Cryptocurrencies are weakening again and Bitcoin is trading at $21,700 as the market circulated fear following news of the termination of Silvergate Capital (SI.US) bank. As a result of the comment from the institution, its stock price fell by 50% after the close of yesterday's session:

- The bank publicly indicated that this was the most appropriate solution at this stage. In addition to the difficult financial situation after the avalanche of Q4 2022 withdrawals when investors 'fled' the crypto-institution in the wake of the FTX collapse, among the reasons indicated by the bank were also the actions of regulators, including an investigation by the US Department of Justice;

- Investors' eyes are now also on Signature Bank (SBNY.US), which, focusing on cryptocurrencies in the 2021 bull market, increased revenues and surged in popularity. Its shares are trading 10% lower before the open, signaling an opening at the lowest levels since November 2020. It is unclear to what extent the current declines are the result of exaggerated panic;

- Signature has recently been trying to distance itself from cryptocurrencies. Bloomberg reported that non-corporate customers of crypto exchange Kraken will no longer be able to make deposits or withdrawals in dollars through Signature Bank. Earlier, the bank surprised with its decision to set a limit on Binance for transactions that did not exceed $100,000. In this way, it probably wants to limit the impact of cryptocurrency transactions from retail customers, in order to reduce risk;

- If the problems with Signature Bank actually worsen there is a chance of a greater reaction from the cryptocurrency market because of the scale - the bank has deposits worth more than $100 billion versus just over $6 billion at Silvergate Capital.

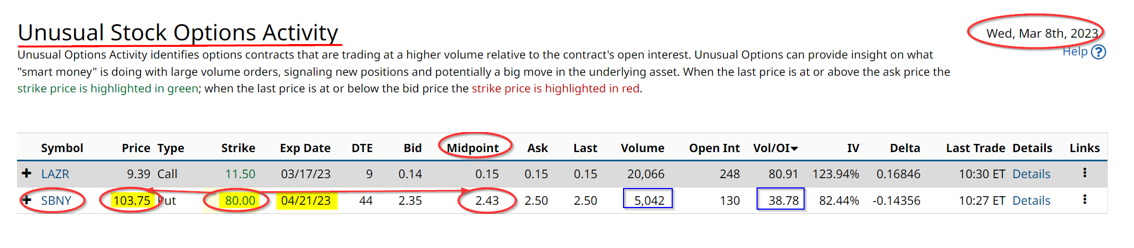

Yesterday, institutional options traders opened a bullish PUT bet on Signature Bank shares. In it, they bet that the stock would not fall significantly until the second half of April, exposing themselves to the possible risk of liquidation in the vicinity of $80 per share. Source: Barchart

Signature Bank shares (SBNY.US), D1 interval. The crypto bank's shares entered a bearish trend after cryptocurrencies began to weaken in 2021. Momentum remains strongly bearish with the first resistance according to Fibonacci retracement at $150 per share, and if weakness continues, a significant support level could be set by the 2020 lows at $70 per share. Source: xStation5

Signature Bank shares (SBNY.US), D1 interval. The crypto bank's shares entered a bearish trend after cryptocurrencies began to weaken in 2021. Momentum remains strongly bearish with the first resistance according to Fibonacci retracement at $150 per share, and if weakness continues, a significant support level could be set by the 2020 lows at $70 per share. Source: xStation5

After the January rebound, profitable BTC reserves held by Short Term Holders (STHs) jumped, rewarding all investors which bought BTC during FTX collapse period. Looking at today's decline, we can conclude that a lot of supply pressure came from this group, historically the most susceptible to market sentiment. Currently, the average gain of STH is already around 10%, which shows that the upward momentum from the beginning of the 2019-2019 bull market has not been maintained. The average share of STH's profitable supply has reached a double peak near 16%. Source: Glassnode

Bitcoin chart, H1 interval. All three averages SMA 50, SMA 100 and SMA200 have dived again, the nearest resistance level is now $21,800 - $22,000, a level set by the 38.2 Fibonacci retracement and previous price reactions. If the price falls below current levels, a test of $20,000 and the 61.8 Fibonacci retracement of the upward wave initiated in December 2022 remains likely. The RSI indicator has been drawing lower and lower peaks since the beginning of February, signaling weakening momentum, and is currently at 30 points and signaling near oversold levels. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.