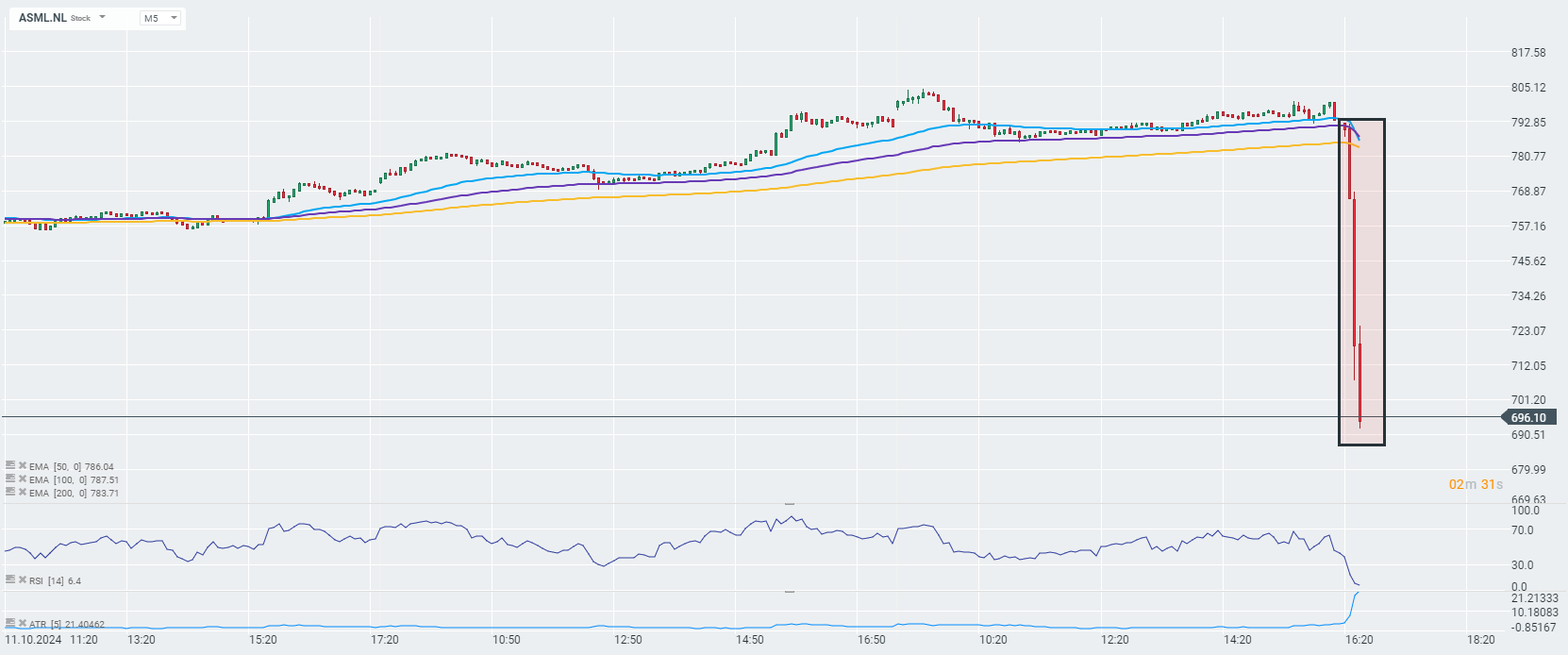

Just before the end of the European session, ASML reported its results. The company's shares lost nearly 11% after the company's orders came in well below expectations, even though other earnings metrics were not so bad. Moreover, the company lowered its guidance for 2025. Moreover, the company lowered its guidance for 2025. Nvidia (NVDA.US) falls 6% in response to the results as Wall Street erases early gains.

THIRD QUARTER RESULTS

- Bookings EU2.63 billion, -53% q/q, estimate EU5.39 billion

- Net sales EU7.47 billion, +20% q/q, estimate EU7.17 billion

- Gross margin 50.8% vs. 51.5% q/q, estimate 50.7%

- Net income EU2.08 billion, +32% q/q, estimate EU1.91 billion

- Cash and other EU4.99 billion, -0.7% q/q, estimate EU4.86 billion

FOURTH QUARTER FORECAST

- Sees net sales EU8.8 billion to EU9.2 billion, estimate EU8.95 billion

- Sees gross margin 49% to 50%, estimate 50.5%

YEAR FORECAST

- Sees net sales EU28 billion, estimate EU27.71 billion

2025 YEAR FORECAST

- Sees gross margin 51% to 53%, saw about 54% to 56%, estimate 53.9%

- Sees net sales EU30 billion to EU35 billion, saw about EU30 billion to EU40 billion, estimate EU35.94 billion

Source: xStation

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.