Danish pharmaceutical company, Bavarian Nordic (BAVA.DK) is trading up more than 3% today and climbing near the highs of early August. It's hard to find justification for this other than yesterday's announcement by the World Health Organization (WHO), which approved an initial $135 million package to accelerate and coordinate the fight against a potential increase in global monkeypox (mpox) virus infections. The WHO program aims to prevent and fund prevention, both on the part of scientists and collaborating institutions.

- News of the virus is creating elevated, speculative volatility in the stocks of companies that stand to profit from the sale of vaccines such as Bavarian, Emergent BioSolutions (EBS.US) and Moderna (MRNA.US) and Biontech (BNTX.US), which are only in the approval stage for their mRNA products.

- African regulators and health ministry officials estimate that about 200,000 doses are currently available, of the vaccine against the 10 million needed. So far, Bavarian has donated about 15,000 doses to Africa, while Emergent has donated 50000.

- The most difficult situation is in Africa, in the Congo region, although in relation to the population the number of cases is still relatively small. So far, the virus has also been detected in Sweden and the Philippines.

Bavarian has told the African Center for Disease Control and Prevention (CDC) that it is capable of delivering 10 million doses of the vaccine by the end of 2025 and about 2 million doses, later this year. By some experts, the Bavarian vaccine is touted as safer, against Emergent. The National Institute of Allergy and Infectious Diseases, will hold a conference on August 29-30 on mpox research and control of virus expansion.

Bavarian Nordic (D1 interval)

The stock has traded almost twice as high since the 2023 minima. Driving valuations are, among other things, expectations for increased demand and production of mpox vaccines.

Source: xStation5

Historically, Bavarian Nordic's shares have been characterized by high volatility, and the last five years can hardly be described as exceptionally successful for the company. However, there have been isolated price spikes in which Bavarian's shares have gained 2 and more than 3 times.

