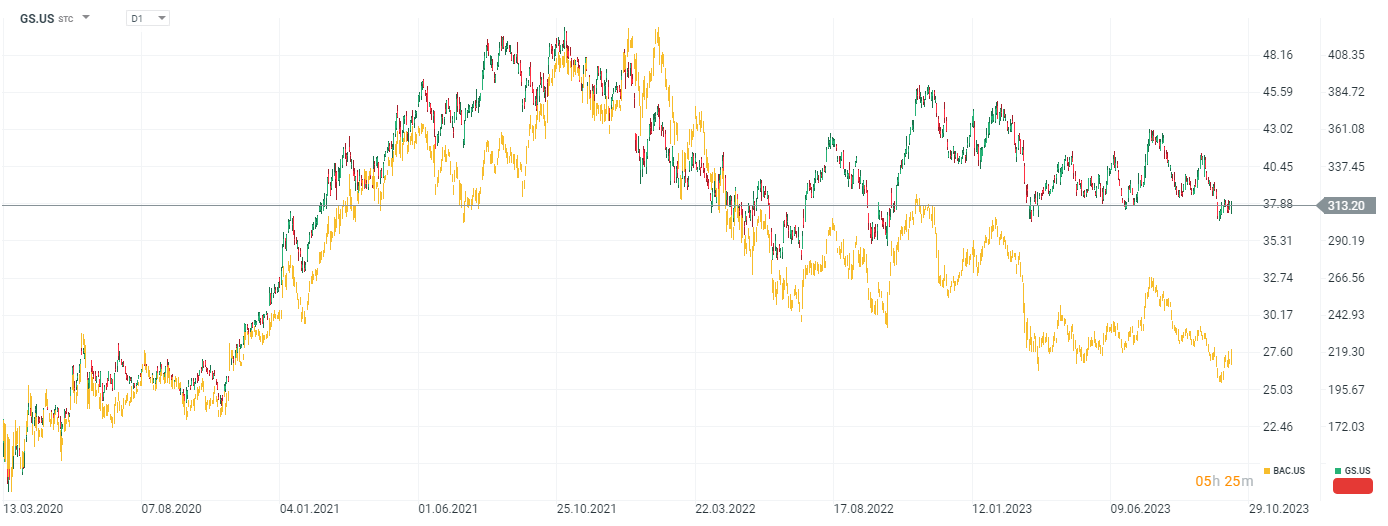

Shares of the second largest bank in the US, Bank of America are gaining more than 3% today as the bank beat forecasts and improved profit by 10% y/y. Goldman Sachs, on the other hand, loses nearly 0.5% after the results - Wall Street took them much more cautiously - net profit fell 33% y/y, slightly higher-than-expected revenues failed to encourage investors to buy shares.

Bank of America (BAC.US)

The bank earned nearly $7.8 billion, compared to $7.1 billion a year earlier. Profits were mainly provided by investment banking and higher interest rates, which improved interest income. Of course, at the same time, the bank reported higher losses on its bond portfolio, which already stands at $131.6 billion compared to $105.8 billion at the end of Q2. The bank plans to hold them to maturity, of course (it doesn't have to realize losses if it never sells the bonds, but it can't invest or borrow these funds at higher rates while it holds them). Bank President Moynihan signaled that consumer spending is weakening.

- Revenues: $25.32 billion vs. $25.14 billion forecast (3% y/y growth)

- Earnings per share (EPS) $0.9 vs. $0.83 forecasts and $0.81 in Q3 2022 10% y/y increase

- Allowance for credit losses: $931 million vs. $520 million in Q3 2022

- Total loan loss provisions: $1.23 billion vs. $1.3 billion forecasts

- Interest income: $14.4 billion vs. $14.1 billion forecasts (4% y/y increase)

- Investment and wealth management division revenue: $5.32 billion vs. $5.34 billion forecasts

- Total deposits: $1.88 trillion vs. $1.77 trillion forecasts

- CET1: 13.5% vs 13.2% forecasts

Wells Fargo analysts described BofA's quarter as 'good' - albeit weaker than JP Morgan or Citi. At the same time, the institution continues to grow despite concerns about the economy. The CEO pointed out that the number of customers grew 'across all business segments. The bank has 'made a name for itself' for its very high exposure to bond losses, which it accumulated more intensively than its competitors during the coronavirus pandemic - as a result, the loss on them weighs on it now and makes the bank more vulnerable to rising yields. According to UBS analysts, this remains the main reason for the discount in valuation against other major US banks.

Goldman Sachs (GS.US)

Goldman Sachs beat Wall Street forecasts primarily due to a stronger-than-expected bond trading result. In a commentary on the results, Goldman pointed to the growing popularity of 'fixed income' and hiptrades, which helped offset declines in foreign exchange, commodities and credit (FICC) trading. Revenues from financing fixed-income instruments reached a record $730 million. Revenues from equity and derivatives trading rose 8% year-on-year to nearly $3 billion thanks to estimates of $2.8 billion.

- Revenues: $11.82 billion vs. $11.19 billion forecast (down 1% y/y)

- Earnings per share (EPS): $5.47 vs. $5.31 per share (down 33% y/y)

- Investment banking revenue: $1.55 billion vs. $1.48 billion forecast (1% increase y/y)

Trading and consulting accounted for two-thirds of the bank's revenues last quarter, and it is still 'trading' that remains its main source of profits and revenues. In 2023, mergers, IPOs and debt issuance failed to 'harvest' in an environment of higher rates and expensive debt. The bank also pointed to write-downs on losses related to commercial real estate. The bank recorded a write-down of $506 million (GreenSky loans) and $358 million from CRE properties in Q3. Wells Fargo analysts commented on the results as below average in the face of higher costs and net returns below target. At the same time David Solomon, Goldman CEO indicated that he has never been so optimistic about Goldman Sachs despite fotness in consumer business about which he hears from CEOs.

Tomorrow, before the US session, Morgan Stanley (MS.US) publishes its results.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.