Warren Buffett and his Berkshire Hathaway are reducing exposure to Bank of America (BAC.US) shares just ahead of the expected start of the Federal Reserve's interest rate cut cycle, SEC data show.

Berkshire Hathaway has been selling Bank of America shares for six weeks, reducing its entire position by nearly 13%. Berkshire's latest report shows that another $982 million worth of shares (129 million shares of the bank) have been sold since last Monday.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app

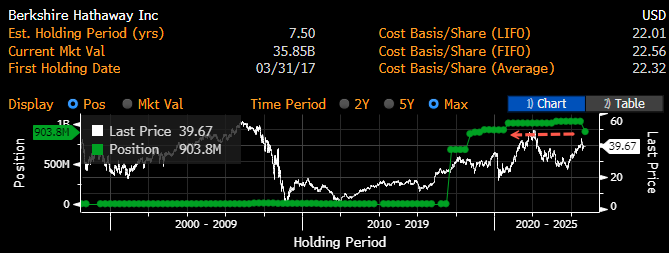

Berkshire remains the bank's largest shareholder at all times, holding 903.8 million shares worth about $36 billion at Tuesday's closing price. Source: Bloomberg Financial LP

It is worth keeping in mind that if the scenario of 3 interest rate cuts of 25 basis points each materializes by the end of the year, BofA's net interest income could be lower by about $225 million in the fourth quarter compared to the second quarter.

BAC.US shares are losing 0.75% before the opening of the session on Wall Street following news that Berkshire's position in the bank's shareholding has been reduced. Source: xStation

BAC.US shares are losing 0.75% before the opening of the session on Wall Street following news that Berkshire's position in the bank's shareholding has been reduced. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.