y: 4,6% vs 4,58% exp and 4,6% previously

US Core PCE m/m: 0,3% vs 0,3% exp and 0,3% previously

US Consumer spending data: 0% vs -0,1% exp and 0,2% previously

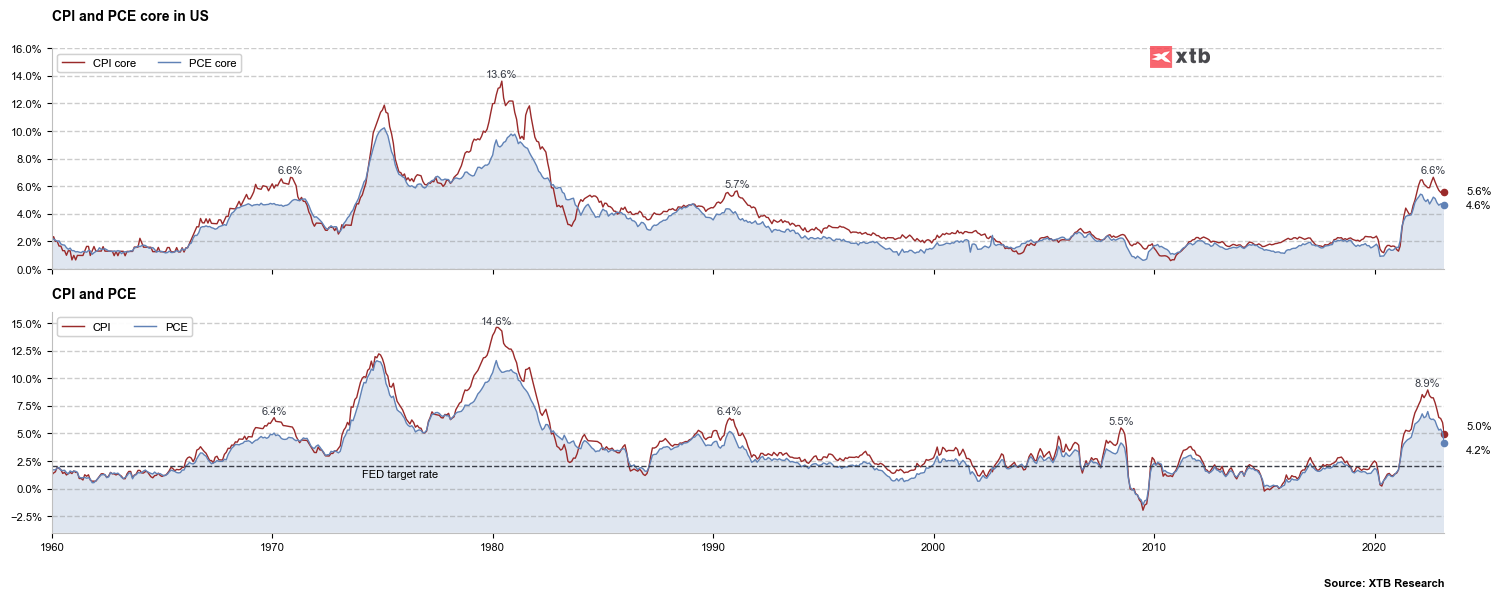

The data are mostly hawkish, because Fed may read it as higher inflation regime warning. The PCE measure is key for Federal Reserve policmakers. Americans income is higher but consumption is slower indicating that inflation put some pressure on US households.

Core PCE inflation is falling slower than the analyst consensus expected. The overall trend against CPI readings is of course still pointed downward. However, the loss of downfall momentum may herald that price pressures are becoming entrenched at levels that are too high. In that case, the Fed would have a much more difficult job to do. Source: XTB

Core PCE inflation is falling slower than the analyst consensus expected. The overall trend against CPI readings is of course still pointed downward. However, the loss of downfall momentum may herald that price pressures are becoming entrenched at levels that are too high. In that case, the Fed would have a much more difficult job to do. Source: XTB

The first reaction of US100 on PCE data is mixed. Source: xStation5

The first reaction of US100 on PCE data is mixed. Source: xStation5

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.