Bitcoin loses 2.7% today and drops below $68.000 level as US dollar and yields surged after much stronger than expected US flash PMI readings.

- Strong services may be a signal that Fed will be hawkish further, supporting 'higher for longer' policy stance. Traders now see first US rate cut possible in December vs November before. This situation pressured momentum of risk assets; both cryptocurrencies and stock market erased early gains despite 10% euphoria on Nvidia shares.

- Despite sell-off on Bitcoin, Ethereum didn't react with strong drop, awaiting SEC decision related to spot Ethereum VanEck ETFs which will be published today. Documents show that bipartisan group of House lawmakers (Tom Emmer / NJ Democrat Josh Gottheimer) sent to SEC chair, Gary Gensler a letter urging the agency to approve spot Ether ETFs.

BITCOIN vs USDIDX (US dollar futures, orange chart)

Ethereum didn't reacted so rapidly to PMI readings but also dropped before, after lower than expected claims, signalling still strong US job market (also supporting dollar). It may be a signal, that investors await today SEC decision and US spot Ethereum ETF acceptance.

ETHEREUM vs USDIDX (orange chart)

Source: xStation5

Source: xStation5

Bitcoin (D1 chart)

Major cryptocurrency loses today, dropping almost 5% from local highs reached at $72.000 level. The rally was clearly driven by Ethereum spot ETFs acceptance rumors.

Source: xStation5

Source: xStation5

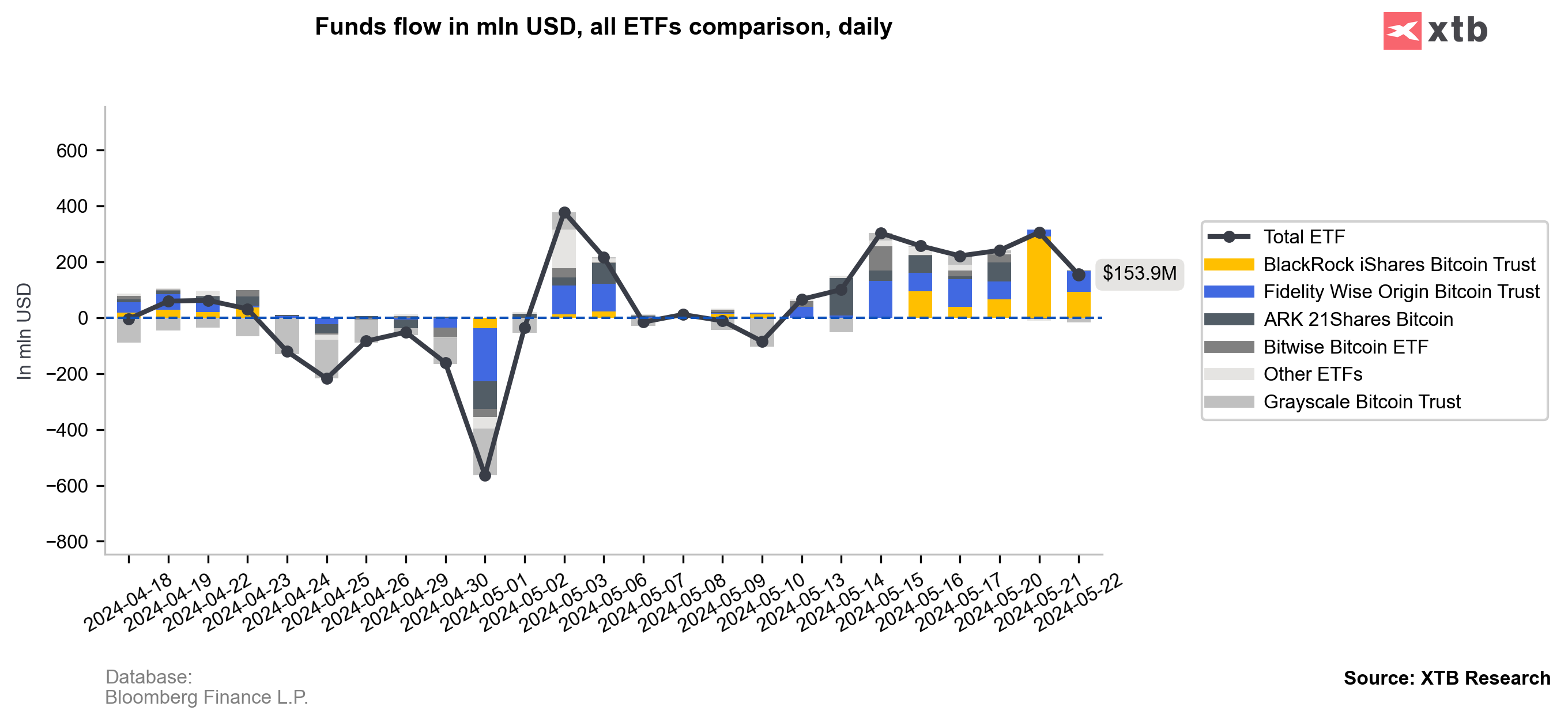

Inflows tu US Bitcoin ETFs (especially BlackRock's IBIT) rised in second half of May 2024. Source: Bloomberg Finance L.P

Inflows tu US Bitcoin ETFs (especially BlackRock's IBIT) rised in second half of May 2024. Source: Bloomberg Finance L.P

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.