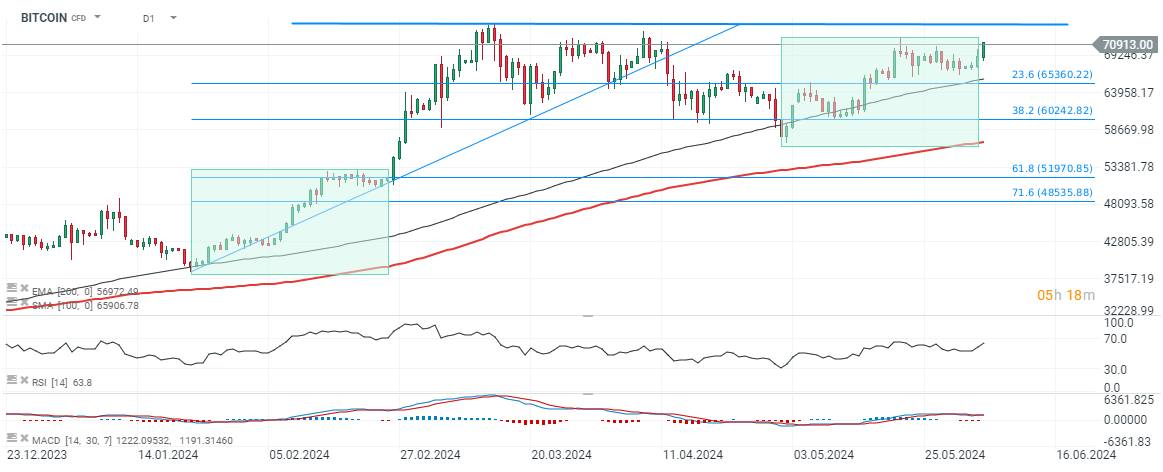

Despite weak sentiments on US stock market and drop of both silver and gold, we can see surprisingly strengthening Bitcoin today. It's hard to find direct reason of that situation because even so-called memstocks deepen declines today and investors risk appetite seems to be low. But still, Bitcoin may benefit from speculating positioning. On the other hand, we can see that futures on USDIDX (US-dollar) erased half of today gains which may be a signal that 'dovish' macro signals from weakening US economy may fuel appetite for Bitcoin, as bond rise again with treasury yields falling. Also, today 'bullish' session on BTC may be a signal that its correlation with other assets such as stocks, bond or yields is falling, making BTC sometimes 'separate' asset, with potential of generating 'alpha'. On the other hand, it's still unclear will this momentum be maintained in the following hours and days, because still important resistance zone is set on $73.000 and $75 000 levels.

Bitcoin (D1)

During the last correction, Bitcoin stopped decline at SMA100 support (the same situation happened in January 2024) and bulls become active again with on-chain data signalling rising Bitcoin demand from the long term investors addresses again.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.