US earnings season for Q4 2020 is in full swing. Microsoft report released yesterday after the close of the session turned out to be a big positive surprise. Company managed to beat earnings and revenue expectations and showed high growth in the cloud segment. Investors will be offered reports from 3 mega-cap companies today after the Wall Street session and it may have a major impact on sentiment towards US tech. Let's take a look at what the market expects from Apple, Facebook and Tesla.

Apple

Apple (AAPL.US) is expected to report quarterly revenue exceeding $100 billion for the first time with median forecast pointing to sales of $102.8 billion (+12% year-over-year). Earnings per share are seen at $1.41, up from $1.25 in calendar Q4 2019. Blockbuster sales are expected to be fuelled by strong demand for new iPhone 12 with some analysts projecting that total iPhone sales in the quarter may have reached around $60 billion. However, increasing adoption of work-from-home schemes has supported iPad and laptop sales in the previous quarters and investors will also look whether the trend continued. Apple shares have already gained almost 8% in 2021 and the earnings report could be a trigger for a big move.

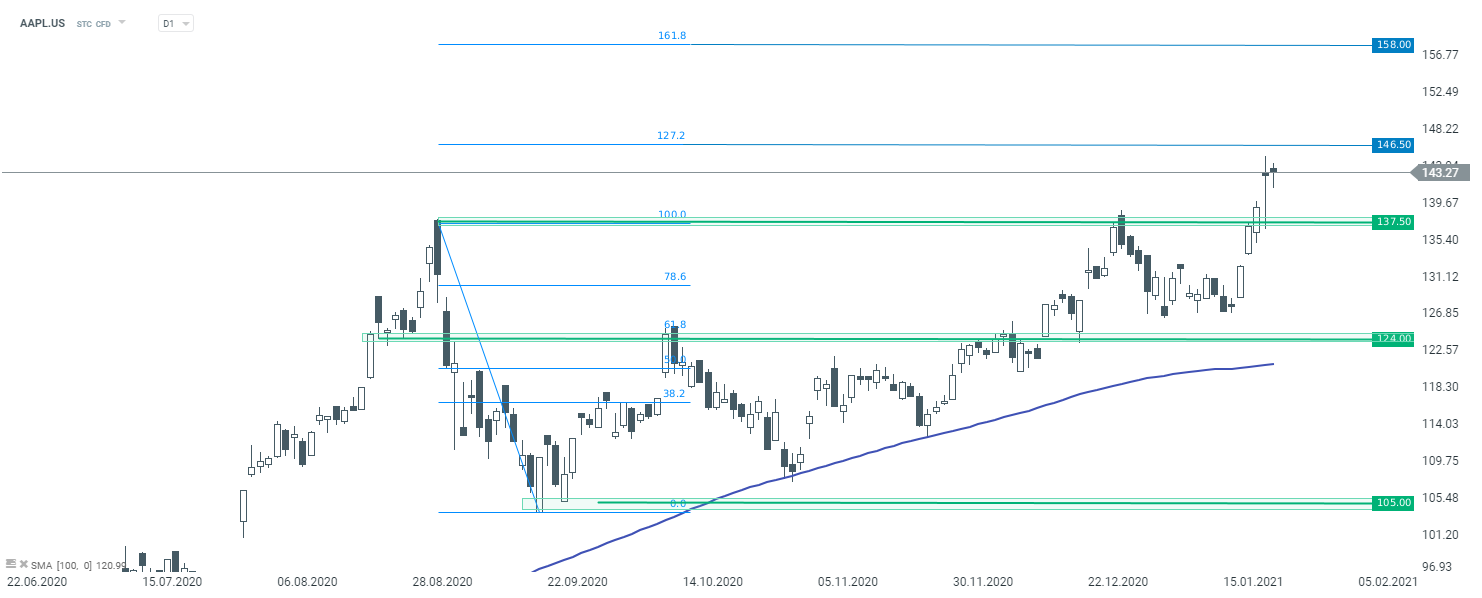

Apple (AAPL.US) managed to jump above the resistance zone at $137.50, marked by highs from the beginning of September 2020 and the end of December 2020. Stock launched this week's trading with a big bullish gap but the upward move has slowed since. Resistance at 127.2% retracement ($146.50) is the next level to watch. Source: xStation5

Apple (AAPL.US) managed to jump above the resistance zone at $137.50, marked by highs from the beginning of September 2020 and the end of December 2020. Stock launched this week's trading with a big bullish gap but the upward move has slowed since. Resistance at 127.2% retracement ($146.50) is the next level to watch. Source: xStation5

Facebook (FB.US) is forecast to report a 24.6% year-over-year increase in sales, to $26.3 billion. Earnings per share are expected to increase from $2.56 to $3.18. As the final quarter of the year sees a lot of holiday spending, ad revenue is expected to be very strong. User growth is expected to be slow but this is mostly because Facebook already has a massive user base. Number of daily active users is expected to increase to 1.83 billion from 1.82 billion at the end of Q3 2020. On the other hand, social media companies have attracted a lot of criticism recently due how they moderate free speech on their platforms. Investors will look whether and how the company addresses these issues during earnings release. Stock has been lagging other mega-cap companies recently with just a 4% gain in 2021.

Facebook (FB.US) has been trading sideways recently. However, stock has caught a big and is closing in on the downward trendline. Breaking above this hurdle could put the share price on a track to test all-time highs in the $303 area. Source: xStation5

Facebook (FB.US) has been trading sideways recently. However, stock has caught a big and is closing in on the downward trendline. Breaking above this hurdle could put the share price on a track to test all-time highs in the $303 area. Source: xStation5

Tesla

US electric car manufacturer Tesla (TSLA.US) is expected to report sales of $10.5 billion, up from $7.4 billion in Q4 2019. EPS is expected to increase by 143% year-over-year to $1.04. Company delivered 499,550 vehicles in 2020, almost matching a target of 500,000 deliveries set for that year. As the company proved that it is capable of meeting its targets, delivery goal for 2021 will be a key point of the upcoming earnings release. Tesla stock is trading 26% year-to-date higher but an ambitious delivery goal could provide more fuel.

Tesla (TSLA.US) broke above the upper limit of wedge pattern with a strong upward move. However, advance has stalled afterwards and it looks like the stock is waiting for the next catalyst. Earnings report could be such a catalyst and could help share price overcome all-time high at around $900. Source: xStation5

Tesla (TSLA.US) broke above the upper limit of wedge pattern with a strong upward move. However, advance has stalled afterwards and it looks like the stock is waiting for the next catalyst. Earnings report could be such a catalyst and could help share price overcome all-time high at around $900. Source: xStation5

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

Morning wrap: Tech sector sell-off (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.