While global markets do attempt to take a breath after the FOMC minutes released yesterday, there’s no sign of stabilization on the cryptocurrency market. While Bitcoin prices are down just 2% today (vs 6% for Ethereum), this decline takes them to the lowest since September.

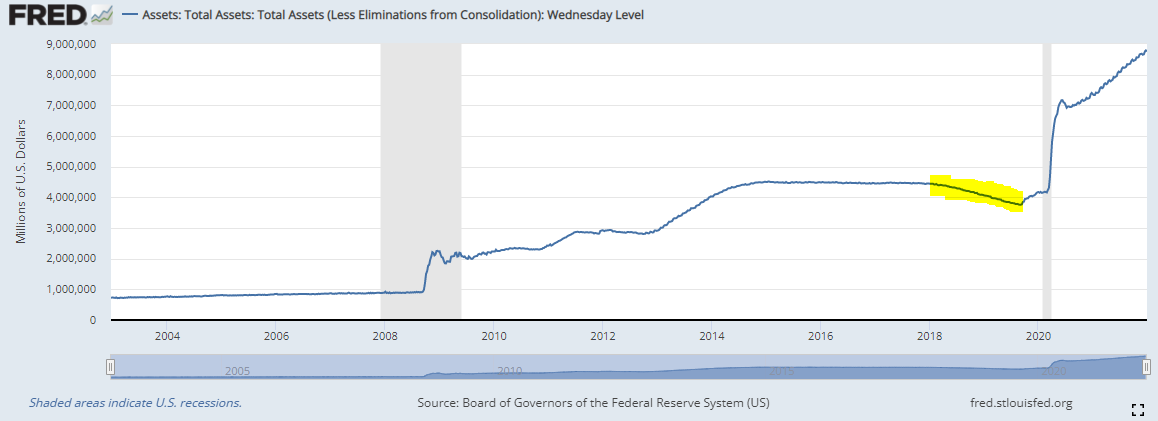

Fed’s balance sheet exploded in 2020 and ballooning continued in 2021. Will it start shrinking in 2022 as it was the case in 2018? Source: fred

Fed’s balance sheet exploded in 2020 and ballooning continued in 2021. Will it start shrinking in 2022 as it was the case in 2018? Source: fred

Many investors could see this as a buying opportunity because this proved to be true during the May-July correction. And given the unrelenting nature of the bull market over the years and broadening interest among institutions they could very well be right. However, could the Fed spoil the party with policy tightening?

2018 was an awful year for Bitcoin. Coincidentally it was also a year of balance sheet reduction in the US.

2018 was an awful year for Bitcoin. Coincidentally it was also a year of balance sheet reduction in the US.

Lessons from 2018 and reaction to the FOMC minutes could be concerning. Bitcoin price tumbled in 2018, a year that was challenging for many markets as the Fed reduced its balance sheet. Could this potentially be repeated this year?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

Morning wrap: Tech sector sell-off (06.02.2026)

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.