Bank of Japan deputy governor, Uchida spoke publicly in Hakonde:

- BoJ will not raise rates unless the market is stable

- Market is buoyed by US data, US economy should experience soft landing, however

- Path for interest rates may depend on market situation

- Policy will remain defensive, even with several hikes

- Real interest rates still strongly negative

- Financial conditions remain strongly accommodative

- Personally thinks markets will calm down and think carefully about further moves due to the situation

- Economically than has not changed, only market conditions show that one must be prudent

- Consumer spending remains strong, but one should be careful about it

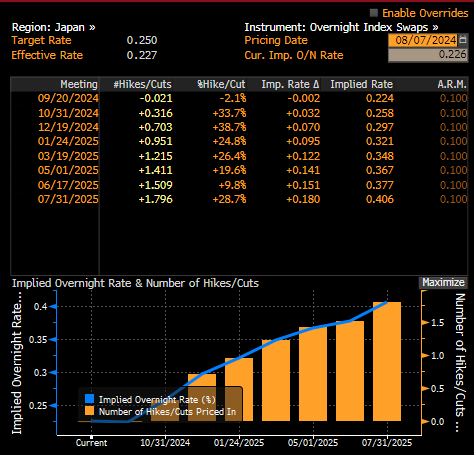

The market expects less than a 10bp hike this year. On the other hand, expectations for a hike have risen marginally since yesterday. A nearly full hike is priced in by January. Source: Bloomberg Finance LP, XTB

USDJPY is clearly weakening after Uchida's statement. The JPY is already losing 1.7% against the dollar. On the other hand, the yen's weakening has diminished as of 06:45 a.m. USDJPY is reacting to support at 146.5.

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.