The cryptocurrency market is trying to unwind declines, with the price of Bitcoin hovering around $17,000 waiting for a catalyst for further movement. And here it is. US economy unexpectedly added 263 k jobs in November, compared to 261k increase in October and well above market expectations of 200k. Today's reading shows that the labour market in US is still tight and Fed will most likely remain committed to bringing down inflation with more rate hikes. Risk assets are under pressure again:

News

- Experienced European Central Bank staffers Ulrich Bindseil and Jürgen Schaaf have warned of deeper problems in the cryptocurrency market, where the collapse of FTX and Luna has caused a decline in institutional interest, reputation and a possible drop in technology adoption. They also believe that current price levels are being 'artificially maintained;

- The ECB staff's declaration came under an avalanche of criticism from digital asset industry commentators, who pointed to, among other things, high stock market volatility and the unprecedented depreciation of the U.S. dollar against Bitcoin over the past decade;

- The Binance exchange halted withdrawals in the face of a potential hacking attack on the private key of cryptocurrency developer Ankr Protocol, where hackers are believed to have exploited vulnerabilities in the code for the infinite issuance of new tokens. Chanpeng Zhao, CEO of Binance, clarified that the company did not become a target of the attack, and the team is engaged to clarify the circumstances of the attack;

- Bankman Fried himself, in an interview with the New York Times, admitted to making a number of mistakes and oversights in managing the exchange and the Alameda Research fund situation, but denied that he had knowingly committed fraud. Well-known investor Mike Novogratz criticized SBF, claiming that 'he is delusional and should stand trial for exploiting clients' funds.

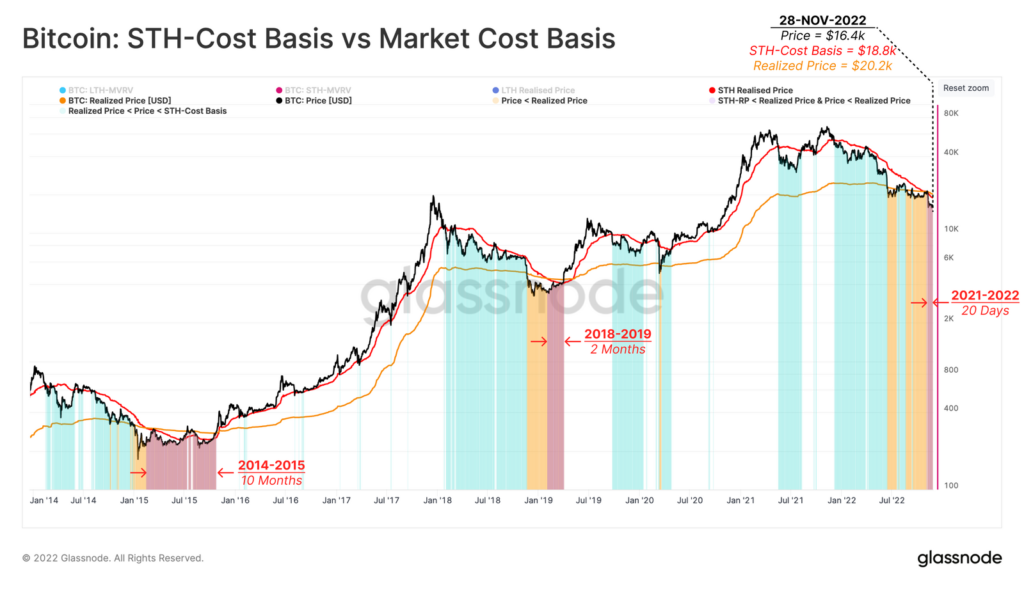

The chart shows the average BTC purchase price of Short Term Holders (STH) investors, which is $18,800, and the current average historical blockchain BTC purchase price, which is $20,200. An analysis of the relationship of the cost base of STH investors , the realized price and the spot price may give more clues to identify Bitcoin's transition from the extreme phases of the bull market to the recovery. Glassnode divided the chart into three phases. The initial phase of declines (green) when investors' average Bitcoin purchase prices are much lower than the spot price. The phase of reaching the bottom (yellow) when the bear market extends, and the market finally gives up and capitulates then the market price falls below the realized price (now the deviation is very visible). We also see the final phase when Bitcoin records a final sell-off (brown), which is met with demand from short-term investors. This leads to the purchase price of STH for moments being significantly lower than the realized price giving this group an 'edge' over all other investors. Historically, this phase lasted longer - from 2 months to as long as 10 months - now it lasts about 24 days. Source: Glassnode

Bitcoin price, H4 interval. Bitcoin has again started to correlate with the US NASDAQ index (yellow chartS) after we observed a divergence after the FTX collapse - Bitcoin affected by the FTX collapse was losing when Wall Street was recording dynamic increases. We can consider the return of the correlation with the indices as the first sign of hope that cryptocurrencies have put behind them the period of 'domino effect' caused by the FTX bankruptcy, and investors are once again, with a little more conviction when the dust has settled, considering allocating capital to digital assets. Source: xStation5

Bitcoin price, H4 interval. Bitcoin has again started to correlate with the US NASDAQ index (yellow chartS) after we observed a divergence after the FTX collapse - Bitcoin affected by the FTX collapse was losing when Wall Street was recording dynamic increases. We can consider the return of the correlation with the indices as the first sign of hope that cryptocurrencies have put behind them the period of 'domino effect' caused by the FTX bankruptcy, and investors are once again, with a little more conviction when the dust has settled, considering allocating capital to digital assets. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.