US, data pack for May.

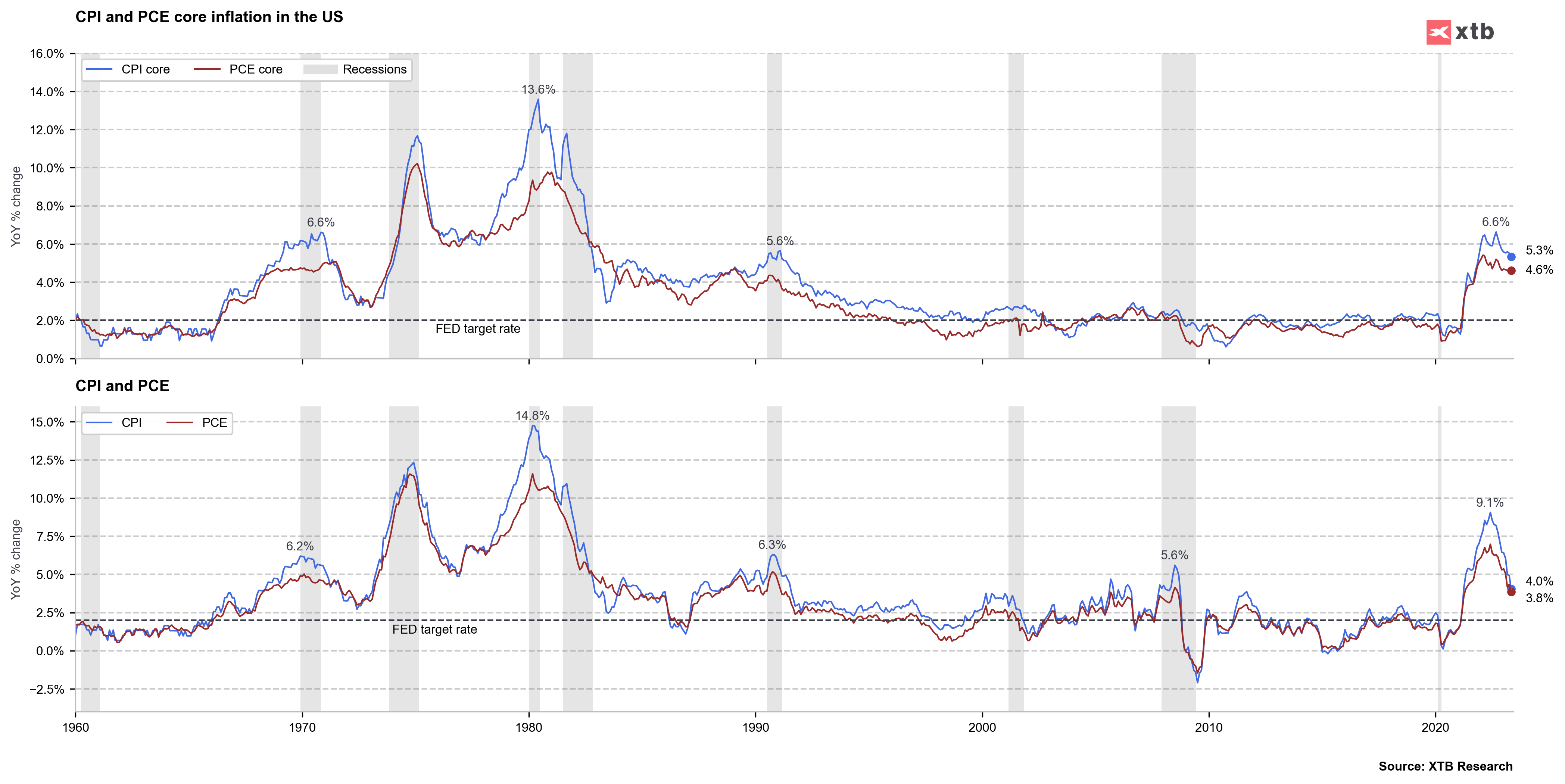

- PCE price index y/y: 3.8% vs 3.8% exp. and 4.4% previously

- PCE price index m/m: 0.1% vs 0,1% exp and 0.4% previously

- Core PCE y/y: 4.6% vs 4.7% exp and 4.7% previously

- Core PCE m/m: 0.3% vs 0.4% exp and 0,4% previously

- Consumer spending data: 0.1% vs 0.3% exp and 0.4% previously

In May, current-dollar personal income increased due to higher compensation, transfer receipts, and income from assets. Spending on services, particularly healthcare, "other" services, and transportation, rose, while spending on goods, including vehicles and energy, decreased. Personal outlays increased, and personal saving reached $910.3 billion.

Prices saw a slight increase, with goods prices decreasing and services prices rising. Compared to the previous year, the PCE price index increased, driven by higher prices for goods and services. Real PCE experienced a small decrease, primarily in spending on goods.

The US dollar depreciates slightly before the PCE publication, with EURUSD rising to 1.087. After the publication, the dollar is weakening further against the EUR.

EURUSD, M15 interval, source xStation 5

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.