Tomorrow, on 13 October earnings of major US banks will open the Q3 (financial Q1 2024) earnings season for US companies. JP Morgan (JPM.US), Wells Fargo (WFC.US) and Citigroup (C.US) will present results before the market opens. What to expect from the banking industry and what will analysts pay attention to?

- Investors expect the big banks to prove to be the 'beneficiaries' of the weaker condition of regional lenders, which are struggling with customer outflows and losses on bonds and commercial real estate;

- The market sees JP Morgan in particular (CET1 ratio 13.8%) as the main winner - Wells Fargo as well as Citigroup are expected to perform significantly weaker. Next week we will know earnings of Bank of America, Goldman Sachs (both on 17 October) and Morgan Stanley (on 18 October)

- JP Morgan analysts do not expect deposit outflows or liquidity problems at the big banks. They pointed out that even in March and April 2023 large banks in the U.S. did not see outflows and, much to the contrary of some analysts' expectations, registered deposit growth - increasing liquidity offering new business opportunities;

- Higher interest rates and deposit outflows from small to large, 'safer' banks with a still-strong economy may favor the performance of top-5 US banks - although risks and serious challenges are evident on the horizon

- Banks are competing with each other by offering depositors ever-higher interest rates - they are also struggling with money market funds, which have begun paying as much as more than 5,5% to individuals and companies that want to invest capital passively. The regional bank sector seems to be in a particularly problematic situation and will have a very hard time competing with the largest institutions. The regional bank season will begin with US Bancorp's holding company, October 18 before the session opens.

Economy is still strong - but risk persist

After the collapse of three mid-sized banks in the spring 2023, the market is reassured that the largest U.S. institutions are likely to come through the crisis with dry feet and are positioning themselves well to benefit from the (still) continuing strength of the U.S. economy and higher interest rates, positively impacting interest income. On the other hand, however, they must face more competition and offer depositors higher interest rates on deposits. Moreover, consumer credit activity (and demand) may decline in 2024 when the economy slows down in an environment of expensive credit. PIMCO analysts expect growth in the U.S. economy to weaken at the end of this year and 'hover' between stagnation and shallow recession in 2024.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appThe challenges are undoubtedly sizable but, in contrast to small lenders, the largest institutions can count on more help from the Federal Reserve and access to funds from the lending window. By the same token, Wall Street does not see a sizable opportunity among them to materialize the systemic risks associated with mounting losses on bonds or commercial real estate (to which regional banks have relatively greater and potentially most dangerous exposure). In addition, investors expect capital to flow into the largest banks - fleeing 'unstable' small regional lenders.

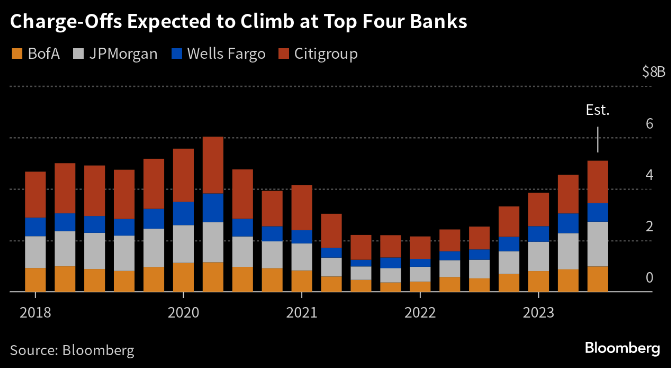

Higher interest rates also mean greater risk of bankruptcies and loan defaults according to Bloomberg data, the largest U.S. banks face the prospect of the highest write-offs of 'bad loans' since Q2 2020. Expected loan loss provisions in the third quarter at the largest U.S. banks according to analysts will reach $5.3 billion (nearly 100% y/y increase) - historically, however, still not very high levels. Source: Bloomberg Finance LP

As uncertainty about the future trend of the economy grows and the strength of consumers in the medium term may be under pressure Wells Fargo, Citi and JP Morgan are increasing 'rainy day funds'. Source: Reuters, Manya Saini

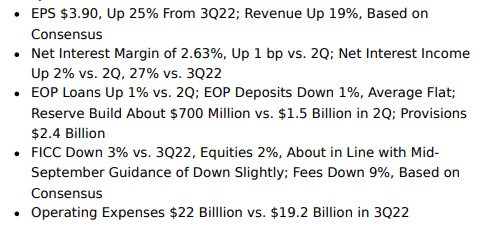

JP Morgan (JPM.US)

Analysts of KBW index have recently indicated that JP Morgan's stock could behave better due to the banking giant's growing market share, rising deposit volumes and volumes, and an overall improvement in net earnings in 2023. Bloomberg data suggests the bank is likely to see the strongest growth rate among U.S. investment banks. Loan loss provisions are expected to grow 16% y/y. An increase in the bank's loan portfolio indirectly resulting also from the acquisition of failed First Republic Bank could translate into additional profits from higher interest rates.

