James Bullard, President of St. Louis Fed, hit a hawkish tone during a speech today and triggered noticeable moves on gold and USD markets. Bullard confirmed that his dot on the latest dot plot pointed to rate lift-off in late 2022, earlier than median. He said that the Fed should be ready to make policy adjustments in order to push inflation back towards the goal and that he is worried that the US central bank is aiding the already hot housing market. Bullard also said that recent inflation has been "more intense than expected" and that there is upside risk to inflation forecasts. His comments on taper debate were somewhat puzzling as he said that debate will continue during the coming meetings but at the same time he said that organizing taper debate will take several meetings.

Gold dropped over $10 per ounce on the back of his comments while EURUSD dipped towards 1.1870. Bullard's comments spooked markets as he has been a rather dovish Fed member as of late. His hawkish U-turn signals that Fed officials are becoming increasingly aware of the negative impact of keeping loose policy for a prolonged period of time.

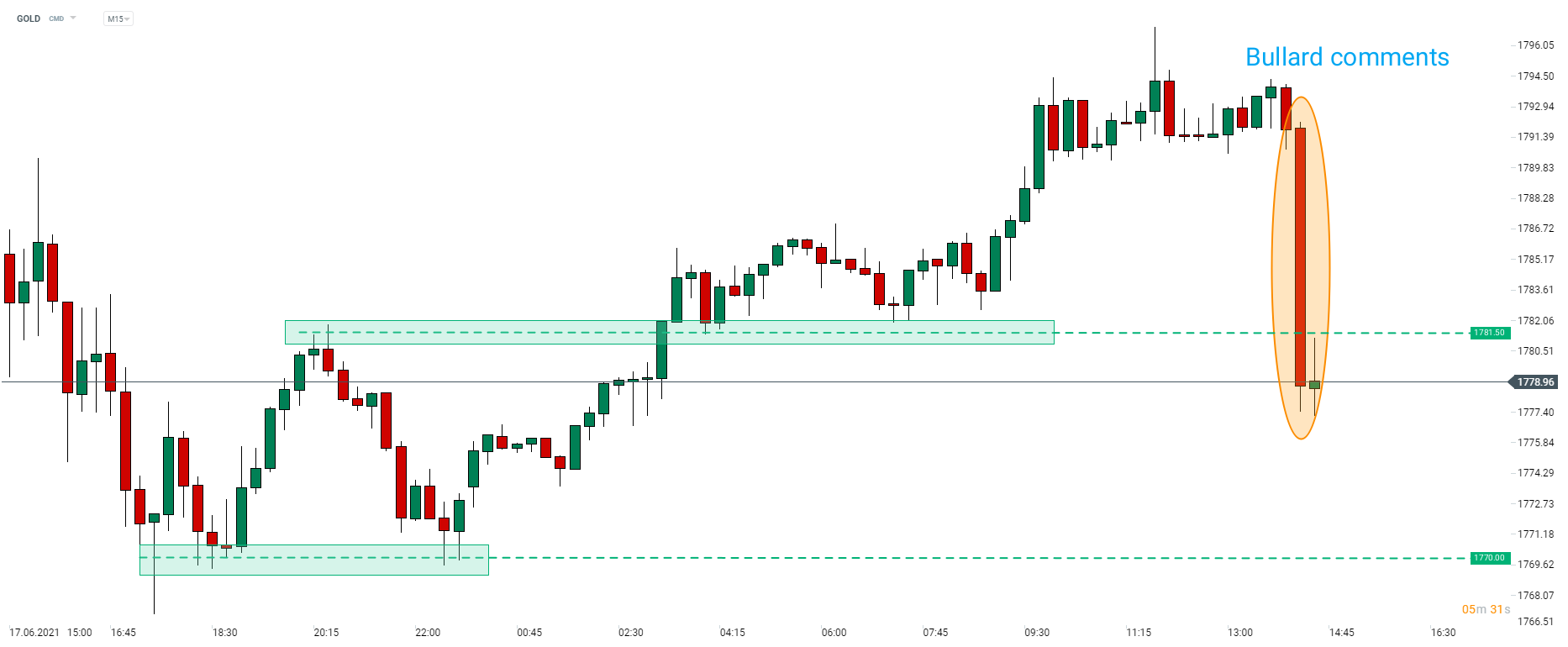

Gold dropped around $10 per ounce following a hawkish U-turn from Fed's Bullard. Precious metal erased the majority of today's gains. Source: xStation5

Gold dropped around $10 per ounce following a hawkish U-turn from Fed's Bullard. Precious metal erased the majority of today's gains. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.