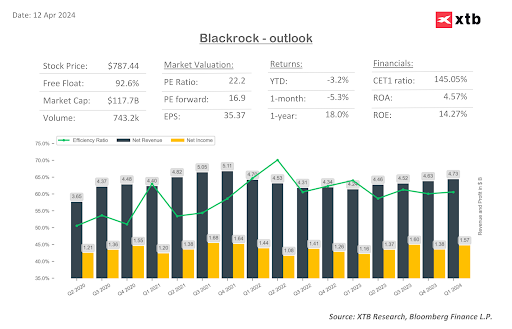

BlackRock reported higher 1Q24 results than market consensus. The company recorded a record AUM (assets under management), which at the end of the quarter amounted to $10.47 trillion (+15% year-over-year). The average AUM for the quarter was $10.18 trillion, up 14% year-over-year. Revenues exceeded market expectations by 1.06%, diluted earnings per share were 5.04% higher than consensus, and the AUM value surpassed expectations by +0.37%.

Revenues amounted to $4.73 billion, up +11% year-over-year and +2% quarter-over-quarter. The solid growth foundation includes a positive market impact on AUM value, organic growth of base fees, which increased by 8.8% year-over-year—marking the third consecutive quarter of increasing dynamics—and a strong rebound in the performance fees segment, which saw a +270% growth year-over-year, although these fees were -34% lower than in the previous quarter.

The quarterly capital inflow to the long-term segment amounted to $76 billion, nearly 40% of the inflows recorded in the entire year of 2023. The largest inflow was recorded from the Americas, accounting for $58 billion.

The fund shows strong results against the financial sector backdrop, presenting solid growth in every key financial performance segment. Following these results, it is likely that market expectations for future quarters may increase, which ultimately, in the long-term perspective, could be an impetus for growth. After a strong opening, the share price initially stabilized (at the peak moment, the company recorded a +3.7% increase in share price), and now the supply side prevails, pushing down the share price.

FINANCIAL RESULTS FOR 1Q24:

- AUM: $10.47 trillion (+15% year-over-year)

- Average AUM: $10.18 trillion (+14% year-over-year)

- Revenue: $4.73 billion (+11% year-over-year)

- Operating profit: $1.69 billion (+18% year-over-year)

- Operating profit margin: 35.8% (+1.9 percentage points)

- Net profit: $1.57 billion (+36.8% year-over-year)

- Diluted earnings per share: $10.48 (+37% year-over-year)

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.