Estimated revenues: $39.55 billion (19% growth y/y)

Estimated earnings per share (EPS): $3.9 vs. $4.98 in Q2 (3.53 projected in Q2 2023, 29% y/y increase)

Net interest margin: 2.63% vs. 2.62% in Q3 2022

Operating expenses: $22 billion vs. $19.2 billion in Q3 2022

Earnings expectations according to Bloomberg analysts. Source: Bloomberg Finance LP

Wall Street expects rising trend of JP Morgan's earnings per share from, the largest bank in the US. Interestingly, the share price has been declining lately despite rising EPS (red line) - if the results confirm strong EPS - will JP Mogran face dynamic growth? Source: Bloomberg Finance LP

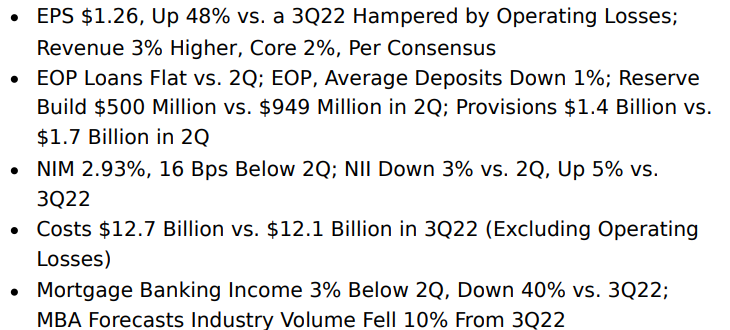

Wells Fargo (WFC.US)

Analysts pointed out that the bank is slowly recovering from regulatory turmoil, in which it recently refunded $35 million in fees to customers that were charged despite promised discounts on brokerage account fees. Mortgage earnings are expected to fall 40% from Q3 2022 in the face of reduced demand for mortgages burdened by high interest rates. Analysts also expect a 1% decline in average deposits but a nearly 50% lower increase in loan loss provisions relative to Q2 2023.

Estimated revenues: $21.11 billion (modest 3% increase y/y)

Estimated earnings per share: $1.26 (up 48% y/y when affected by operating losses)

Operating expenses: $12.7 billion vs. $12.1 billion in Q2 2022

Commission income: USD 1.4 billion vs USD 1.7 billion in Q2 2023

Earnings expectations according to Bloomberg analysts. Source: Bloomberg Finance LP

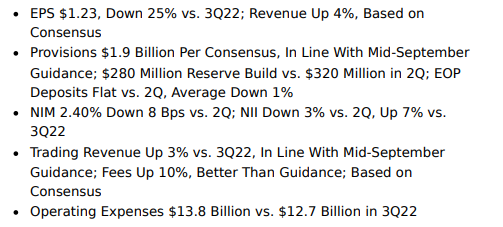

Citigroup (C.US)

The bank is undergoing restructuring in which its foreign consumer banking divisions are being sold off. The market will await comments from CEO Jane Fraser on the ongoing restructuring and (possibly) possible job cuts. Loan loss provisions are expected to rise 9% in the third quarter. Wall Street expects Citigroup's loan portfolio and interest income to benefit from exposure to credit cards and the normalization of that industry's dynamics in the third quarter. Wall Street expects the bank's costs to increase quarter-over-quarter and year-over-year ($13.8 billion vs. $12.7 billion in Q3 2022) but Citi is still on track to meet its annual cost guidance of no more than $54 billion (excluding the FDIC impact).

Estimated revenues: $19.22 billion (higher 4% y/y)

Estimated earnings per share (EPS): $1.23 vs. $1.37 in Q2 2023 (estimated at $1.32 at the time)

Financial Q3 expectations according to Bloomberg analysts. Source: Bloomberg Finance LP

JP Morgan (JPM.US) and Wells Fargo (WFC.US) charts, D1 interval

Looking at JP Morgan (JPM.US) shares, we can see that the price action has already negated the bearish 'head and shoulders' formation in the spring and the stock has managed to rise nearly 40% from the April lows. The main resistance level in the short term is around $149 - $150 where we see the 23.6 Fibo retracement of the 2020 upward wave and an important psychological level - the breakout of this area could herald a rally towards historical maxima. On the other hand, a fall to the area around $140 (important SMA200 support, red line) may put a question mark over the further trend for the bank's shares and, in an extreme bearish scenario, herald a test of the spring 2023 levels.

Source: xStation5

Looking at the chart of Wells Fargo (WFC.US), we can see that all three key averages (SMA200, 100 and 50) therefore seem all the more important to see the stock's reaction after the Q3 results. Unlike JP Morgan, Wells Fargo shares failed to dynamically rebound from the bottom of April this year, and a downward reaction could push them around $36 where we see the 61.8 Fibo retracement of the upward wave from spring 2020. On the other hand, a positive reception of the report could create a chance to break the SMA200 at $42 per share - which could potentially mean a change in the trend to upward.

Source: xStation5Insight/2023/10.2023/10.10.2023_Looking%20Ahead%20to%20Bank%20Earnings%20Season/02-the-kbw-regional-bank-index.png?width=3404&height=1864&name=02-the-kbw-regional-bank-index.png) The U.S. regional bank index is still near the June 2023 lows, potentially suggesting that this is not the end of the troubles and challenges facing the banking sector. Losses on bond portfolios are widening, pressured by rising yields. Source: FactSet

The U.S. regional bank index is still near the June 2023 lows, potentially suggesting that this is not the end of the troubles and challenges facing the banking sector. Losses on bond portfolios are widening, pressured by rising yields. Source: FactSet

Use of Bank Term Funding Program funds remains high. Source: FactSet

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.