Source: xStation5

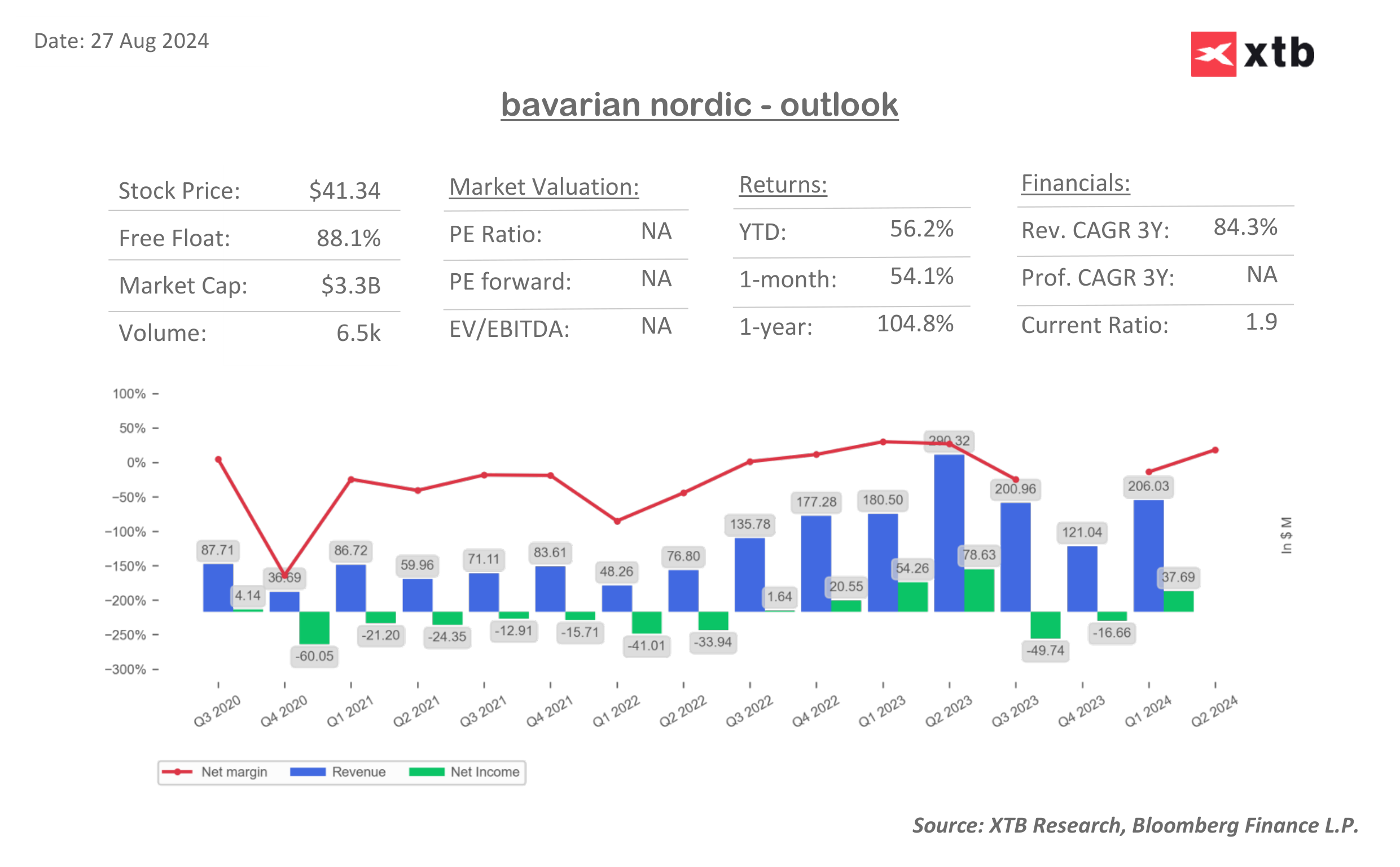

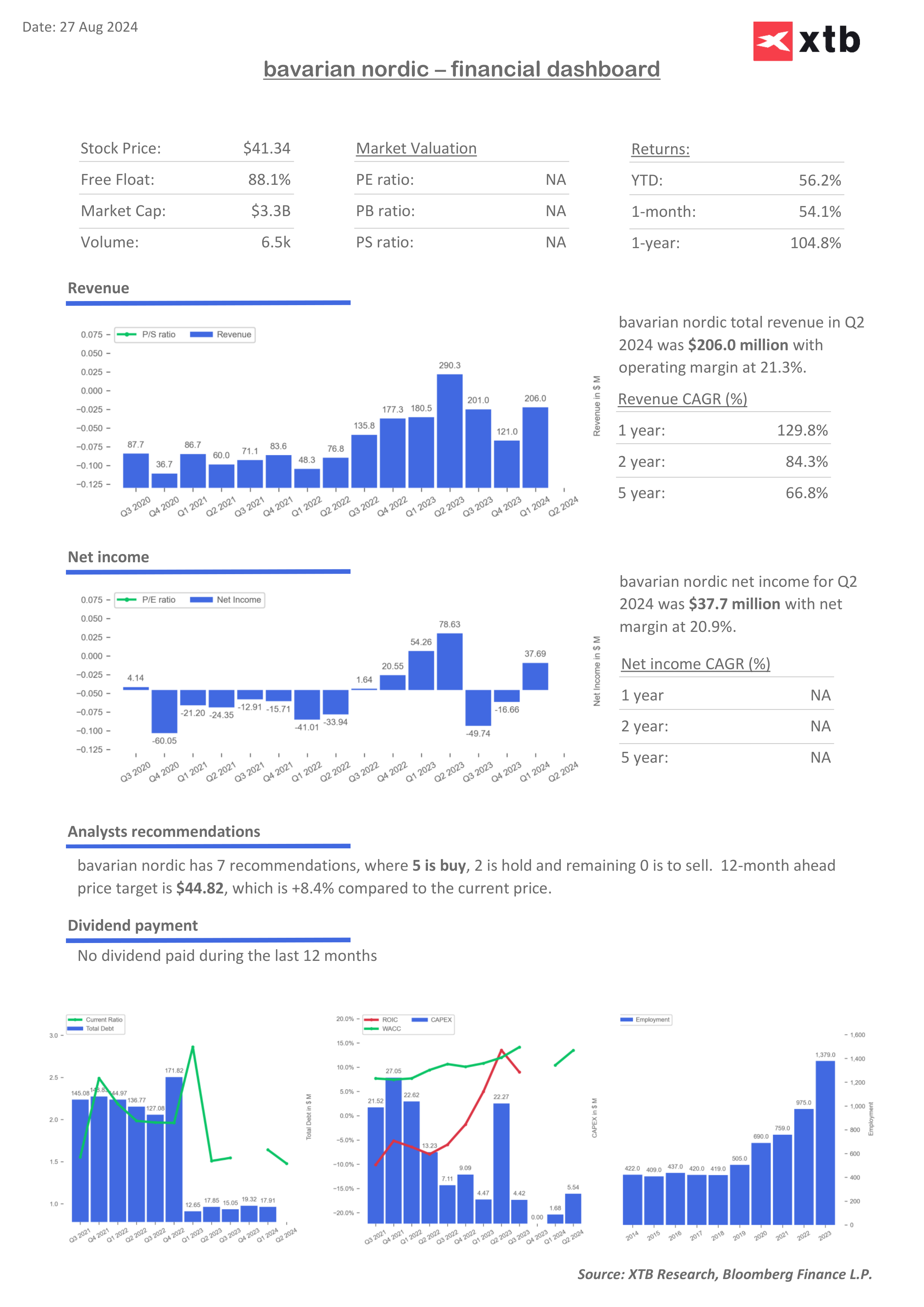

Revenues, earnings and financial multiples dashboards of Bavarian Nordic

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.