- Bitcoin failed to break out below resistance set by SMA 200

- Long-term holders accumulate the "king of cryptocurrencies"

Last week brought a slight deceleration of bullish sentiment in the cryptocurrency market. Bitcoin halted its gains just above $48,000 and began a corrective move towards $45,000. However, this period was full of large purchases by major institutions, including: MacroStrategy or Luna Foundation Guard. Bitcoin is becoming used and seen as a form of hedge against uncertain times. Favorable to this trend is the ever advancing utility of tokens, among other things, for securing algorithms.

- Exchanges are witnessing a significant outflow of cryptocurrencies with an intensity estimated at 96,000 BTC per month.

- The total supply of Bitcoin this month reached 19 million units. About 9.52% of the total BTC supply remains to be "dug up". It is estimated that the last of the BTC supply will be completely released within 118 years. Approximately 918 BTC is currently being mined daily.

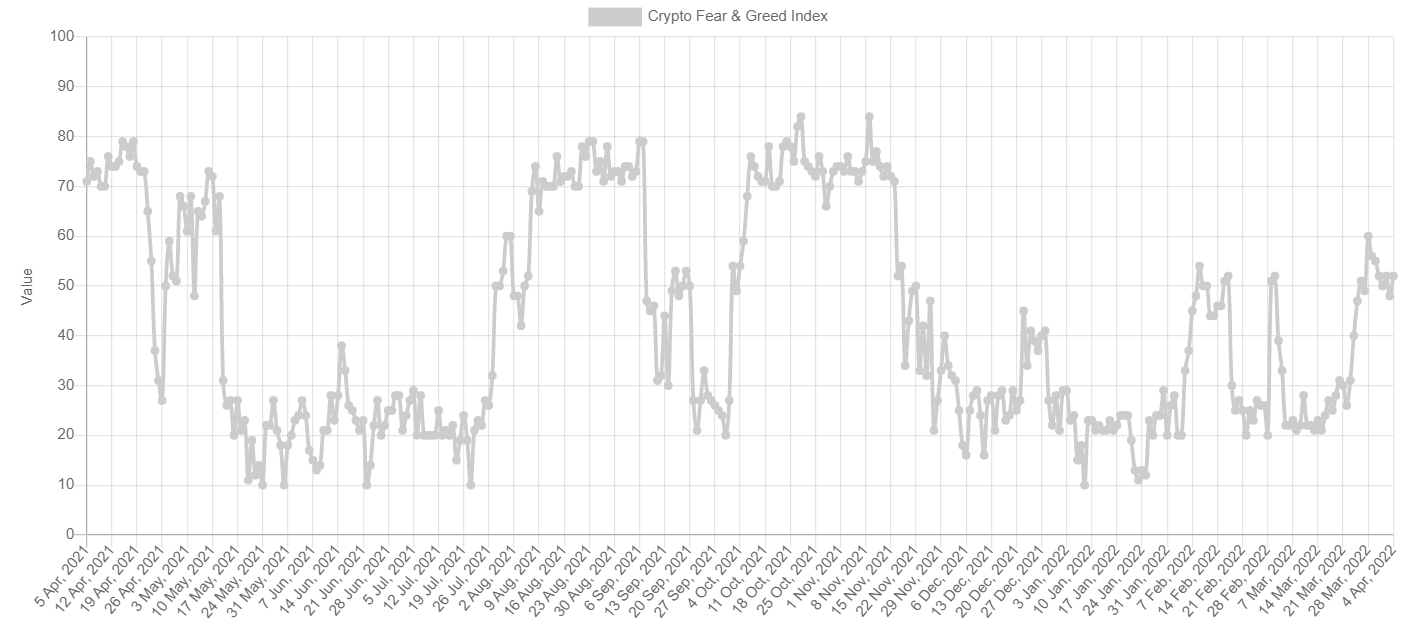

The fear and greed index has fallen from its highest level reached last week since November 2021. Source: alternative.me

BITCOIN chart, D1 interval. BTC broke out above the limits near $45,000, which was the barrier of local peaks from February 2022. The upward movement was continued up to the area of $48,000, where the 200-day moving average (gold line) runs. The demand side failed to break out of this limitation permanently and a downward-corrective impulse is currently underway. Currently, the most important supports for the price of the "king of cryptocurrencies" are the areas between $44,000 and $45,000. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.