The beginning of a new trading week is marked with big price moves on a number of assets, with cryptocurrencies and precious metals drawing the most attention. Bitcoin surges 7% and trades above $67,000 mark for the first time since November 2021, while gold gains 1.6% and is on its way to book the first close above $2,100 per ounce in history!

The main driver of the cryptocurrency rally are still-strong inflows into Bitcoin spot ETFs. Introduction of ETFs made Bitcoin investments available to a broader range of investors. Bitcoin demand generated by those funds is said to be outstripping supply, creating an environment for gargantuan price gains. Meanwhile, gold continues the strong upward impulse triggered on Friday by release of disappointing US manufacturing ISM index for February. Weak US data triggered a 'dovish' reaction in the markets with USD dropping and precious metals gaining.

However, there is also a factor that may be supporting both BITCOIN and GOLD at the start of a new week. Fitch ratings agency downgraded credit rating of the New York Community Bancorp (NYCB.US) to the junk level. Fitch said that weakness recently disclosed by the bank caused it to re-evaluate NYCB's capital adequacy as well as its exposure to commercial real estate. Meanwhile, Moody's ratings agency said that NYCB may be forced to further increase provisions for bad loans over the next two years amid its exposure to commercial real estate.

Issues at NYCB have been in the making for a while, but the downgrade to a 'junk' rating highlights how bad things are already. Having said that, at least part of today's move higher in GOLD and BITCOIN can be driven by increased demand for safe havens amid risk of another banking collapse in the United States.

Rally on BITCOIN shows no signs of easing. Coin broke above the $67,000 mark today, although it has pulled back below it later, and is trading less than 3% below all-time highs from November 2021. Source: xStation5

Rally on BITCOIN shows no signs of easing. Coin broke above the $67,000 mark today, although it has pulled back below it later, and is trading less than 3% below all-time highs from November 2021. Source: xStation5

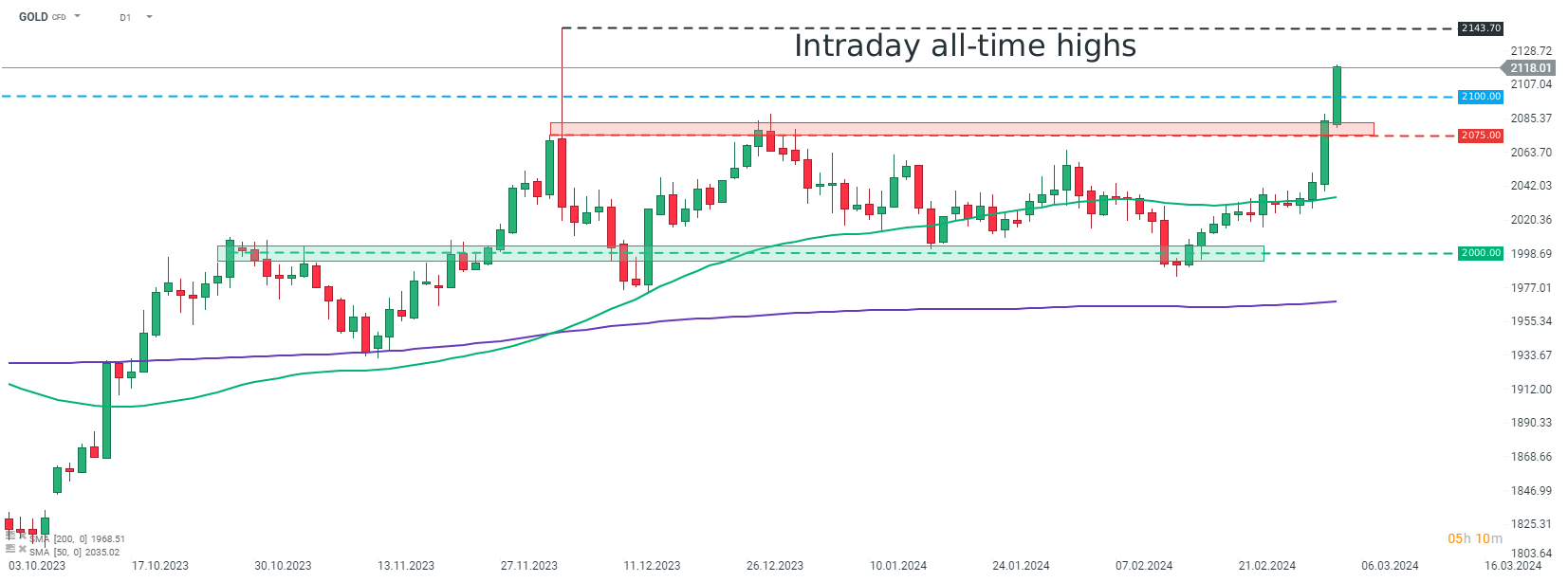

GOLD is on the way to the first close above $2,100 per ounce in history! However, precious metal still trades around 1% below its intraday all-time highs reached in December 2023. Source: xStation5

GOLD is on the way to the first close above $2,100 per ounce in history! However, precious metal still trades around 1% below its intraday all-time highs reached in December 2023. Source: xStation5

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.