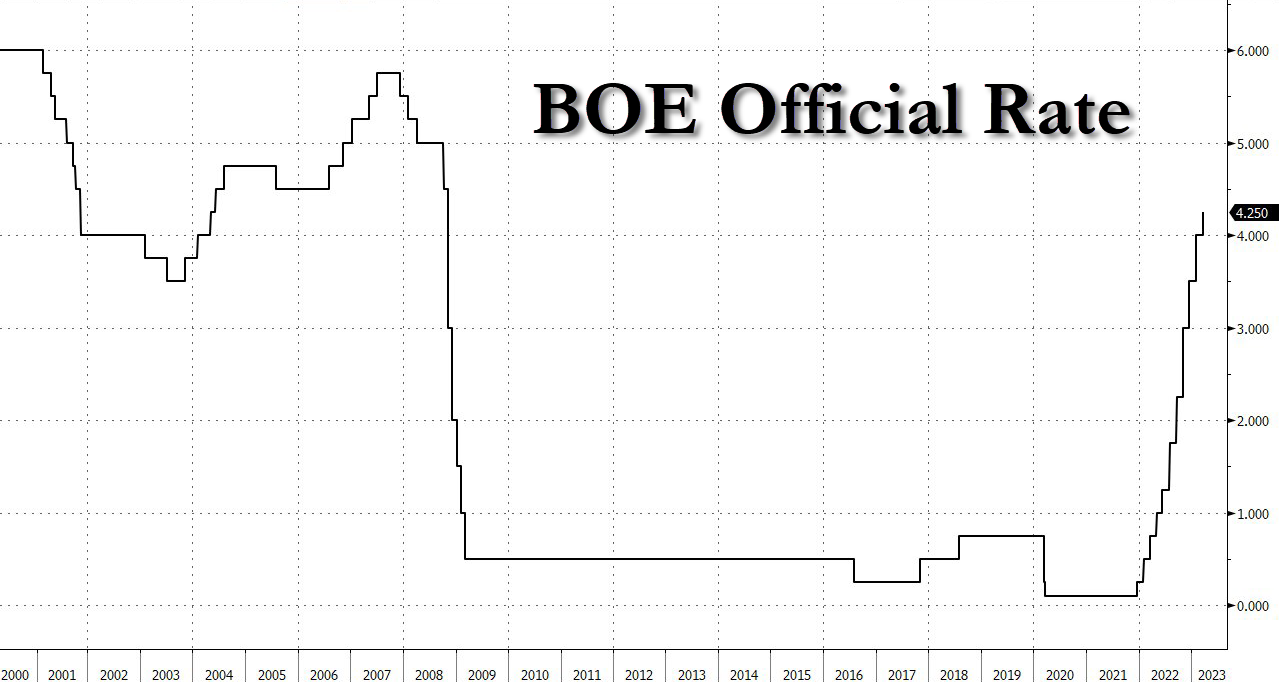

Bank of England raised its benchmark interest rate by 25 bps to 4.25 % as widely expected. Inflation is still likely to fall sharply over the rest of the year and to a lower rate than anticipated in February, but policymakers warned that if there were to be evidence of more persistent pressures, then further tightening would be required. On the recent banking crisis, the central bank noted that the UK banking system maintains robust capital and strong liquidity positions, and remains resilient. Policymakers will also continue to monitor closely any effects on the credit conditions faced by households and businesses, and hence the impact on the macroeconomic and inflation outlook.

BoE official rate. Source: Bloomberg via ZeroHedge

-

Q2 CPI likely to be lower than forecast in February, due to longer energy price cap and lower wholesale prices.

-

Fiscal support in the March budget will raise GDP by roughly 0.3% over the following years.

-

BoE MPC Vote Hike Actual 7 (Forecast 7, Previous 7

-

BoE MPC Vote Cut Actual 0 (Forecast 0, Previous 0)

-

BoE MPC Vote Unchanged Actual 2 (Forecast 2, Previous 2)

-

BoE Decision Maker Panel: Businesses see year-ahead inflation of 5.6% in 3 months to February vs 6.2% in 3 months to November.

-

BoE: Staff anticipate no increase in unemployment and 0.2% Q2 employment growth (February's forecast: -0.4%).

-

Traders add to BoE rate hike bets, pricing a 4.62% peak.

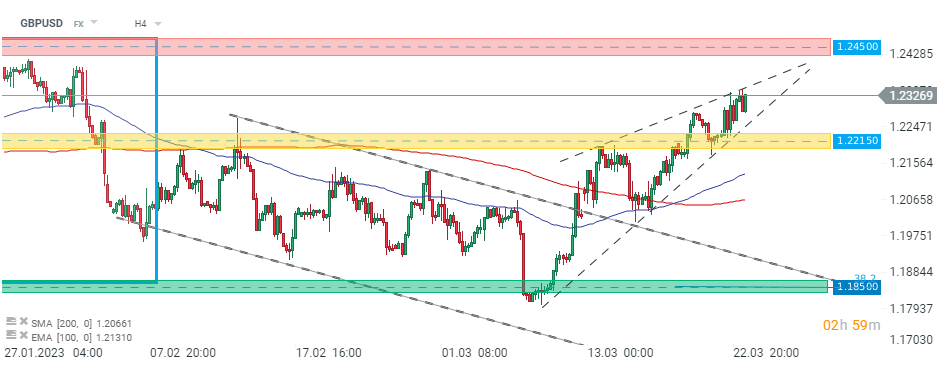

GBPUSD spiked following today’s BoE decision and approaches upper limit of the local triangle pattern. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.