- Sudden, dynamic increases in the crypto market are due to a squeeze of short positions and a general change in traders' positioning after another period of lower Bitcoin volatility. Bulls at current levels saw a larger risk premium in an oversold market

- Bitcoin is gaining despite a strong dollar index (USDIDX) and declines on the EURUSD, which underscore that the 'greenback' is still very strong. Potentially, however, the DXY index has reached important resistance at 105 points, and a possible weakening of the US dollar could 'unleash' Bitcoin's upside potential - here too, the 'risk-reward ratio' seems to be driving the bulls

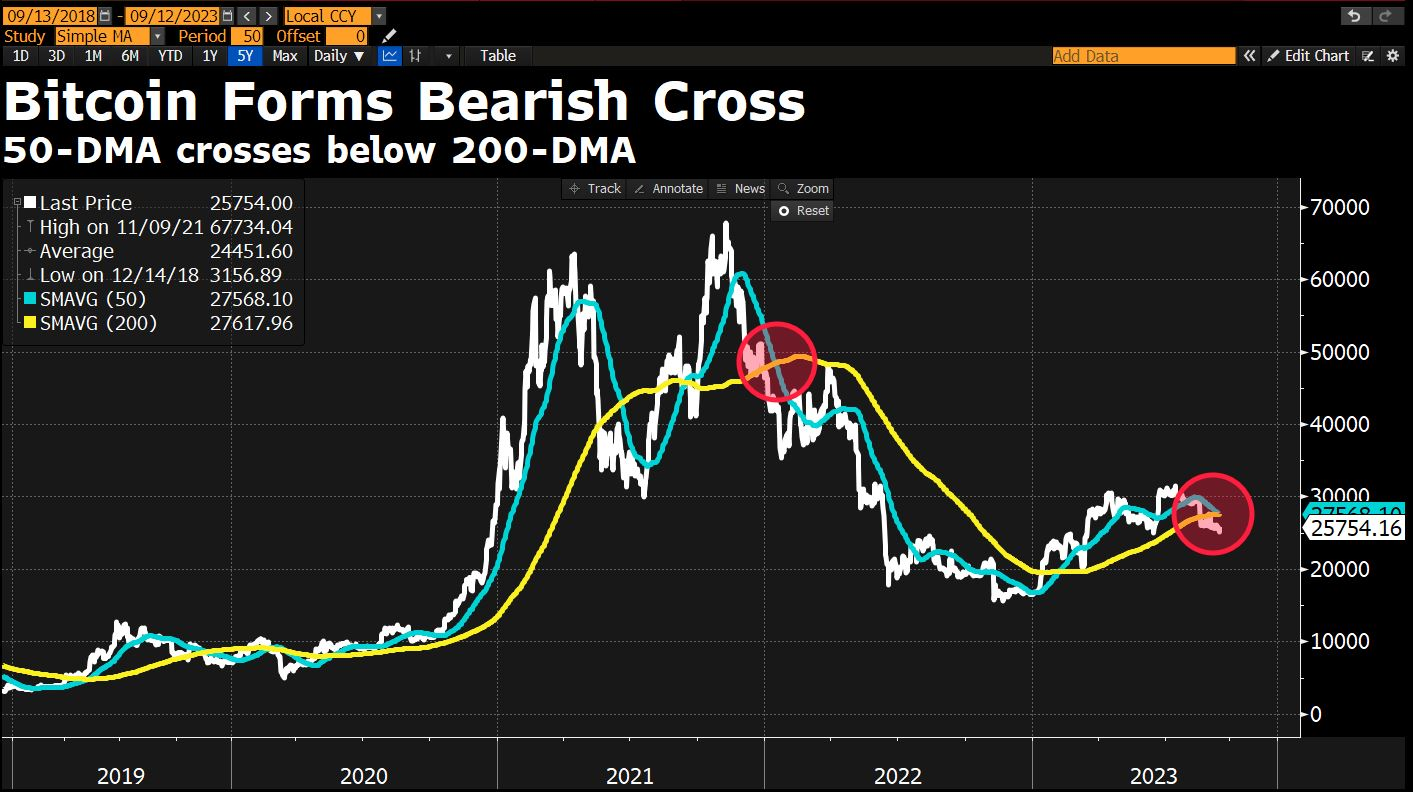

- The potential 'death cross' formation on Bitcoin limits risk appetite and may foreshadow a prolonged period of weakness - nevertheless, in reality, this indicator often proves to be 'lagging' and occurs when the market is oversold and prices are low;

- Increases are accelerating in the altcoin market, which lost heavily yesterday on a wave of concerns about the liquidation of assets (about $3.4 billion in cryptocurrencies) by the FTX exchange, which is in liquidation (estimated sales of $100 to $200 million per week). Solana is gaining more than 5%, Bitcoincash and Filecoin are rising strongly.

BITCOIN stopped the downward impulse almost exactly in the psychological support zone at the level of $25,000, and today the price of the most popular cryptocurrency returned above $26,000. From the perspective of technical analysis, it is worth noting the formation of an incomplete bullish embrace formation, which is somewhat at odds with the previously mentioned intersection of the 50-day and 200-day SMAs, which indicates the so-called "death cross" formation, a pattern seen as a moment of embracing a bear market. Source: xStation5

Source: Bloomberg Finance LP

Morning wrap: Tech sector sell-off (06.02.2026)

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

🚨Bitcoin crashes 4% to $69k📉Sell-off on Ethereum and Ripple

Chart of the day: BITCOIN 40% below recent peak 🚨 Eroding fundamentals risk selling spiral 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.