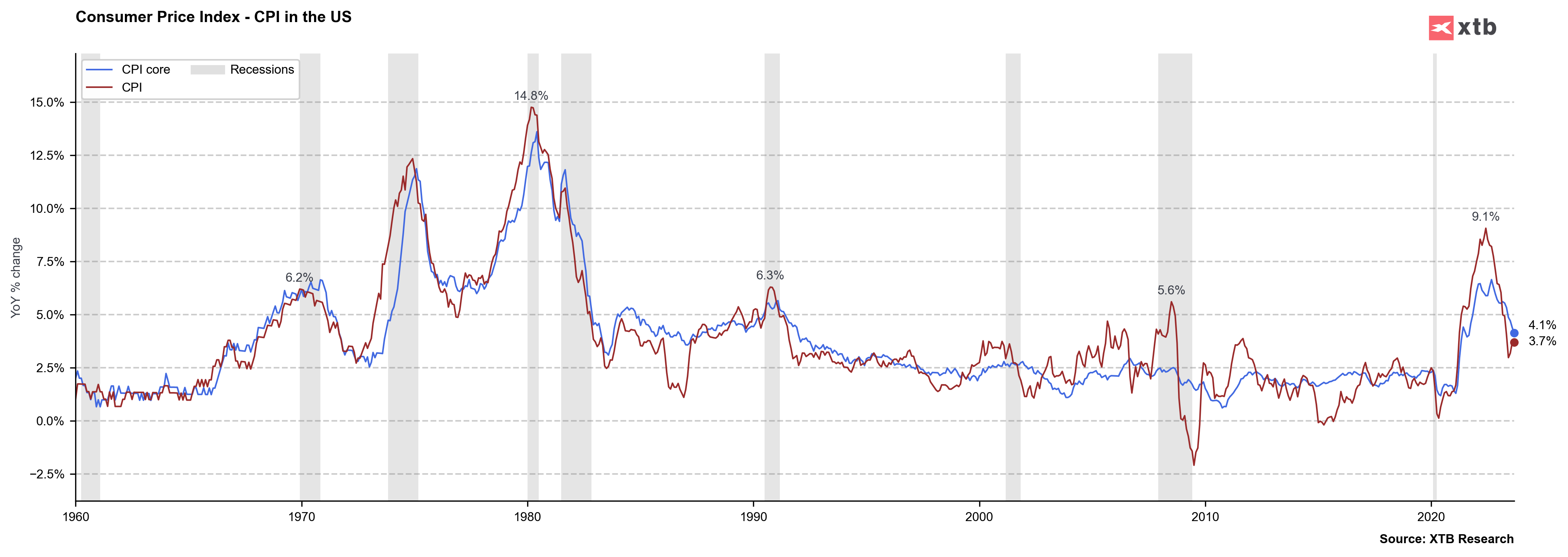

US CPI reading for September y/y: 3,7% vs 3,6% exp and 3,7% previously

- US CPI reading for September m/m: 0,4% vs 0,3% exp and 0,7% previously

US Core CPI reading for September y/y: 4,1% vs 4,1% exp and 4,3% previously

- US Core CPI reading for September m/m: 0,3% vs 0,3% exp and 0,3% previously

US Initial jobless claims: 209 k vs 210 k exp. and 207 previously

- US contiuned jobless claims: 1702 mln vs 1676 mln exp and 1664 mln previously

Slightly higher than expected US CPI reading may be a signal to Fed that's still to early to end the rate hike cycle and the situation will be safer if interest rates will increase at least once more time (maybe the sooner, the better until strong economy is a mandate to do that). At the same time 'negatively' surprise is very little and inflation cooled off strongly in US economy, what's more and important - the core reading is lower in line with expectations. US jobless claims number was slightly higher but the job market is still very tight (despite higher reading of continued jobless claims). USDIDX gains after the US inflation data and we can see sellers pressure on US100.

Source: xStation5

Source: xStation5

Source: XTB Research

Source: XTB Research

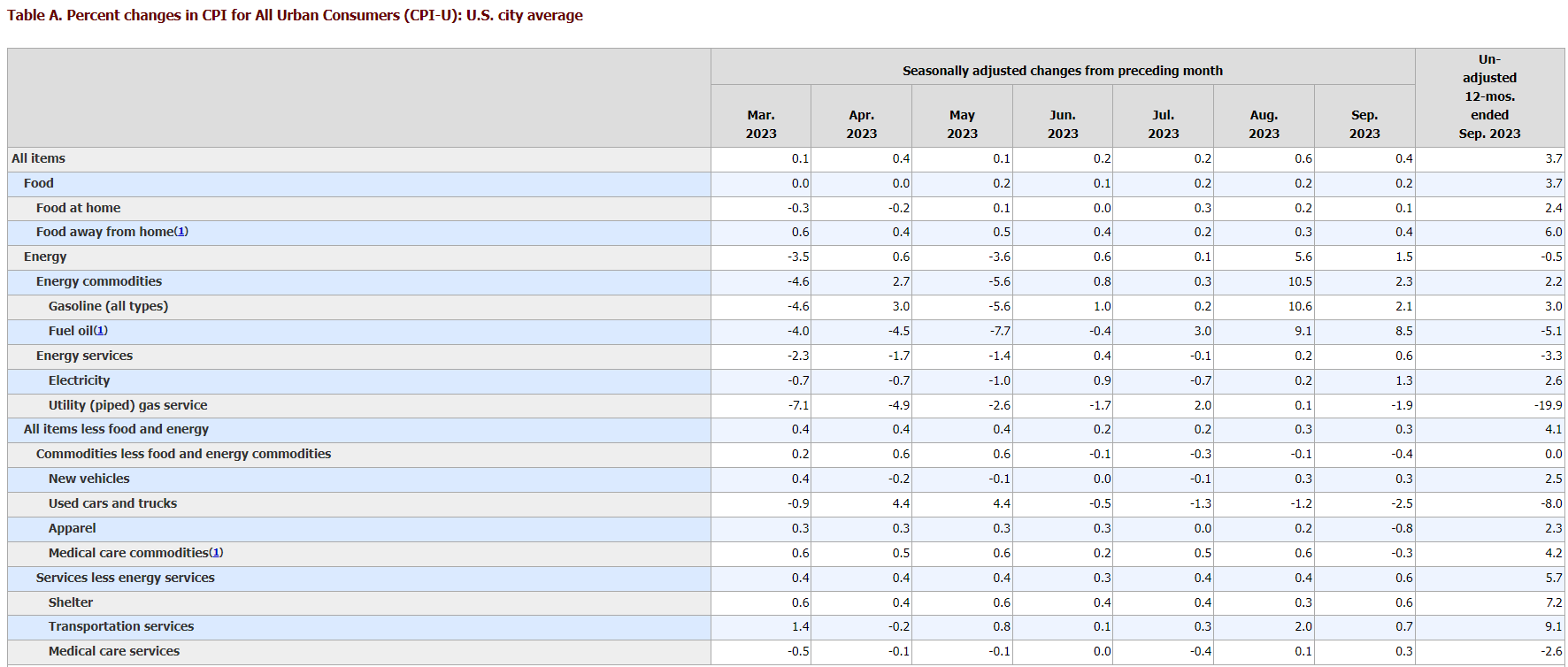

Higher services (especially transportation and shelter data may be a litte negative surprise for the markets. Source: BLS

Higher services (especially transportation and shelter data may be a litte negative surprise for the markets. Source: BLS

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.