Beyond Meat (BYND.US) stock jumped more than 15% on Friday after producers of plant-based meat substitutes posted a narrower-than-expected loss in Q4, even with sales falling more than 20% YoY. Company also forecast solid revenue gains for the coming year.

-

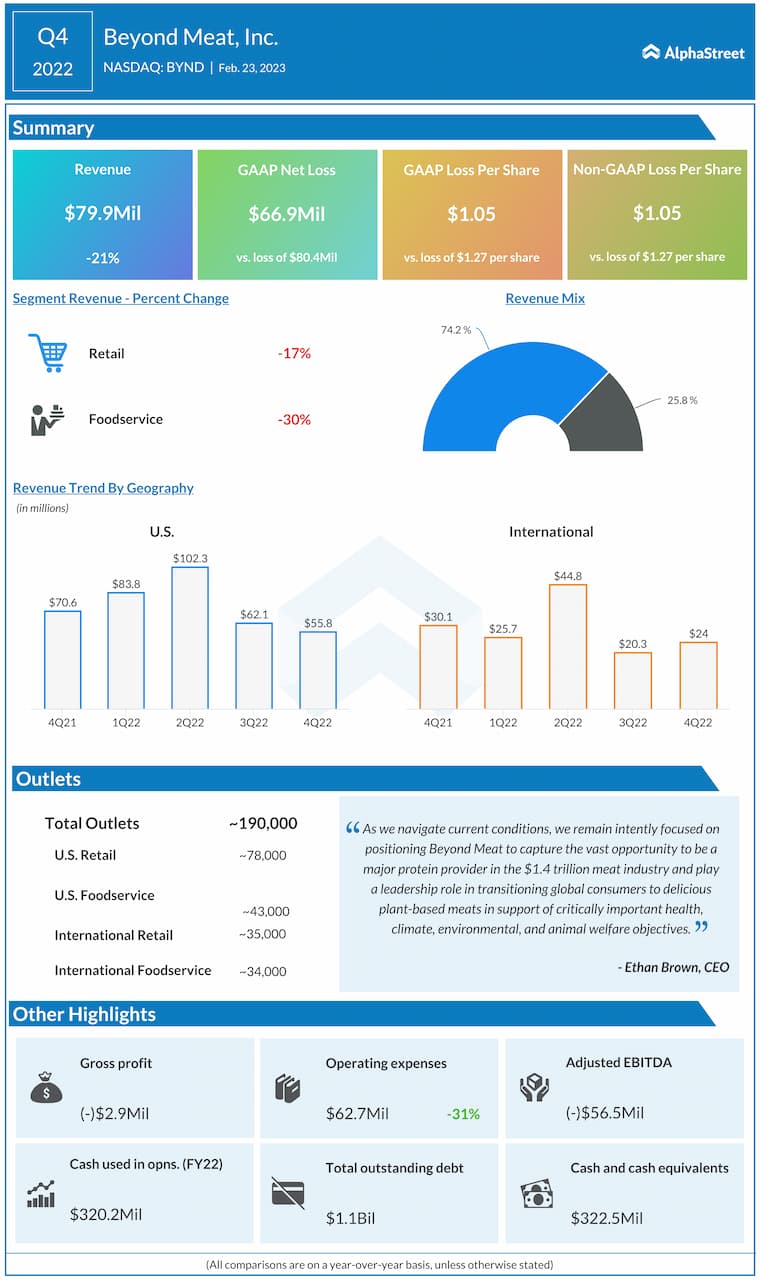

Beyond Meat recorded a loss of $1.05 a share, narrower than projections for a loss of $1.18 a share, according to FactSet.

-

Revenue of $79.9 million topped market expectations of $75.8 million.

Highlights of Beyond Meat Q4 financial results. Company reported better-than-expected Q4 revenue despite flagging consumer demand. Source: Alpha Street

-

"Our fourth-quarter results clearly demonstrate delivery against our strategy and plan, including solid sequential progress on margin recovery and operating expense reduction, and continued inventory drawdown," Beyond Chief Executive Ethan Brown said in a statement announcing the numbers.

-

Those savings along with lower costs for raw ingredients should help Beyond Meat tackle one of its most persistent problems: the high cost of its products relative to animal-based meat. Yesterday, Walmart was advertising Beyond Meat burgers at $9.68 per pound; lean ground beef was $5.86 per pound.

-

"We are encouraged by tighter cost management, but for us to become constructive, demand will have to increase - on this, we remain skeptical," Cowen analyst Brian Holland said.

-

Company expects full-year sales in the region between $375 million to $415 million as it looks to revive growth for its plant-based products amid persistent food price inflation and a pullback in consumer spending.

Beyond Meat (BYND.US) stock rose sharply on Friday, however upward momentum seem to lose steam in the evening, as buyers failed to reach key resistance at $24.00, which coincides with 38.2% Fibonacci retracement of the last downward wave. Price pulled back to local support at $19.00, which coincides with 23.6% retracement. Should a break lower occur, a downward move may deepen towards next support at $15.20, where the lower limit of the 1:1 structure and 200 SMA (red line) can be found. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

The Week Ahead

Kongsberg Gruppen after earnings: The company catches up with the sector

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.