The Bank of England maintained interest rates at 5.25%, as expected. However, there were two notable changes in this meeting. Firstly, the Monetary Policy Committee’s rate split, and secondly, the tone in the MPC statement was marginally less cautious than in previous meetings. Catherine Mann and Jonathan Haskel, who voted for rate hikes at the February meeting, have folded and joined the majority of the MPC and voted to maintain the interest rate at this meeting. Swati Dhingra, the most dovish member of the MPC, voted to cut rates to 5%.

This is a notable shift, and it is the first time that both Haskel and Mann have not voted for a rate hike to 5.5% for 5 months. This suggests that even the hawks at the BOE can appreciate the progress made on inflation, and feel happy with the current level of rates. This opens the door to rate cuts in the coming months, although the BOE was unwilling to disclose the timing of a potential cut. Instead, Governor Bailey said that it is ‘not yet at the point’ to cut rates. The message from today’s BOE meeting mostly stuck to the same old script calling for patience when it comes to rate cuts, and the Bank will keep ‘under review’ how long rates should be at this level.

The BOE becomes more dovish

However, there was a subtle shift in tone in today’s statement and minutes. The BOE seems more relaxed and confident that inflation is declining, and it also called the current interest rate ‘restrictive’. It said that the current interest rate was ‘weighing on activity in the real economy, is leading to a loser labour market and is bearing down on inflationary pressures’, even if service price inflation remains sticky.

Like the Fed, the BOE remains data dependent, but the ongoing progress when it comes to the deceleration in prices has been noted by the BOE. This weighed on the pound, GBP/USD fell during Thursday’s trading session and reached a low of 1.2726. However, this is not the lowest level of the week so far, which suggests that there could be some GBP selling fatigue coming into play. Likewise, Gilt yields are also lower on Thursday and the 2-year yield is close to its lowest level of the year so far.

BOE and Fed expected to move together

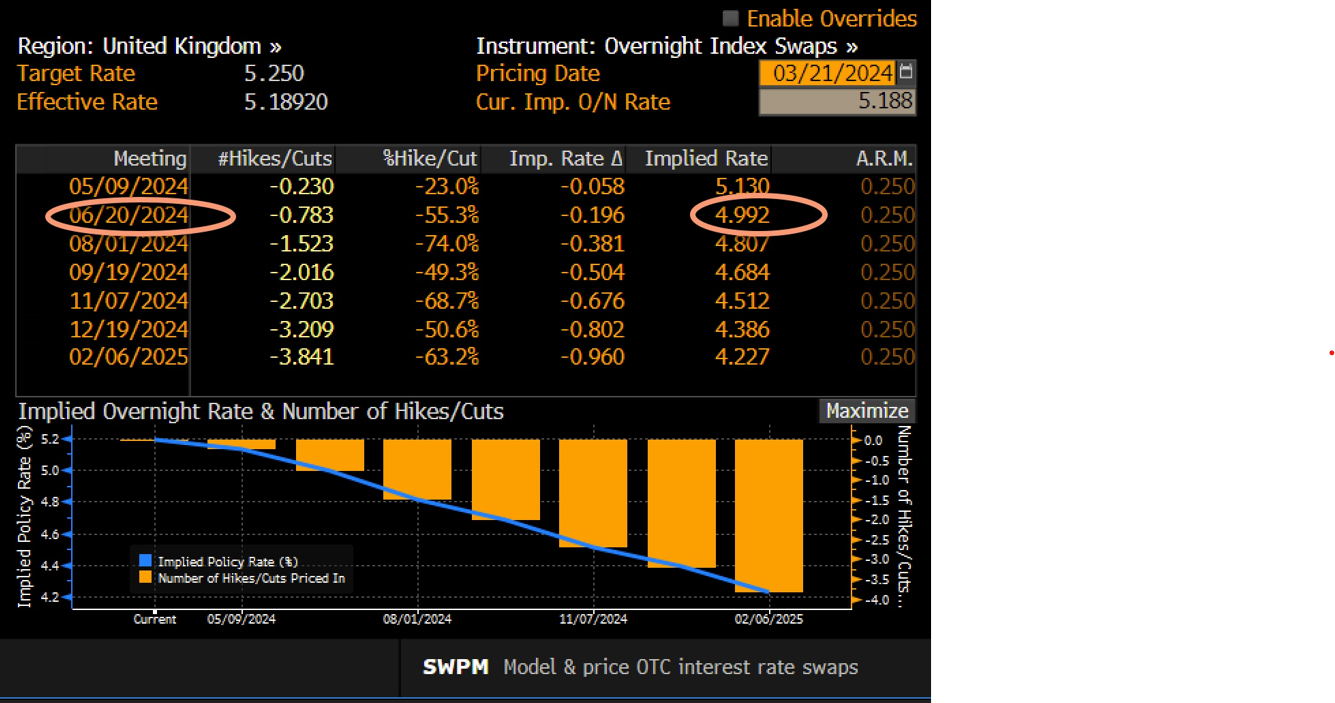

The market now expects the first rate cut from the BOE to come in June, with just over 3 cuts priced in for the rest of the year. Just last week, the market had expected only 2 rate cuts. This puts the BOE on the same path as the Fed, when it comes to rate cuts in 2024 and is further confirmation that the UK is no longer a global outlier when it comes to interest rate expectations. This is good news for UK growth and for the UK consumer.

Chart: UK market-based interest rate expectations

Source: XTB and Bloomberg

UK stocks are also making YTD highs. The FTSE 100 is higher by 1.5%, and today’s BOE rate decision will not do anything to get in the way of higher stock prices. The FTSE 250, which is more directly affected by domestic interest rates also made a fresh 2024 high and is at its highest level since December 2023. The gold price is also extending gains this lunchtime, as demand flows into the world’s oldest inflation hedge. This suggests that while investors pile into stocks and risky assets on the expectation that central banks will hike in mid-year, they are also wary of inflation pressures in the pipeline. Oil prices are backing off slightly today, however the price of Brent crude oil is at its highest level since October 2023. Added to this, the prices of key agricultural commodities like coffee and corn are stronger, suggesting that there could be upward pressure on food prices later this year.

The 2 narratives driving stocks

There are two narratives driving the FTSE 100 right now: Glencore is the top performer, and the materials sector is up more than 3.2%, which is benefitting from the commodity price increases. The second narrative is the boost to the consumer, and the consumer discretionary sector is the second-best performer, rising by more than 2%. This comes as the BOE takes a step closer to raising interest rates, and after retailer Next said that it expects to see lower rates of inflation later this year.

Overall, the BOE was more dovish than expected because no MPC members are voting for rate hikes. This is an historic shift at the BOE for this hiking cycle, and suggests that we are moving to a new phase of monetary policy for the BOE and that lower interest rates are coming.

Join NFP Live Now

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP Market Live

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.