• The S&P Global US Manufacturing PMI rose to 47.8 in February from 46.9 in January, well above market forecasts of 47.3 flash estimates showed.

The reading pointed to a fourth consecutive month of falling factory activity although the smallest in the current sequence of decline. Production continued to fall amid weak client demand and new orders decreased sharply, with some companies noting that sufficient stocks at customers and high inflation dampened demand conditions. Meanwhile, lower buying activity also contributed towards an improvement in vendor performance. Suppliers’ delivery times were reduced to the greatest extent since May 2009 amid weak demand for inputs and fewer logistics issues. Employment rose at the fastest pace since last September and firms reduced their backlogs of work solidly. Input prices softened although selling prices rose the most in three months. Finally, the level of business confidence was broadly in line with that seen in January.

• The S&P Global US Services PMI jumped to 50.5 in January from 46.8 in the previous month, also above analysts' estimates of 47.2, a preliminary estimate showed.

Quite a positive surprise. Services are back above expansion territory, which shows that the economy may not be slowing down at all. This is also good news for GDP from the perspective of Q1.

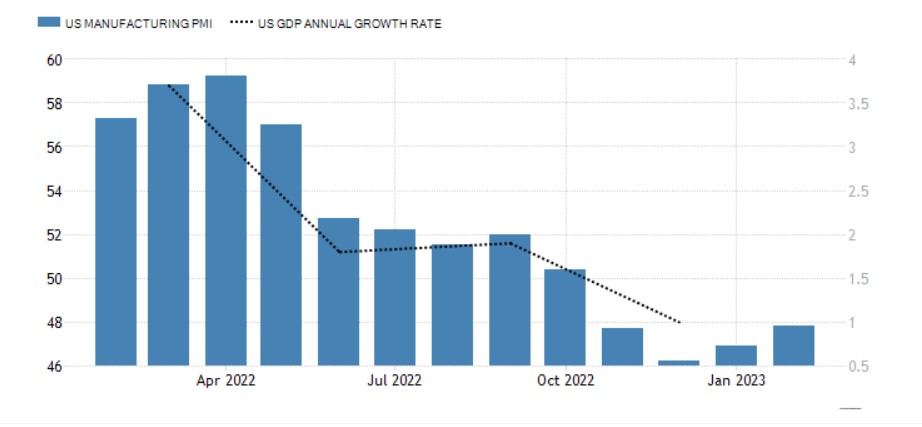

US GDP may rebound in the first quarter. Source: Trading Economics

EURUSD deepened decline after PMI release. The pair broke below major support at 1.0660. Source: xStation5

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.