US retail sales data for February was released at 1:30 pm GMT and did not trigger any major moves on the markets. Highlights of the report:

• Headline: -0.4% MoM vs -0.3% MoM expected (3.0% MoM previous). The biggest decreases were seen in sales at furniture stores (-2.5%), food services and drinking places (-2.2%), miscellaneous retailers (-1.8%), motor vehicles and part dealers (-1.8%), clothing stores (-0.8%), gasoline stations (-0.6%). In contrast, increases were seen in nonstore retailers (1.6%), health (0.9%), food and beverages stores (0.5%), general merchandise stores (0.5%) and electronics and appliances (0.3%).

• Ex-autos: -0.1% MoM vs -0.1% MoM expected (2.3% MoM previous)

Simultaneously to the release of retail sales figures, the US PPI report for February was released.

-

Annual producer inflation in the United States edged down/higher to 4.6% last month from an downwardly revised 5.7% in January, well below analysts’ estimates of 5.4%. The rate of inflation was the lowest since March 2021, adding to signs that inflationary pressure in the world's largest economy might be cooling following the policy tightening delivered by the Fed over the past year.

-

The producer price index for final demand less foods and energy dropped to 4.4% from a year earlier in February, from 5.4% in January and below market expectations of an 5.2% increase.

Both retail sales and producer prices moved lower in February. Source: Bloomberg via ZeroHedge

Source: Bloomberg via ZeroHedge

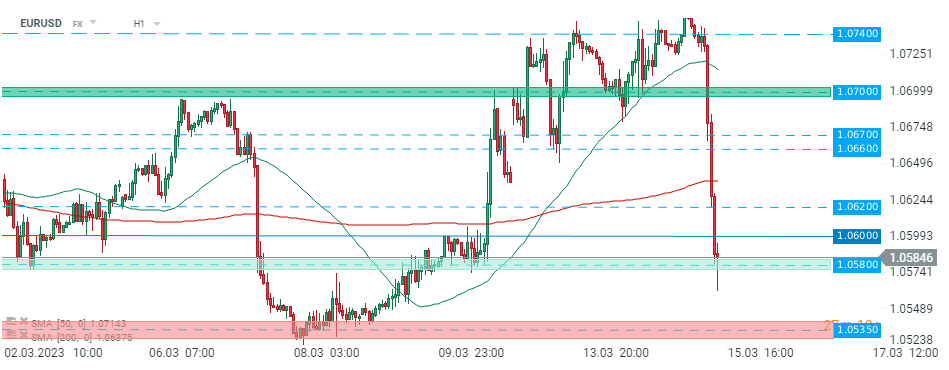

EURUSD is rather unimpressed by today's data. The pair continues to trade around support at 1.0580. Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.