Deposit rate: 4.0% (consensus: 3.75%; previously: 3,75%). The market was pricing around a 60% probability of a hike. Other key rates were also raised by 25 pb. On the other hand, the ECB signals that this may be the end of the hiking cycle:

-

"We consider that interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to timely."

-

"The rate increase today reflects the ECB’s assessment of inflation outlook in light of incoming economic and financial data, dynamics of underlying inflation, and strength of monetary policy"

-

The past interest rate hikes continue to be transmitted forcefully

-

Inflation continues to decline but it is still too high and remains at heightened levels for too long

-

Future decisions will ensure that interest rates will be set at sufficiently restrictive levels as long as necessary.

-

EBC will still be data-dependent in future decisions

-

EBC sees inflation at 5.6% in 2023, prior forecast at 5.4%. EBC sees also inflation at 3% next year, in line with previous projections

-

ECB revised down projections for underlying inflation: 5.1% for 2023, 2.9% for 2024 and 2.2% for 2025%

-

ECB sees GDP growth at 0.7% in 2023, prior 0.9%. In 2024: 2.9% vs 3.0% and in 2025: 1.5% vs. 1.6% previously

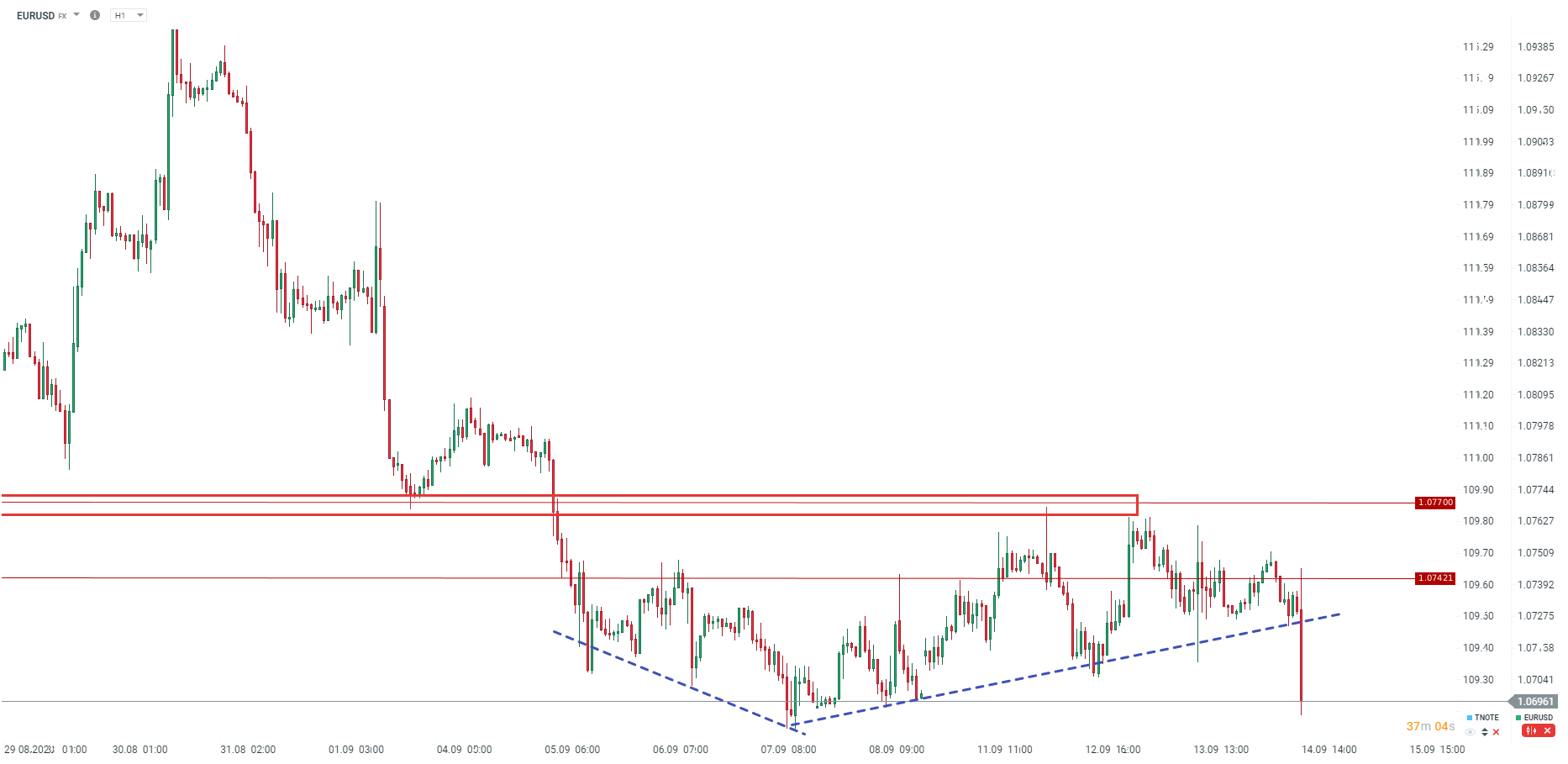

EURUSD has fallen to the lowest since September 8 as the ECB signaled that it may be the end of the hiking cycle. The ECB stated that the rate at this level for a prolonged time should bring inflation towards the goal. The market is pricing around a 30% probability that the bank will decide to hike further this year.

Of course, we should remember that at 01:45 pm BST Lagarde will deliver a speech after the decision and may try to change the market view on further decisions.

Source: xStation5

BREAKING: US CPI below expectations! 🚨📉

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.