Eyes of oil traders are turned to Europe today as the European Union debates over the shape of the looming embargo on Russian oil. This is a major medium- and long-term factor for oil prices and is pushing crude prices higher today. Amid such high level talks it is easy to miss another factor for oil prices with more short-term implications on prices - weekly report from US Department of Energy on the level of oil and oil derivative inventories. Report completely missed estimates from API released yesterday in the evening.

-

Oil inventories: +1.30 mb vs -1.2 mb expected (API: -3.48 mb)

-

Gasoline inventories: -2.23 mb vs -0.2 mb (API: -4.50 mb)

-

Distillate inventories: -2.34 mb vs -1.1 mb (API: -4.46 mb)

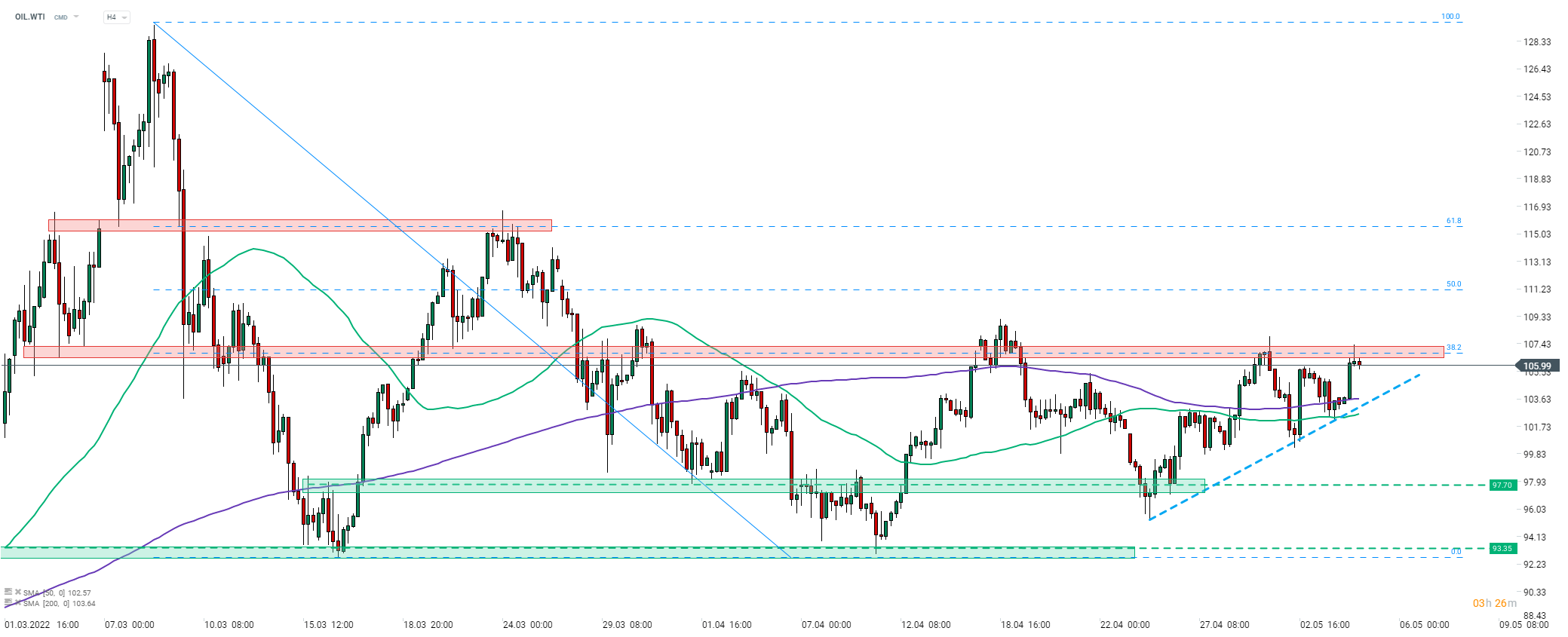

A build in headline crude inventories put some pressure on oil prices with WTI pulling back below $106 area. Taking a look at WTI chart at H4 interval (OIL.WTI), we can see that price made a failed attempt of breaking above resistance zone marked with 38.2% retracement earlier today ($106.75). A long, upper wick of previous H4 candlestick painted in the resistance zone suggests that some kind of a reversal may be looming. If pullback deepens, a near-term support to watch can be found in the $103.50 area, where the short-term upward trendline and 200-period moving average are located.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.