Bitcoin gains almost 8% today to almost $60, 000, as Wall Street reacts to stronger than expected US labour market data. Also, Ethereum prices are 10% higher, rising above $2500. Filecoin gains 11%, and other smaller cryptocurrencies such as Waves or Fantom rally 20% and 10% respectively.

- Market bets that stepping improvement in sentiments on Wall Street will support demand on Bitcoin ETFs, with rising demand on dollar-hedge trades such as gold, which also gains today.

- o, despite rising treasury yields, after stronger US data, the relief rally on Wall Street is based on expectations that the Fed will cut rates in autumn, while recessionary economy momentum is not a foregone conclusion as ISM services and jobless claim came in stronger than expected.

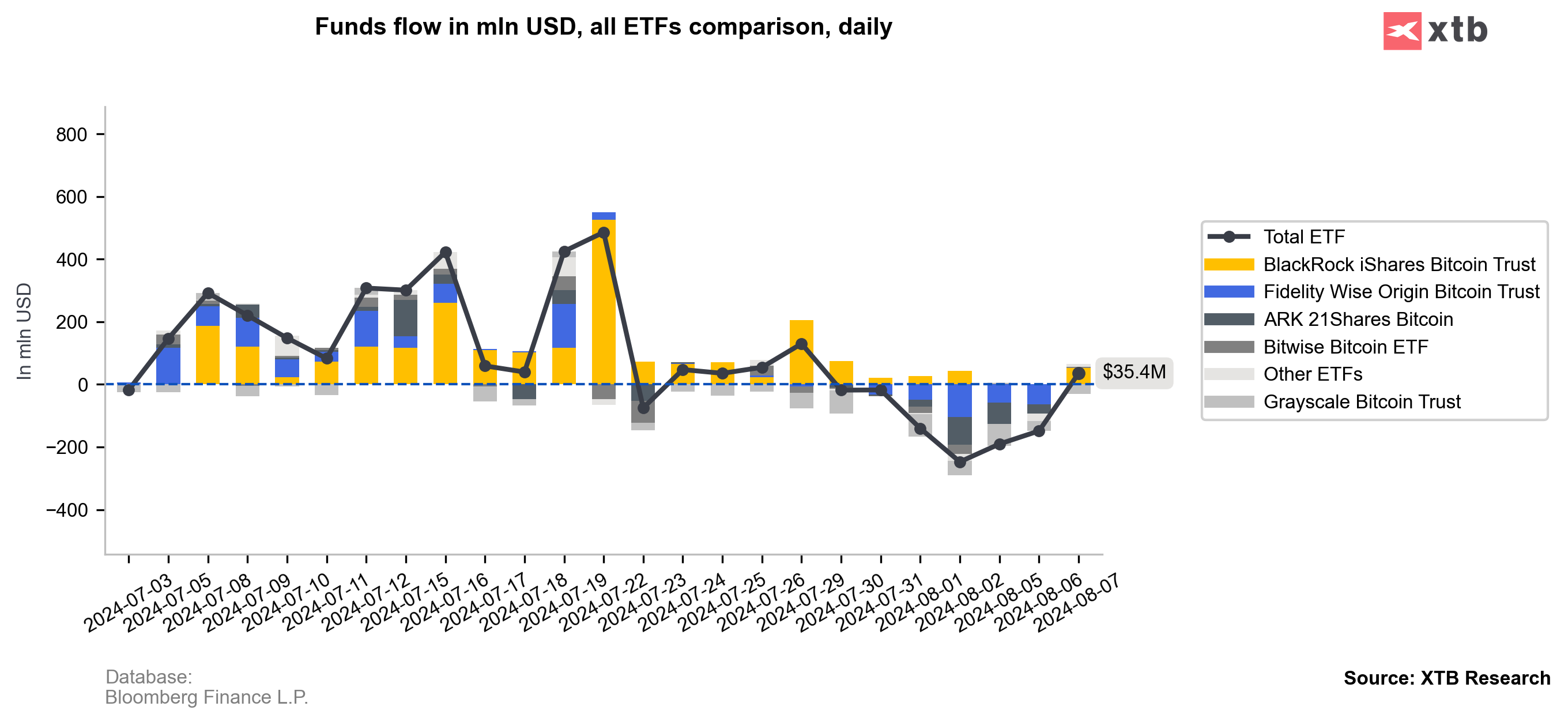

US Bitcoin ETFs showed net outflows during the last sessions, however the scale of those outflows was not so huge, with almost 0 net outflows from BlackRock's IBIT ETF - despite 'crash' across multiple assets and financial markets. Source: XTB Research, Bloomberg Finance L.P.

US Bitcoin ETFs showed net outflows during the last sessions, however the scale of those outflows was not so huge, with almost 0 net outflows from BlackRock's IBIT ETF - despite 'crash' across multiple assets and financial markets. Source: XTB Research, Bloomberg Finance L.P.

Bitcoin (D1 interval)

Bitcoin stopped declines exactly at 71.6 Fibonacci retracement of the rising wave from the January 2024. As for now BTC is still traded below key resistance zone at $61,500 and 38.2 Fibonacci retracement at $60,000.

Source: xStation5

Source: xStation5

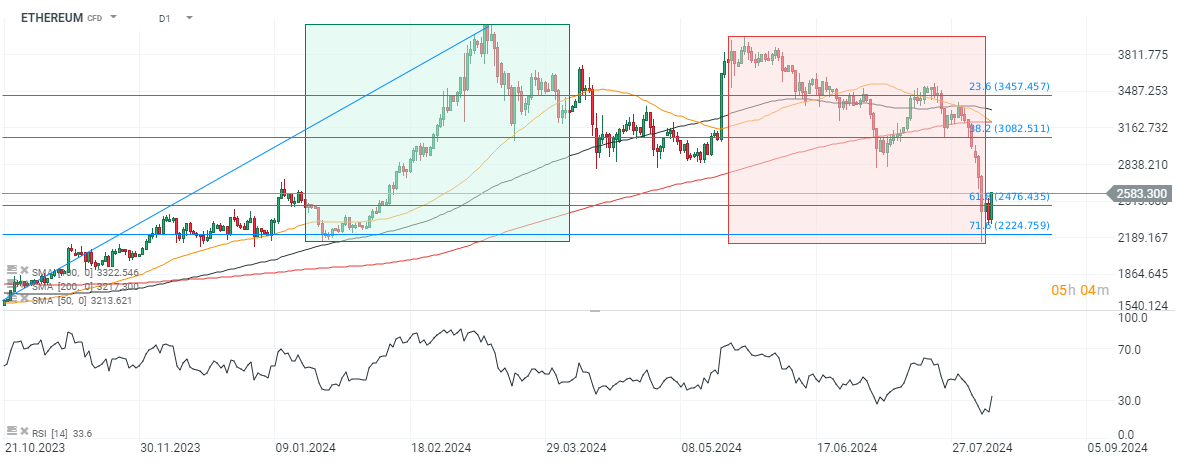

Ethereum stopped the 'crash' from $3800 to $2200 also near 71.6 retracement of the upward wave since September 2023, with the correction scale almost 1:1 similar to the scale of January - March 2024 rally. Major resistance zone is now set at 38.2 Fibo near $3100.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.