Boeing (BA.US) might be seen as one of the winners of the so-called rotation trade, which occurred in November. Stock gained over 60% as investors bet that the airline industry would recover sooner than previously expected due to mass vaccination programmes. In fact, the United Kingdom started such programme today and the first person received Covid-19 vaccine.

However, Boeing’s data, which was released today, suggests that the company lost another 63 orders for its newly un-grounded 737 MAX jet in November. The total backlog declined again as Boeing lost a net total of 28 orders. What is more, the firm delivered only 7 aircraft to customers (merely one of them was a passenger plane) in November, down from 24 in the same month a year ago.

The conclusion is quite clear: in spite of coronavirus vaccine hopes, the aviation industry still struggles heavily. According to Reuters, Boeing delivered 118 jets this year while its European rival - Airbus (AIR.DE) - as much as 477 (out of which 64 in November). Therefore, the gap between those two companies is not likely to narrow in the near-future (we have covered this issue in our “Stock of the week: Boeing” commentary from November 26).

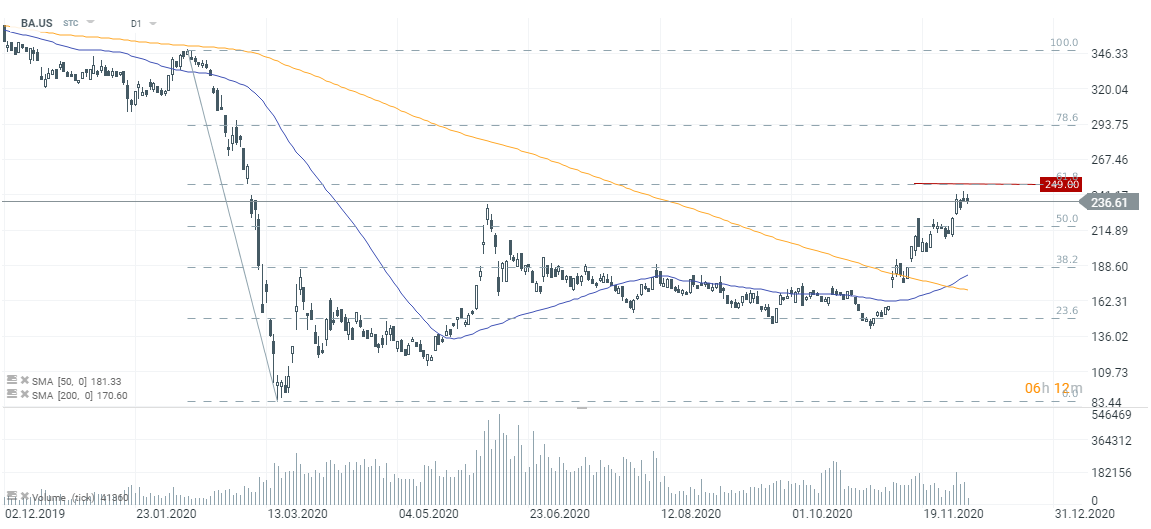

Boeing shares are falling nearly 1% today. The price have stabilised in the past few days. Should market bulls regain control, their first target might be the $249 area (the 61.8% Fibo retracement of the coronavirus sell-off). Source: xStation5

Boeing shares are falling nearly 1% today. The price have stabilised in the past few days. Should market bulls regain control, their first target might be the $249 area (the 61.8% Fibo retracement of the coronavirus sell-off). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.