Today is one of the most important events in recent weeks - the economic symposium in Jackson Hole, where Federal Reserve Chairman Jerome Powell will speak. In the past, this symposium was used by central bankers to present important positions. However, this happened primarily over a decade ago when Ben Bernanke was leading the Fed. In recent years, the statements of central bank heads have been more measured.

What to expect from Powell? There's a considerable gap between the July and September meetings, and since then, we've received data that may fully support the Fed's initiation of monetary policy normalization in September. Markets are pricing in even more than one rate cut next month. The market clearly expects Powell to announce interest rate cuts, but further details of his speech may determine larger changes.

THE ARTICLE WILL BE UPDATED BELOW

- 3:00 PM CET - Start of the speech

- 3:01 PM CET - Fed's Powell: We will do everything we can to support a strong labor market as we make further progress toward price stability. We do not seek or welcome further cooling in labor market conditions. The timing and pace of rate cuts will depend on data, outlook, and the balance of risks. The time has come for policy to adjust.

- Federal Reserve Chairman believes that inflation is on a sustainable path back to 2%. Upside risks to inflation have diminished, downside risks to employment have increased.

Fed Chair Jerome Powell signaled a significant shift in monetary policy during his speech at the Jackson Hole Economic Symposium.

Key points include:

- The Federal Reserve is ready to cut interest rates, with Powell stating, "The time has come for policy to adjust."

- While no specific timeline was given, Powell's remarks suggest a potential rate cut at the Fed's next meeting in mid-September, which might range from 25 to 50 basis points.

- The focus has shifted from fighting inflation to maintaining a strong job market, with Powell emphasizing they don't welcome further cooling in labor market conditions.

- Recent job reports and revised labor market estimates show a cooling job market, influencing the Fed's stance.

- Powell acknowledged past mistakes, including the assumption that pandemic-era inflation would be temporary.

- The speech struck a more hopeful tone compared to previous years, but Powell made clear that the battle to control prices without causing widespread layoffs is not over.

- Market reactions were positive, with major stock indexes rising during the speech.

- The upcoming presidential election adds complexity to the Fed's decisions, as rate cuts could have political implications.

- Despite the positive economic outlook, Powell and his colleagues remain cautious, remembering past prediction errors.

- Other Fed officials, like Boston Fed President Susan Collins, have also indicated that

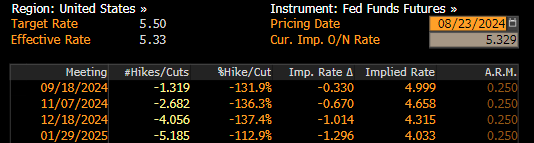

The market has fully priced in rate cuts in September. Now the question is on choice between 25 and 50 basis points. Currently there is more than 30% chance of 50 basis points cut. The base scenario is smaller decrease.

Implied rate cuts. Source: Bloomberg Finance L.P

MARKET OVERVIEW:

The market currently prices in about a 33% chance of a 50 basis point cut in September and fully prices in 100 basis points of cuts in 2024. The reaction to the first words is significant but limited: about 50 pips up on EURUSD, about 25 points up on US500, and about 20 USD up on gold. US500 and gold are testing yesterday's local highs.

Source: xStation

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.