01:30 PM GMT, United States - Employment Data for February:

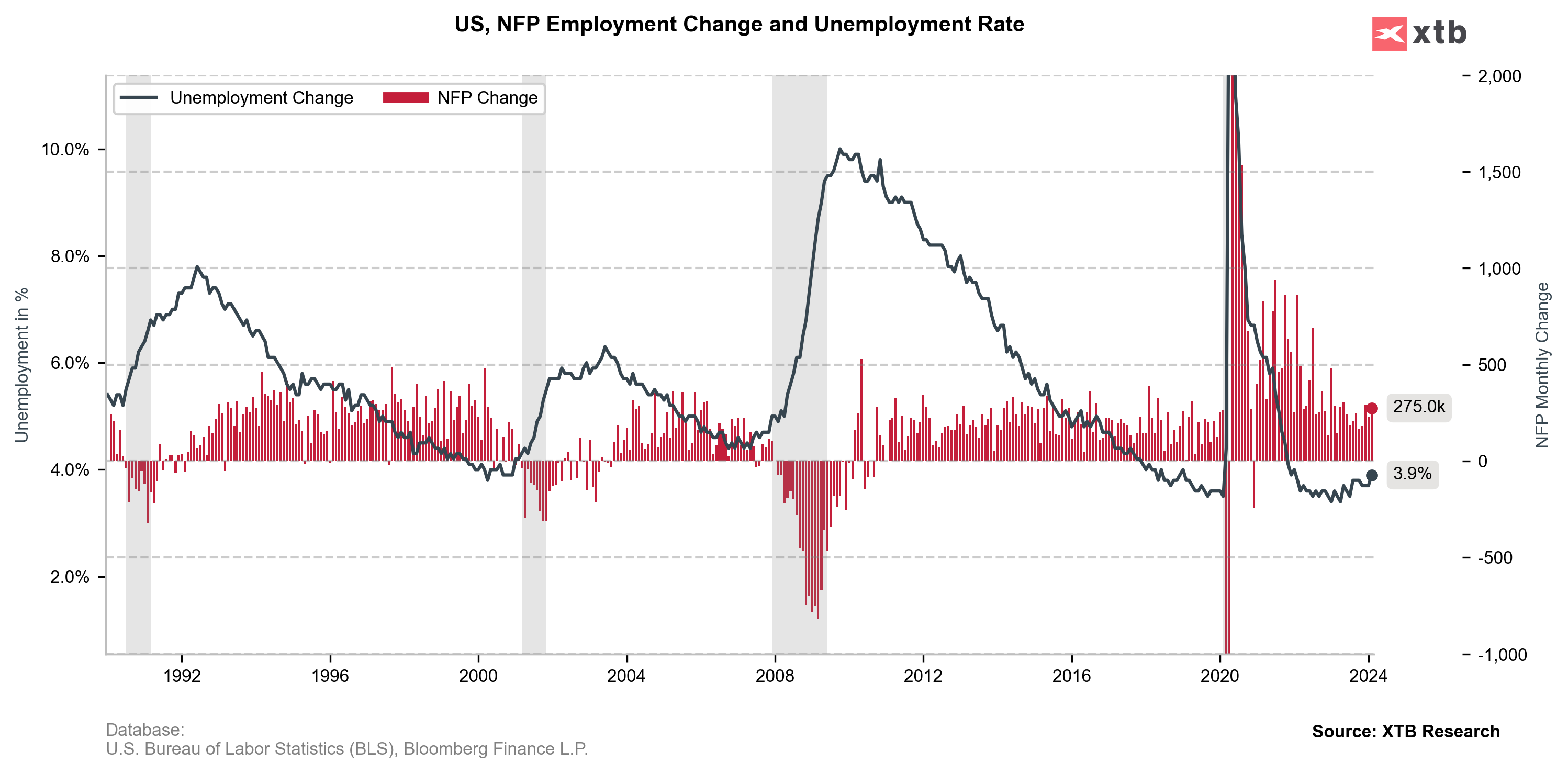

- Nonfarm Payrolls: actual 275K; forecast 198K; previous 229K;

- Private Nonfarm Payrolls: actual 223K; forecast 160K; previous 177K;

- Unemployment Rate: actual 3.9%; forecast 3.7%; previous 3.7%;

- Participation Rate: actual 62.5%; previous 62.5%;

- Average Hourly Earnings: actual 4.3% YoY; forecast 4.4% YoY; previous 4.4% YoY;

- US short-term interest-rate futures rise after jobs report.

- Traders still see a June start to fed rate cuts after job report, with about 30% chance of starting May 1st.

Good data, clearly above expectations, but a lot of revisions visible. Plus lower wage growth, which weakens the dollar. The unemployment rate up, although it is worth remembering that this comes from the household survey, which may reflect the current situation a little better. The sheer number of employed people is falling, but the number of full-time jobs is rising, as many people are working 2 or even more jobs.

Source: xStation 5

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.