Shares of Boeing (BA.US) are trading over 3% higher in premarket today after the company reported financial data for Q1 2023. Results turned out to be a positive surprise. While core loss per share turned out to be deeper than expected, the company managed to deliver a solid revenue beat. Moreover, cash burn at the company is not as intense as expected with operating and free cash flow beating expectations significantly.

Q1 2023 highlights

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app- Core EPS: -$1.27 vs -$0.97 expected

- Revenue: $17.92 billion vs $17.43 billion expected

- Operating cash flow: -$0.32 billion vs -$1.49 billion expected

- Adjusted free cash flow: -$0.79 million vs -$1.86 billion expected

Full-year guidance (unchanged)

- Adjusted free cash flow: $3.0-5.0 billion

- Operating cash flow: $4.5-6.5 billion

- Aircraft deliveries: 400-450

Boeing reported its seventh quarterly loss in a row as the company is yet to recover from damage caused by two deadly 737 MAX crashes and subsequent groundings. Boeing said that it is producing 787 planes at a rate of 3 per month and plans to increase it to 5 per month in late-2023. The company said that recent flaws found in its 737 planes will not dent its delivery and cash-generation targets but there are concerns that it may negatively impact delivery schedules.

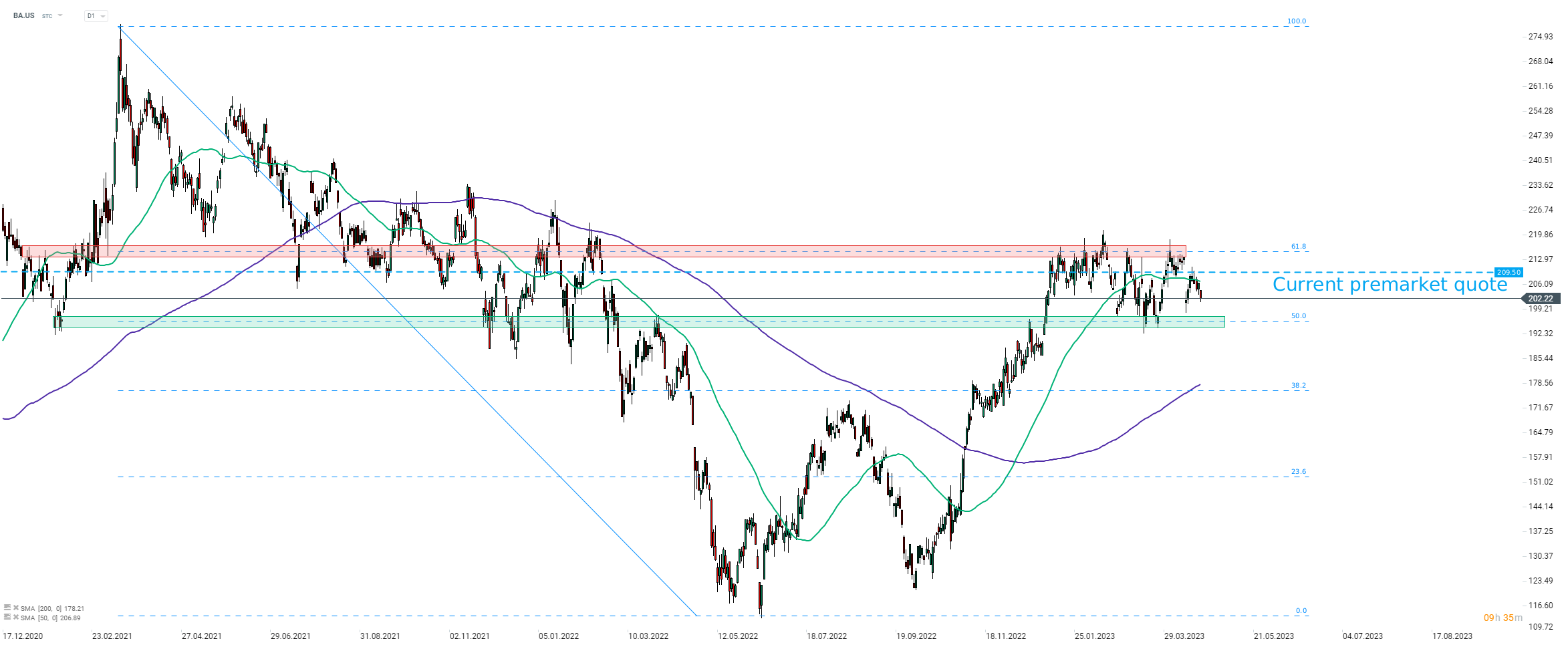

Boeing is trading over 3% higher in premarket today. Current premarket quotes point to opening of today's cash trading session near recent local highs. In such a scenario, overall technical picture for the stock would be left unchanged - price continues to trade in a range marked with 50% and 61.8% retracements and direction of a breakout would likely determine direction of the next big move.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.